/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) will announce its fourth quarter fiscal 2025 financial results on Tuesday, Aug. 5. SMCI stock has been on a tear ahead of Q4 earnings, rallying 63.7% over the past three months. This reflects a sharp rebound that signals the market’s renewed confidence in the company’s AI-driven future.

Fueling the recent surge is robust demand for Supermicro’s AI solutions, which are critical components in high-performance computing infrastructure. The stock received an additional boost from a $20 billion partnership with Saudi Arabia-based DataVolt. This strategic deal expands Supermicro’s global footprint and fortifies its pipeline for future growth.

The recent momentum marks a significant turnaround for a company that, just last year, found itself in the crosshairs of short-seller Hindenburg Research. The report leveled serious allegations, including accounting irregularities, causing SMCI shares to tumble. The situation escalated when Super Micro delayed its annual SEC filings, raising concerns over possible delisting from the Nasdaq Exchange.

However, the company managed to weather the storm. By submitting its overdue financials, Super Micro narrowly avoided a delisting and has since regained the market’s trust, as reflected in the recent rally in its price.

Still, the road hasn’t been entirely smooth. In its fiscal third quarter, Super Micro reported $4.6 billion in revenue, falling short of expectations. Management pointed to a temporary pause in purchasing as customers considered whether to invest in Nvidia’s (NVDA) existing Hopper GPUs or wait for the next-generation Blackwell platform. As a result, certain orders were deferred, although the company expects many of those deals to materialize by the end of September.

Given the recent rally, it’s clear the market is already pricing in acceleration in Super Micro’s top-line growth in Q4. That sets the bar high for the upcoming earnings report. Any signs of continued hesitation in AI infrastructure spending or a cautious tone from management could trigger notable volatility in SMCI shares.

AI-Driven Demand to Boost SMCI’s Growth

Super Micro’s top line could continue to benefit from high AI-driven demand. The company’s management expects its top line to be in the range of $5.6 billion to $6.4 billion, reflecting an increase of 5% to 21% over the $5.3 billion reported in the same quarter last year. The increase in sales of its server and storage systems, primarily driven by the rise in demand from customers for GPU servers, high-performance computing, and rack-scale solutions, will drive its revenue.

This top-line growth will likely be driven by the rising demand for SMCI’s GPU servers and high-performance computing systems. As AI applications become more sophisticated and widely adopted across industries, both enterprise clients and cloud service providers are leaning heavily on SMCI’s server and storage solutions. AI GPU platforms accounted for more than 70% of the company’s revenue in Q3, reflecting the solid demand for its platform.

The company’s future pipeline looks promising, with strong momentum in design wins and customer interest. SMCI is ramping up production of its Data Center Building Block Solutions (DCBBS), built on new-generation GPU platforms, which will accelerate future growth.

Further, SMCI is a leader in energy-efficient computing, especially through its direct liquid cooling (DLC) technology. Last year, it delivered 4,000 high-powered AI racks equipped with DLC, significantly reducing energy costs for clients. With its next-generation cooling solution DLC-2 on the horizon, SMCI is well-positioned to drive further adoption as companies become increasingly focused on sustainability and cost efficiency.

While revenue is expected to climb, its profit margins could remain under pressure. Management has flagged higher inventory reserves for older-generation products as a concern during the Q3 conference call, and gross margin is projected to dip to around 10%, down from 11.2% a year earlier.

On the earnings front, the company expects earnings per share (EPS) in the range of $0.40 and $0.50 in Q4. Analysts expect the company to report EPS of $0.35, which reflects a 36.4% year-over-year decline.

Analysts’ Recommendation for SMCI Stock Ahead of Q4 Earnings

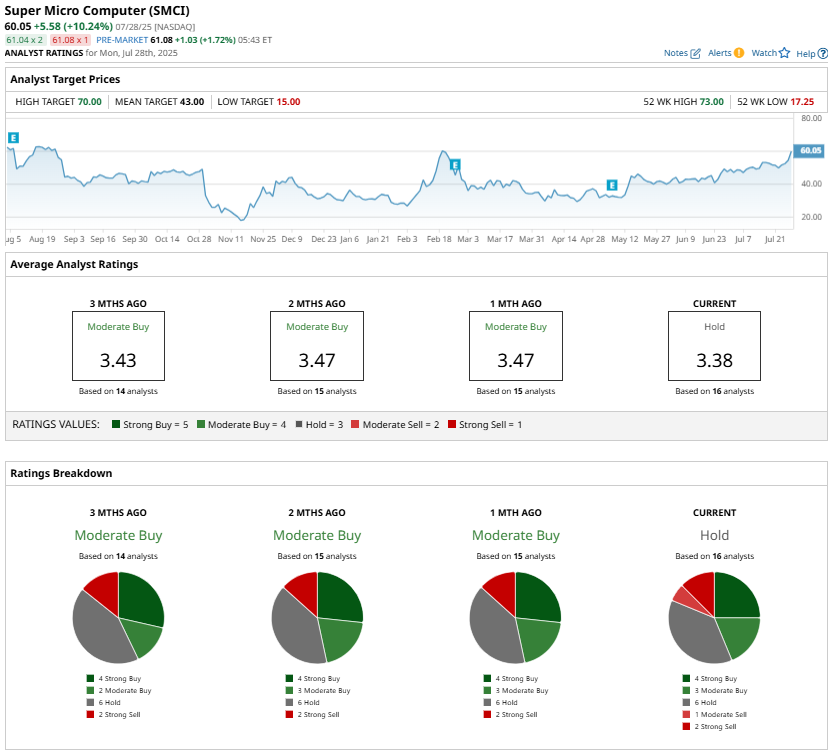

Wall Street analysts, while acknowledging the company’s momentum, remain conservative. The consensus rating on SMCI is “Hold,” and the average price target of $43 suggests the stock could see a pullback of more than 25% from current levels.

The Bottom Line

Super Micro has made a strong comeback from past regulatory and reputational challenges, positioning itself as a key player in high-performance and energy-efficient computing. However, with Q4 earnings on the horizon and the recent rally in its price, expectations are sky-high. Any signs of margin pressure, deferred orders, or cautious management commentary could prompt a sharp correction. While the long-term growth narrative remains intact, SMCI could remain highly volatile in the short term.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.