Stripe is a prominent payment processor used by millions of online businesses. It enables businesses to receive payments from global customers and withdraw them to bank accounts in various currencies.

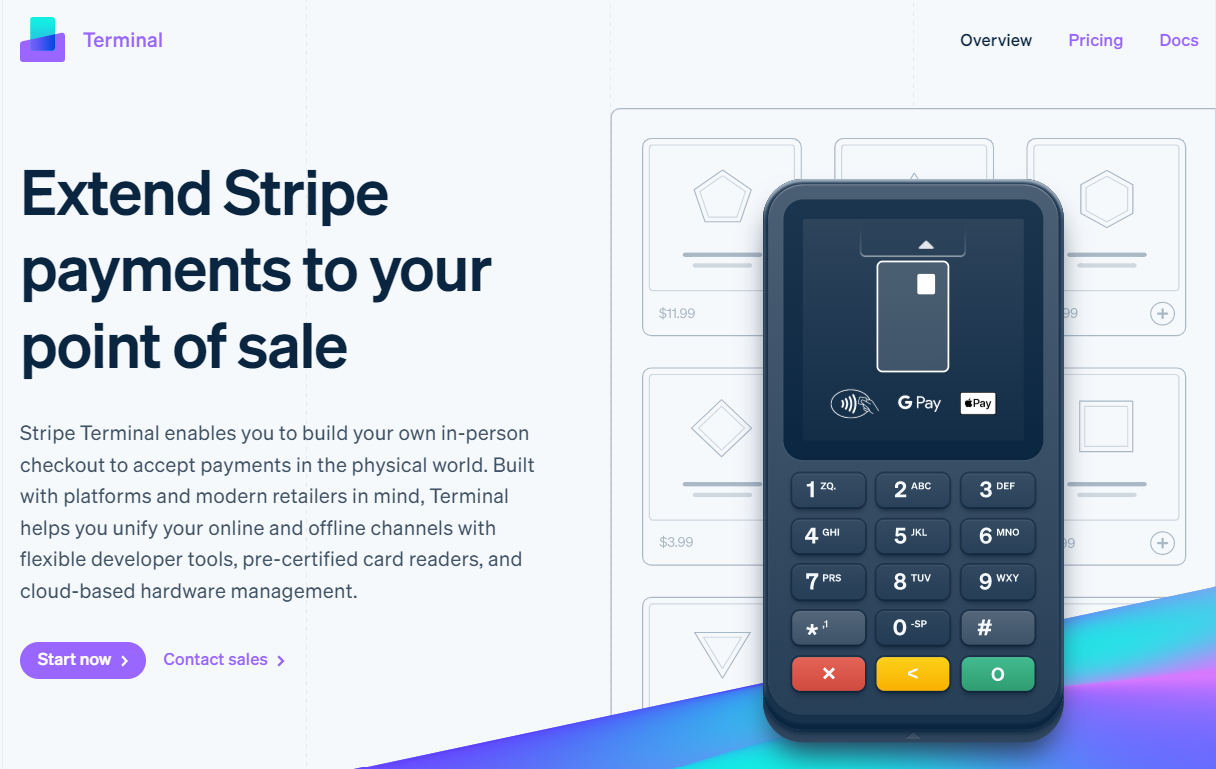

Though best known as a digital payment processor, Stripe offers a point of sale (POS) solution for businesses to accept in-person payments. This service, the Stripe Terminal, launched in 2018 and has seen widespread adoption.

Choosing a POS system can be daunting, given the numerous options available. Stripe Terminal is one option, and I tested it extensively to help you decide if it’s your ideal solution. I examined its features, pricing, and user-friendliness, among other vital factors. Read on to learn more about the pros and cons of choosing Stripe Terminal for your business.

Stripe Terminal: Plans and pricing

I like that Stripe has a simple pricing structure for its point-of-sale system, and there are no setup fees except the initial cost of buying the hardware. You can buy the Reader M2, a portable card reader, for $59; the BBPOS WisePOS E, an Android-based touchscreen smart reader, for $249; the BBPOS WisePad 3, a compact card reader with a PIN pad, for $59; or the Stripe Reader S700, a sleek-looking smart reader with an HD screen and longer battery life, for $349.

The best hardware choice depends on your type of business. For example, you can choose the portable card reader if you run a pop-up store or sell at trade shows. However, if you run a full-fledged stationery store, the WisePOS E or Stripe Reader S700 are your best options.

Unlike some POS systems I’ve tested, Stripe has no monthly fees, but it does have transaction fees. It charges 2.7% + 5 cents for every successful POS transaction. If a customer taps their card to pay, an extra 10 cents will be charged per transaction.

Stripe Terminal: Features

Stripe offers a comprehensive solution for businesses to accept and manage in-person payments. However, Stripe is unique in one way. It’s not a ready-made solution like many rival POS systems I’ve tested. Instead, it’s more of an agnostic system you can integrate with your existing POS software solution.

In simpler terms, Stripe doesn't offer a pre-built POS app, so you'll have to integrate the Terminal hardware with an existing POS system or build a custom POS solution. This trait makes the setup more hectic than most POS systems I’ve tested.

Programming experience is needed to integrate the Stripe Terminal into any existing point-of-sale app. Most business owners don’t have this experience, so they’ll need external help, increasing the setup costs.

Recognizing a dire market need, some developers built point-of-sale apps that integrate directly with the Stripe Terminal. Payment For Stripe and AlfaPOS are the most prominent apps in this space, and they’re ready-made solutions that integrate with Stripe.

Instead of going through the stress of integrating another POS system, you can download Payment For Stripe and AlfaPOS and set things up quickly. The drawback is that these apps charge payment processing fees in addition to Stripe’s.

For instance, Payment For Stripe collects a 1.2% fee on every transaction. In addition to Stripe’s 2.7% + 5 cents fee per transaction, you’ll pay a total of 3.9% + 5 cents, which is noticeably high. Similarly, AlfaPOS charges 1% atop Stripe’s processing fees, totaling 3.7% + 5 cents.

Though with relatively high fees, I recommend downloading apps like AlfaPOS or Payment For Stripe to enable easier integration. You can set up these apps yourself instead of hiring a developer to integrate Stripe Terminal with another system or build a custom solution.

However, if you already work with a specific point-of-sale solution, you can hire a developer to integrate it with the Stripe Terminal and accept payments seamlessly. Your existing POS system will likely have additional fees, too.

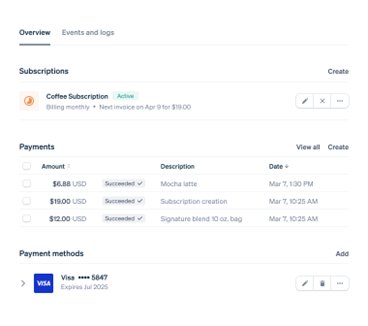

Stripe enables you to unify multiple POS units into one dashboard. For instance, if you have three stores, each with the Stripe Terminal running a custom POS system, you can monitor the data for all three shops from a single dashboard.

You can monitor key metrics like the total value of goods sold and the top-selling goods. You can also collect and store customer data for future use, e.g., saving card details for online subscriptions.

I like that the Stripe Terminal is extensively customizable. You have more control over the design, checkout experience, and other elements, which allows you to offer customers a personalized shopping experience.

For example, I created a mockup splash screen displaying my business's logo and motto. This splash screen always shows when the screen is in idle mode. You can use it to advertise discounts and promotions to customers. Displaying your logo also makes your physical store look professional.

Another example is creating customized email receipts for customers. When someone buys goods in person and consensually provides their email address, you can send a receipt listing the items they purchased. This may seem trivial, but a custom receipt makes the customer relationship feel personal and can spur repeat sales.

Hardware is as essential as software when choosing a point-of-sale system. I like Stripe’s point-of-sale gadgets both for their form and functionality. The portable card reader is battery-powered, taking 2 hours to charge fully, with a 28-hour battery life in active mode. You can connect it to your tablet or desktop via Bluetooth or a USB cable (with simultaneous charging).

The Stripe Reader S700 has a premium look that I liked. It can be handheld or placed on a dock and works with WiFi or Ethernet. Customers can insert their cards into the machine, swipe, or tap their cards to pay for items. On battery mode, it takes about two and a half hours to charge fully and lasts 15 hours in active use.

The BBPOS devices don’t look as sleek as the Reader S700, but they perform their function well. They’re more affordable and work similarly to the Reader.

Stripe’s hardware options offer great value for money. They’re cost-efficient relative to their features. I’ve tested several rival hardware systems that cost more money for similar features.

Stripe Terminal: Interface and use

Generally, Stripe has an intuitive interface that’s easy to grasp. After integrating the Terminal with your point-of-sale solution, you can easily navigate the dashboard to monitor crucial sales data.

The drawback is that setting up the Stripe Terminal can be daunting. Integrating it with your existing point-of-sale solution can get complicated. Some POS solutions aren’t very compatible, so your developer might need to make plenty of adjustments to make the integration work. The more complex the integration, the more time the developer spends and the more they charge for their services.

If you use AlfaPOS or Payment For Stripe, your setup process will be easy because these apps were designed specifically to work with the Stripe Terminal. Their developers have handled the pain of integrating these systems with the Stripe Terminal’s SDKs so users can quickly set things up and begin selling in person.

However, integrating the Stripe Terminal’s SDKs with a POS system whose developers have not invested much in third-party integration can get messy.

Stripe Terminal: The competition

I’ve tested many point-of-sale systems and noted their respective pros and cons. Some offer similar features to Stripe, and others provide better features, but the rival I’d like to highlight is the Shopify point-of-sale system.

Shopify offers a well-built point-of-sale system for retailers. Unlike Stripe, it has a ready-made app that you can install on any iOS and Android device. Then, you can quickly set things up and start selling. There’s no need to hire a developer to integrate SDKs like with the Stripe Terminal.

The drawback is that Shopify’s hardware systems are more expensive, and you need an $89 monthly subscription (for each POS) to access the advanced features. This POS subscription is separate from the Shopify plan you must also pay for, ranging from $32 to $299 monthly. Likewise, Shopify charges a 2.4% to 2.7% fee on each transaction, slightly lower than Stripe’s fees.

Shopify is an ideal point-of-sale system with ubiquitous features if you can afford the higher cost. Its setup process is more straightforward than Stripe’s, and its interface is stellar. However, Stripe is a more affordable choice and much more customizable than Shopify.

Shopify’s features are geared for retailers, but Stripe works for both retailers and other business lines like restaurants and hotels.

Stripe Terminal: Final verdict

The Stripe Terminal has strengths and weaknesses. Unlike most POS solutions I’ve tested, It doesn’t offer ready-made software but works with existing POS systems.

The Stripe Terminal is perfect for medium—and large-scale businesses that want an extensively customizable POS solution. Small businesses are better off with ready-made solutions that aren’t as inconvenient to set up as Stripe’s.