/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

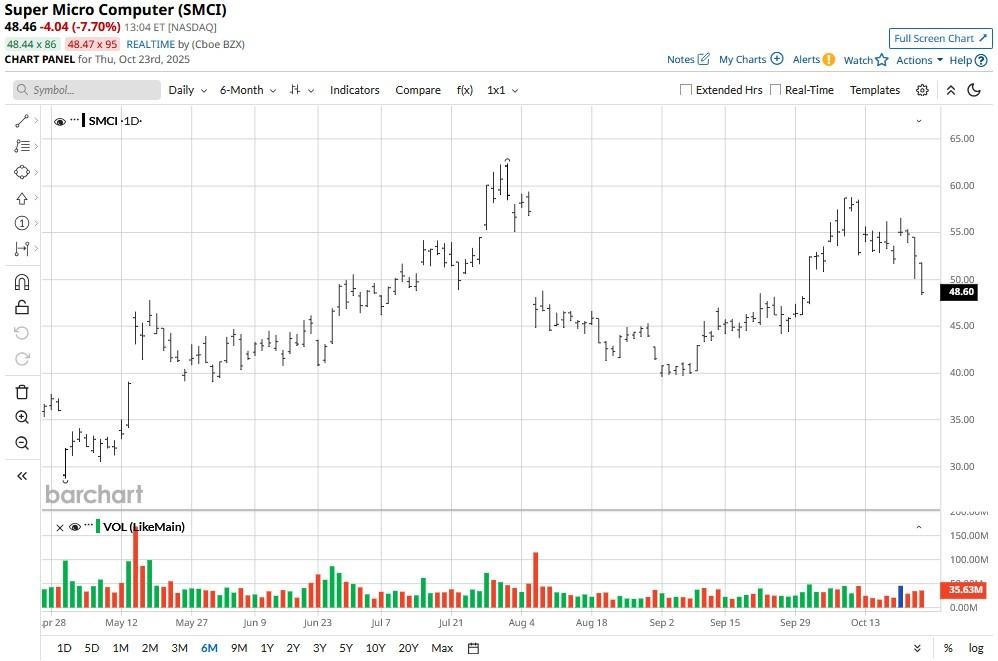

Super Micro (SMCI) shares slipped over 7% in Thursday trading after the company lowered its Q1 revenue forecast, citing delays in customer deployments for large-scale artificial intelligence (AI) deals.

SMCI’s management now expects first-quarter revenue to come in at $5 billion only, well below the up to $7 billion it had guided for earlier and the $6.52 billion that analysts had expected.

Including today’s decline, Supermicro stock is down more than 20% versus its year-to-date high.

Should You Load Up on SMCI Stock Today?

Despite trimming its Q1 outlook, Super Micro reaffirmed its commitment to at least $33 billion in revenue for the full year (fiscal 2026) on Thursday.

The artificial intelligence company also disclosed over $12 billion in newly secured business, with deliveries scheduled for the second quarter, underscoring confidence in long-term demand.

This means the first-quarter shortfall reflects deferred shipments only, not lost sales. In other words, customers are still buying, just receiving later.

For long-term investors, the mere timing shift is far less concerning than a true slowdown, making the related selloff in SMCI shares worth buying.

Supermicro Shares Are Inexpensive to Own

Investors should consider investing in Supermicro shares on the pullback also because they’re now trading at a relatively attractive valuation.

At the time of writing, SMCI is going for a price-sales (P/S) ratio of 1.48x only – sharply below 33x for the likes of Nvidia (NVDA), according to Barchart.

Moreover, market experts seem aligned on the view that artificial intelligence is in its early innings only. In fact, investment firms, including Morgan Stanley, estimates up to $400 billion in AI spend this year alone.

This suggests the company has massive room to grow its share in a market that’s broadly expected to be worth trillions of dollars over time, further strengthening the case for owning SMCI shares for the long-term.

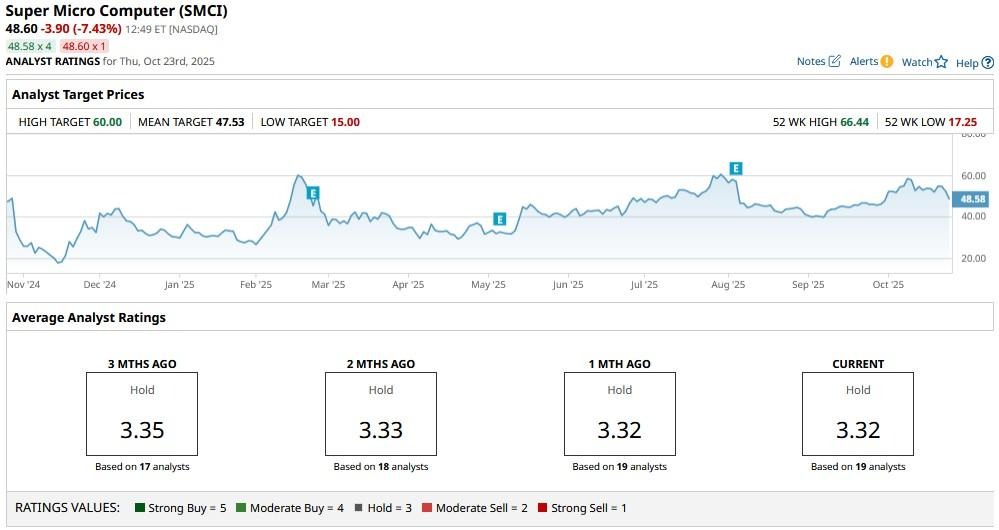

How Wall Street Recommends Playing SMCI

On the downside, Super Micro continues to grapple with governance issues, and that, according to Wall Street firms, warrants caution.

The consensus rating on SMCI stock currently sits at “Hold” only. However, analysts’ price targets on the firm go as high as $60 heading into 2026, signaling potential upside of over 25% from here.