Several American apparel brands and retailers are seeing a dip in their Growth metrics in Benzinga’s Edge Stock Rankings over the past week.

3 Apparel Stocks With Dropping Growth Metrics

In Benzinga’s Edge Rankings, the Growth metric is calculated based on the pace at which a company’s revenue and earnings grow, with importance given to both long-term trends as well as recent performances.

See Also: Forget Nvidia And Arm, These 3 Chip Stocks Are Flashing Bullish Signals

A surge in the growth score essentially indicates that a company had a phenomenal quarter, lifting its compounded annual growth rate and thus elevating its rankings relative to other stocks. A bad quarter can do the exact opposite.

1. American Eagle Outfitters Inc.

Clothing and accessories retailer American Eagle Outfitters Inc. (NYSE:AEO) is losing sheen as momentum from the so-called “Sydney Sweeney effect” appears to be fading. Once boosted by the actress's viral campaign that catapulted the brand back into the Gen Z spotlight, the retailer's growth score has seen a sharp drop.

The score has dropped from 89.65 to 70.49 within the span of a week, without any major news catalyst affecting the stock or its earnings momentum in recent weeks.

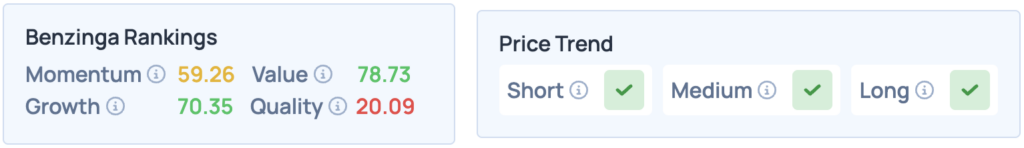

According to Benzinga’s Edge Stock Rankings, the stock still scores high on Value and Growth, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

2. Reitmans Canada Ltd.

Canadian apparel retailer Reitmans Canada Ltd. (OTC:RTMAF) saw its Growth metrics nosedive during the past week, from 98.44 to 30.58, following a string of weak quarterly results.

The company posted a 4.1% year-over-year revenue decline and a net loss of $7.2 million in Q1, while comparable sales dropped 4.5%.

This trend continued into Q2, where revenue was flat and same-store sales declined another 1.3%. More concerning was the 220-basis-point drop in gross margins, with management attributing the pressure to higher promotions and FX headwinds.

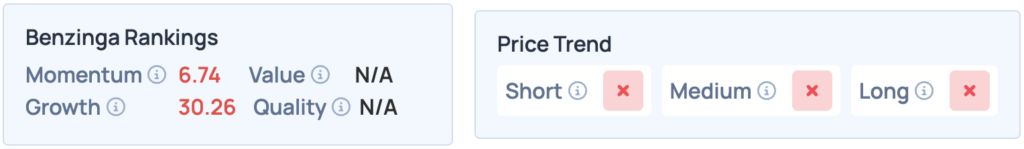

The stock scores poorly in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for more insights into the stock.

3. Caleres Inc.

Footwear company, Caleres Inc. (NYSE:CAL), the parent company of Famous Footwear, has seen its Growth score slump from 91.59 to 48.91 within just a week, amid a mix of soft sales, tariff headwinds, and margin erosion.

In Q2, the company reported a 3.6% year-over-year revenue decline to $658.5 million, missed earnings estimates, while gross margins dropped by 210 basis points, primarily owing to tariff-related headwinds.

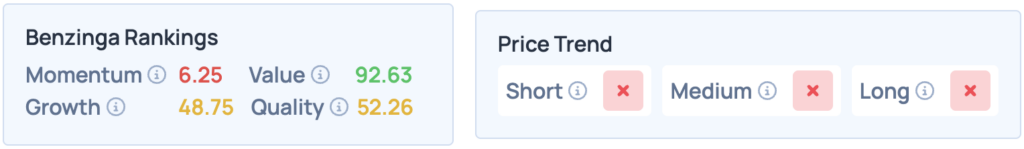

The stock scores poorly in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Eric Glenn / Shutterstock