Sysco Corporation (SYY), headquartered in Houston, Texas, markets and distributes various food and related products to the foodservice or food-away-from-home industry. Valued at $38.2 billion by market cap, the company also distributes personal care guest amenities, housekeeping supplies, room accessories, and textiles to the lodging industry. The food service giant is expected to announce its fiscal first-quarter earnings for 2026 before the market opens on Tuesday, Oct. 28.

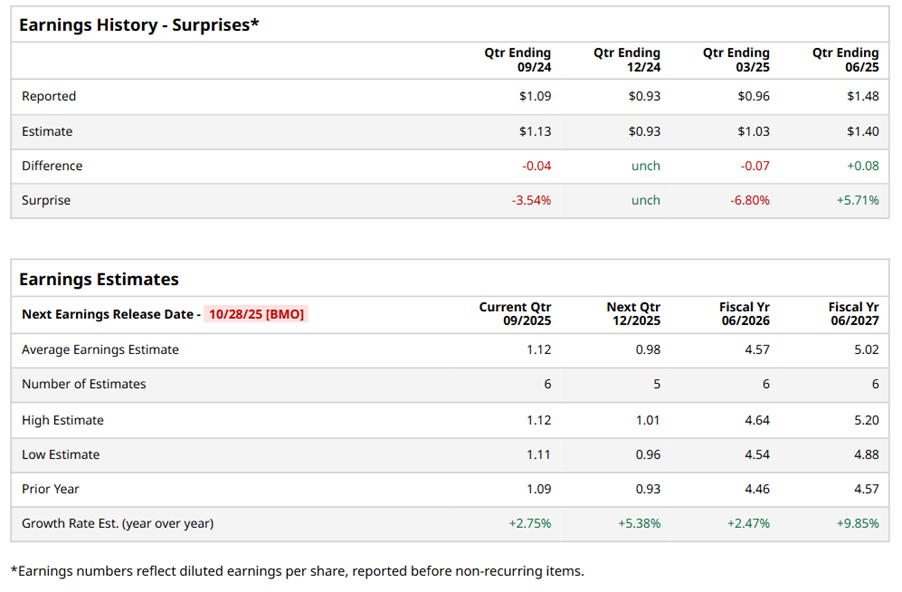

Ahead of the event, analysts expect SYY to report a profit of $1.12 per share on a diluted basis, up 2.8% from $1.09 per share in the year-ago quarter. The company beat or matched the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect SYY to report EPS of $4.57, up 2.5% from $4.46 in fiscal 2025. Its EPS is expected to rise 9.9% year over year to $5.02 in fiscal 2027.

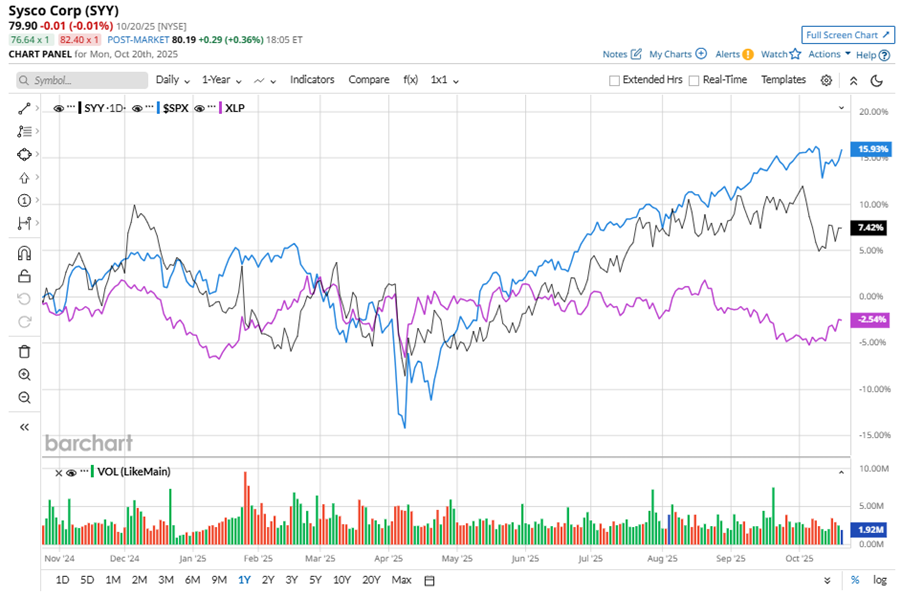

SYY stock has underperformed the S&P 500 Index’s ($SPX) 14.8% gains over the past 52 weeks, with shares up 5.8% during this period. However, it outperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.1% losses over the same time frame.

On Jul. 29, Sysco's shares dropped 2.5% despite the company's better-than-expected Q4 performance. Revenue of $21.1 billion and adjusted EPS of $1.48, both significantly exceeded consensus estimates. Compared to the same quarter last year, Sysco's top line increased by 2.8%, adjusted EPS improved by 6.5%, and adjusted EBITDA rose by 1.8% to $1.3 billion. For fiscal 2026, Sysco projects sales growth of 3% to 5% and expects adjusted EPS growth of 1% to 3%, targeting a range of $4.50 to $4.60.

Analysts’ consensus opinion on SYY stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 17 analysts covering the stock, 11 advise a “Strong Buy” rating, and six give a “Hold.” SYY’s average analyst price target is $86.07, indicating a potential upside of 7.7% from the current levels.