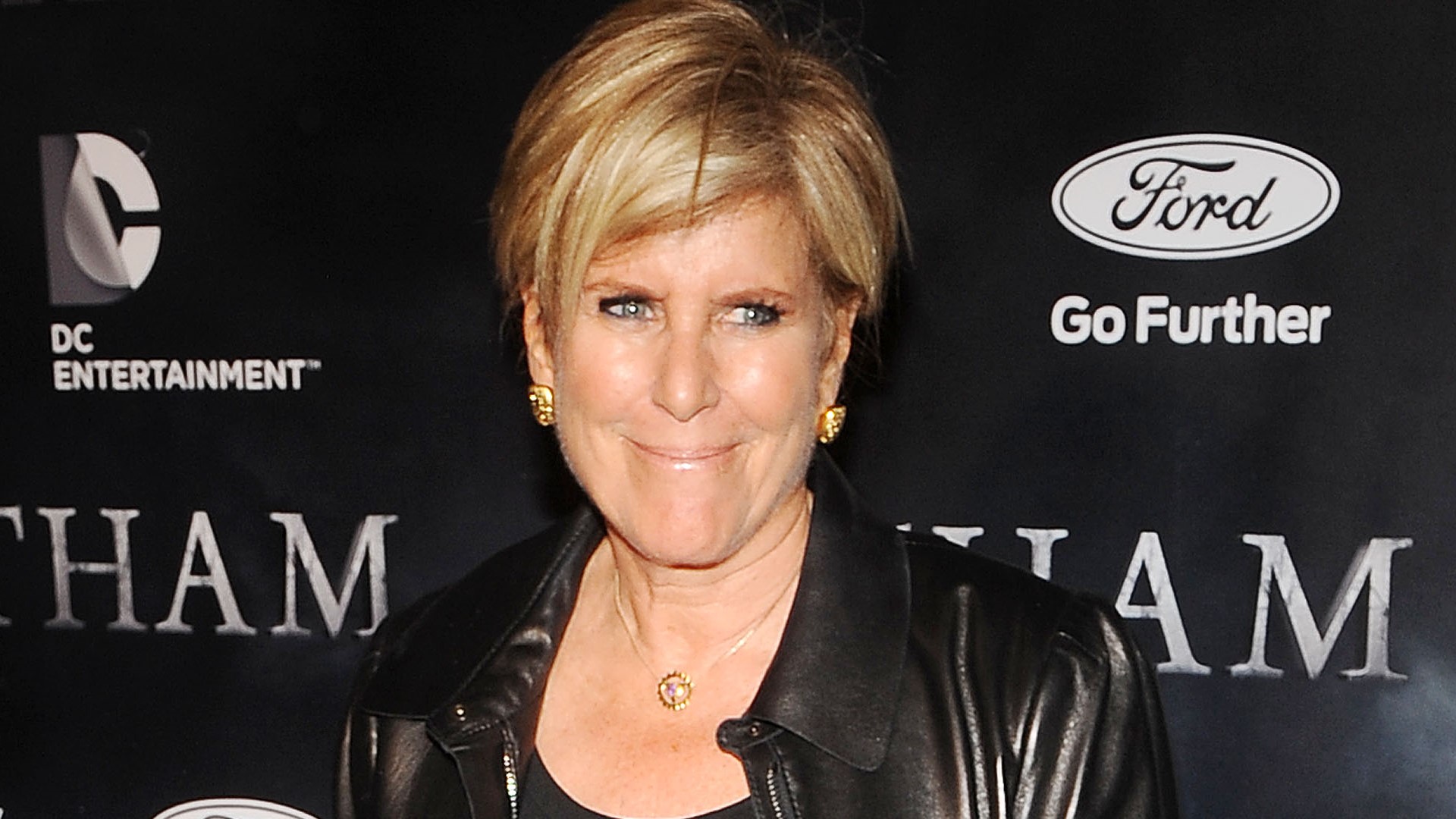

Money expert Suze Orman, a leading voice in personal finance and a bestselling author, joined GOBankingRates on the Richer Way Podcast, hosted by Jamie Catmull, to share her wisdom on ways people can take control of how they spend money. As Orman has an estimated net worth of about $75 million, following any money advice she throws your way is a sound financial strategy.

For You: How Far $750K Plus Social Security Goes in Retirement in Every US Region

Trending Now: 10 Genius Things Warren Buffett Says To Do With Your Money

Along with some tips on how to relate to money, frugality and saving habits, Orman pointed out one expense that adds up very quickly and cuts deeply into people’s savings and other financial goals. Find out below what expense is eating into your bank account, how to cut back, and what else you can do to build wealth.

Avoid the Biggest Spending Mistake

Most financial advisors would tell anyone who is spending too much or not saving enough that they are probably making one specific mistake. Orman refers to it as a money blunder “that happens over and over and over again.”

This mistake is something many people make every day — dining out.

But surely this can’t be the end-all be-all for budgetary concerns, can it? According to Orman, it just might be. “For you to have money, you have to learn to live below your means, but within your needs,” she said.

A need is food you buy at the grocery store. A want is going out to eat and doing so repeatedly, she explained.

To illustrate this, she pointed out that years ago, as a guest on “The Oprah Winfrey Show,” she asked the representative for the financial app Mint.com what was the No. 1 debt people carried on their credit cards — the answer was dining out.

In her 2010 book, “Suze Orman’s Action Plan,” she told people that if they want to save money, they should stop eating out for six months. Numerous readers wrote to tell her how much money they saved.

“I myself obviously am a very, very wealthy woman, and the very last thing I would think about doing is going out to eat,” she said.

Find Out: Are You Rich or Middle Class? 8 Ways To Tell That Go Beyond Your Paycheck

Money Is a Manifestation of You

People have a variety of attitudes toward money that are learned from childhood, their partners, social media or society at large, and not all of these are healthy, to say the least. Orman insisted that to get your finances in order, you need to think of “the true role that money plays in your life.”

Her advice? “[M]oney is simply a manifestation of who you are,” said Orman. “You are the ones who have to go out and work for it. You are the ones that have to decide are you going to save it, spend it, invest it? Money cannot do anything without you.”

If something is going wrong with your money, she asserts that means that something is going wrong with you “because you and your money are one.” This puts impulse buys and monthly payments under a whole new microscope.

Money Can Teach You

Rather than find this concept alarming, Orman believes that money can be a teacher.

“After 40 years of probably working with money more than any other financial pundit out there, I’m here to tell you that I know this for a fact, that money can teach you more about yourself than anything else,” she said.

By paying attention to where you have money problems, be that debt or a lack of an emergency fund, you can start to fix these problems. However, she warned, “You can never fix a financial problem with money.”

Attitude and awareness are key when it comes to creating a budget or paying your rent or mortgage on time each month without bankrupting your checking account.

Adopt Frugal Habits for Life

While Orman may be wealthy, she sticks to frugal habits. In addition to rarely going out to eat, she keeps her cars as long as possible. Her current car she’s held onto for 12 years so far, and said, “I have no plans of getting rid of that car for years to come.”

She also wears the same clothes and jewelry over and over again, pointing to a favorite necklace she still wears that is on her neck on the cover of her 1994 book “You’ve Earned It, Don’t Lose It.” The purse she carries she bought in 1993, as well.

While Orman doesn’t have to be frugal because of her wealth, she holds a unique philosophy toward money.

“When you respect money, when you honor money, no matter how much money you have, then your money turns around and honors you,” she said.

In the short run, however, cutting back on dining out is a good place to start while you work on your attitude toward money and adopt other frugal habits.

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- 3 Luxury SUVs That Will Have Massive Price Drops in Summer 2025

- 4 Things You Should Do if You Want To Retire Early

- Mark Cuban Says Trump's Executive Order To Lower Medication Costs Has a 'Real Shot' -- Here's Why

- The New Retirement Problem Boomers Are Facing

This article originally appeared on GOBankingRates.com: Suze Orman Urges You To Cut This Expense That ‘Happens Over and Over Again’