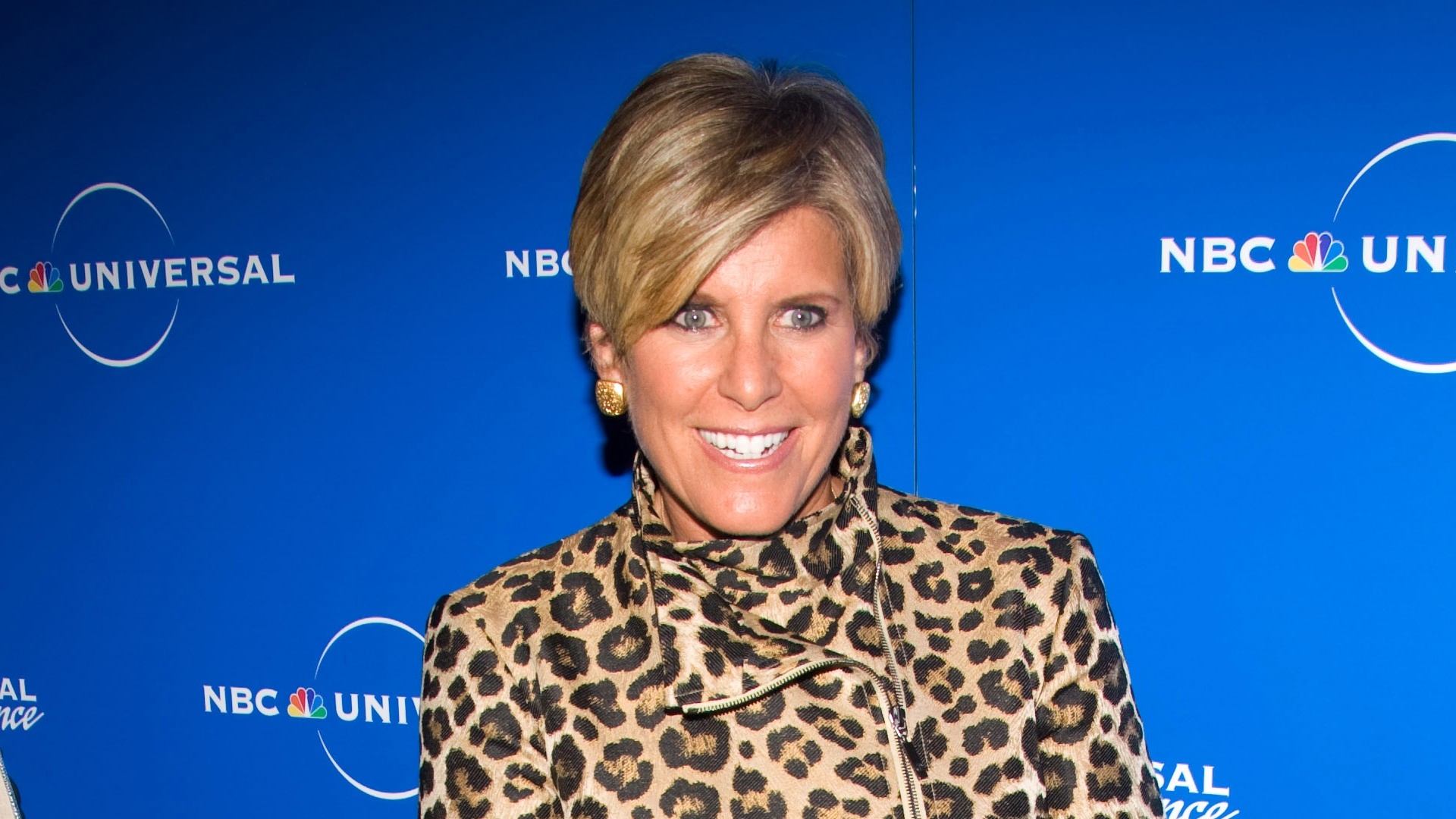

Many Americans feel some level of anxiety over their finances, citing inflation, everyday expenses, the state of the economy and unsatisfactory income as the primary contributors. If this describes your current money mindset, Suze Orman encourages you to dig deeper for the root causes of your money woes.

For You: I’m a Self-Made Millionaire: These 2 Habits Made Me Rich Without Trying

Read Next: 6 Things You Must Do When Your Savings Reach $50,000

That was the main money tip she provided in an interview on GOBankingRates’ “Live Richer” podcast, hosted by Jaime Catmull. She admitted this financial advice is “very, very different than anything you’re going to hear any place else” — but that doesn’t make it any less important. Let’s dig in.

Money Is a Manifestation of Who You Are

“You have to understand that money is simply a physical manifestation of who you are,” Orman said. “You have manifested it, and if something is going wrong with your money, that means that something is going wrong with you because you and your money are one.”

Orman encouraged listeners “to look within to see why you are doing without, and that is where you will find the answer, because you can never fix a financial problem with money.”

That explains why so many consumers fail to make progress toward retirement planning or their other financial goals — or worse, fall deeper in debt — even when they increase their incomes. Termed “lifestyle inflation,” or “lifestyle creep,” this phenomenon illustrates the impact personal decisions and behaviors have on finances.

So before you ding your credit score, keep in mind that you are in charge. “Money cannot do anything without you,” Orman said during the interview. But money can do something for you.

She continued, “Money can teach you more about yourself than anything else. And when you have a feeling like something’s going wrong, it probably is, and it also will show up in your money. In what way? Debt. In what way? No emergency funds, all kinds of ways.”

Find Out: The $50 Mistake Warren Buffett Says Everyone Should Avoid

You Control Your Financial Future

As hard as it might be to face the truth about the root of your financial struggles, it can also be empowering to realize that you — not inflation rates or the economy or even your income — control your financial future.

Tanya Nichols, certified financial planner (CFP), founder and president of the Minnesota-based wealth management firm Align Financial, offered advice for aligning your money with your life in a blog post on her company’s website.

She suggested asking yourself what happiness and financial success look like for you. Nichols called the answers “enough” and recommended eliminating any spending that doesn’t help you achieve it. At the same time, it’s the little accomplishments that make a difference, so be sure to celebrate your small wins and acknowledge the steps you took to ease your financial concerns.

Final Take To GO: What Else Does Orman Recommend?

Suze Orman has several recommendations that can help you navigate your way through rough financial waters. Here are a few key tips:

- Spend on needs, like groceries, but eliminate spending on wants, like restaurant meals.

- If you don’t already have one, open an emergency savings account.

- Open a Roth IRA and deposit at least a little bit of money into it every month.

Those small steps will free up some cash so you can pay off debt, accelerate savings, protect your finances against an unexpected emergency and get on track for a secure retirement.

Frugality can be a challenge, but Orman is careful about how she spends her money.

“Do I need to be frugal? No, not really,” said Orman. “But I love it because when you respect money, when you honor money, no matter how much money you have, then your money turns around and honors you.”

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- Score Big on 6 Walmart Black Friday Deals for Middle-Class Shoppers

- Trump's $2K Dividend: What Low-Income Americans Should Expect

- 5 Clever Ways Retirees Are Earning Up to $1K Per Month From Home

- 9 Low-Effort Ways to Make Passive Income (You Can Start This Week)

This article originally appeared on GOBankingRates.com: Suze Orman’s Top Money Tip Is ‘Very Different’ From Most Advice You Hear