London (AFP) - Global stock markets rallied on Wednesday in a volatile trading, with investors given an "energy boost" by an intervention by the Bank of England.

But geopolitical tensions continued to temper enthusiasm, analysts said, with heightened Ukraine tensions and looming recession fears.

Wall Street stocks traded up after the Bank of England's surprise intervention in the British bond market pushed down bond yields in Britain and the United States.

Following a historic slump in the pound, the BoE announced it was temporarily buying up long-dated UK government bonds "to restore orderly market conditions."

"The BoE intervention helped cooling the (dollar) strength and give an energy boost to the market," said Ipek Ozkardeskaya, senior analyst at Swissquote bank.

The UK government's 30-year bond yield retreated to 4.44 percent after the announcement, having hit a 1998 peak at 5.14 percent.

The yield on the 10-year US Treasury note -- a closely-watched proxy of US interest rates -- also pulled back as analysts said the BoE manoeuvre had "soothed" investors in the short run.

Britain's new finance minister Kwasi Kwarteng's tax-cutting budget sent shockwaves through markets, pushing the pound to a record low and leading to dire warnings for Britain's economy -- though sterling later rallied against the US currency.

The BoE intervention followed rare criticism from the International Monetary Fund, which argued that Britain's recent budget could increase inequality and worsen inflation.

"The BoE's intervention is an attempt to soothe investor nerves after they were spooked by last week's mini-budget," said City Index analyst Fawad Razaqzada.

After early losses, major indices in London, Frankfurt and Paris all closed up Wednesday.

Fear grips markets

Analysts warned of looming risks in the shape of soft economic data and crumbling earning expectations.

"Fear of tightening-induced recessions has wiped out the recovery we saw in stock markets over the bulk of the summer as investors were once again burned by an over-eagerness to catch the bottom in the market, despite there being little evidence of it being justified," said OANDA's Craig Erlam.

"That fear has now gripped the markets and we may see a little more caution going forward," Erlam said.

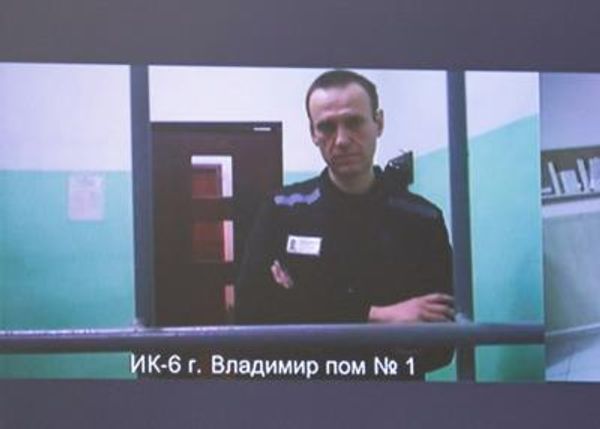

Sentiment was also rattled by worries about developments in Ukraine, after Kremlin-installed authorities in four regions under Russian control claimed victory in annexation votes, with Moscow warning it could use nuclear weapons to defend the territories.

Ukraine and its allies have denounced the so-called referendums as a sham, saying the West would never recognise the results.

Volatile oil prices also rose Wednesday, as the EU proposed a new round of sanctions on Moscow, including a possible oil price cap.

Leaks from two Russia-Germany undersea gas pipelines -- which the EU said were caused by deliberate sabotage -- also threatened to fuel further tensions in the energy conflict.

Key figures at around 1550 GMT

London - FTSE 100: UP 0.3 percent at 7005.39 points (close)

Frankfurt - DAX: UP 0.4 percent at 12183.28 (close)

Paris - CAC 40: UP 0.2 percent at 5765.01 (close)

EURO STOXX 50: UP 0.2 percent at 3335.30 (close)

New York - Dow: UP 1.1 percent at 29436.77

Tokyo - Nikkei 225: DOWN 1.5 percent at 26,173.98 (close)

Hong Kong - Hang Seng Index: DOWN 3.4 percent at 17,250.88 (close)

Shanghai - Composite: DOWN 1.6 percent at 3,045.07 (close)

Pound/dollar: UP at $1.0748 from $1.0730 on Tuesday

Euro/dollar: UP at $0.9639 from $0.9595

Euro/pound: UP at 90.67 pence from 89.39 pence

Dollar/yen: DOWN at 144.45 yen from 144.81 yen

Brent North Sea crude: UP 1.9 percent at $86.73 per barrel

West Texas Intermediate: UP 2.9 percent at $80.77 per barrel

burs-rfj/rox/cdw