/Synopsys%2C%20Inc_%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $86.4 billion, Synopsys, Inc. (SNPS) is a global leader in electronic design automation and semiconductor IP, powering the era of pervasive intelligence from silicon to systems. The company enables technology leaders worldwide to accelerate design, verification, and time-to-market across AI, automotive, cloud, and beyond.

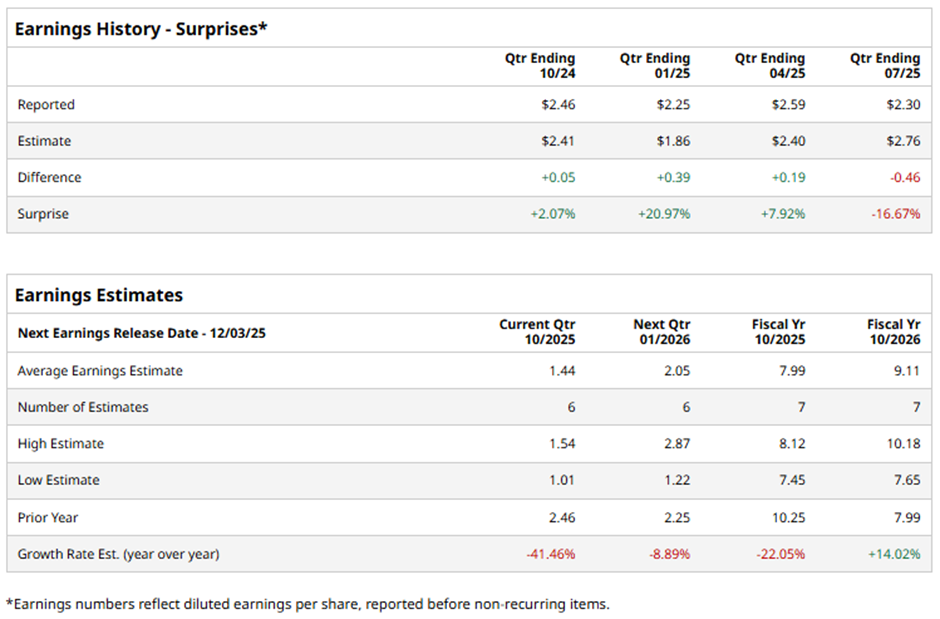

The Sunnyvale, California-based company is slated to announce its fiscal Q4 2025 results soon. Ahead of the release, analysts expect Synopsys to report EPS of $1.44, a 41.5% decrease from $2.46 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the chip design software provider to report EPS of $7.99, a 22.1% drop from $10.25 in fiscal 2024. However, EPS is projected to grow over 14% year-over-year to $9.11 in fiscal 2026.

Shares of Synopsys have dipped 7.2% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 18.4% gain and the Technology Select Sector SPDR Fund's (XLK) 29.8% surge over the same period.

Shares of Synopsys plunged 35.8% following its Q3 2025 results on Sept. 9. The company reported weaker-than-expected adjusted EPS of $3.39 and revenue of $1.74 billion. The decline was primarily driven by weakness in its Design IP segment, where several deals failed to materialize due to new export restrictions affecting China and challenges with a major foundry customer.

Analysts' consensus view on SNPS stock remains moderately optimistic, with an overall "Moderate Buy" rating. Out of 21 analysts covering the stock, 14 recommend a "Strong Buy," one "Moderate Buy," three "Holds," one "Moderate Sell," and two "Strong Sells." This configuration is less bullish than three months ago, with 16 analysts suggesting a "Strong Buy."

The average analyst price target for Synopsys is $556, indicating a potential upside of 19.5% from the current levels.