Here are five things you must know for Friday, June 17:

1. -- Stock Futures Bump Higher But Growth Worries Persist

U.S. equity futures bumped higher Friday, while Treasury bond yield and the dollar held near recent levels, as stocks look set to close out their worst week in two years focused on growth prospects in the world's biggest economy.

With big rate moves from central banks now largely behind it -- or clearly telegraphed for the near-term -- markets are now adjusting to slower growth prospects for both the U.S. economy and its major global peers, as inflation continues to surge, consumers pull back on discretionary spending and businesses trim new investment plans.

Data from Europe today, in fact, indicated that higher consumer prices remain an uncomfortable fact of current life, with the region's inflation rate holding at a record high 8.1% last month despite recent efforts -- as well as higher rate signaling -- from the European Central Bank.

In the U.S, the recession debate has intensified following data from the Atlanta Fed showing essentially no growth in the domestic economy this quarter, following a 1.5% contraction over the first three months of the year, alongside a slow by steady increase in weekly jobless claims, stalled consumer spending and a weakening housing market.

That debate has pushed U.S. Treasury bond yields -- which were recently marching higher in the face faster Federal Reserve rate hikes -- back to multi-week lows as investors retrench into the safety of risk-free government bonds amid the ongoing sell-off in stocks.

Benchmark 10-year Treasury bond yields dipped to 3.218% in overnight trading, against a 3.153% peg for 2-year notes, while the dollar index rose 0.62% against a basket of six global currencies to 104.29 in early European trading.

Europe's region-wide Stoxx 600 was marked 1.1% higher in early Frankfurt trading, following on from a 0.32% slide for Asia's MSCI ex-Japan benchmark.

On Wall Street, futures tied to the Dow Jones Industrial Average, which closed below the 30,000 point level for the first time since January of last year, are indicating a 225 point opening bell gain while those linked the S&P 500, which is down 23.1% for the year, are priced for a 33 point gain.

Futures linked to the tech-focused Nasdaq are looking at 115 point opening bell gain.

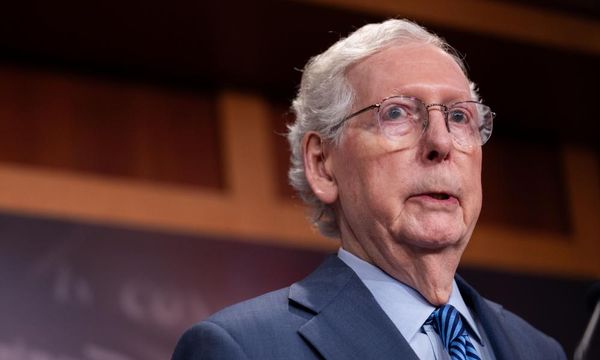

2. -- Biden Insists Recession Not 'Inevitable', But Americans 'Really Down'

President Joe Biden stressed late Thursday that a recession in the world's largest economy is not "inevitable" as he and his administration scramble to revive growth prospects heading into this fall's mid-term elections.

Americans, who endured a two-year pandemic only to be faced with the fastest inflation in forty years, record high gas prices and slowing economy are "really, really down", President Biden said, and argued that that pessimism has carried over into consumer sentiment, which hit an all-time low last week.

However, the President rejected the idea the recession was looming, telling the Associated Press in an Oval Office interview that "first of all, it’s not inevitable."

"Secondly, we’re in a stronger position than any nation in the world to overcome this inflation," The President said. "Be confident, because I am confident we're better positioned than any country in the world to own the second quarter of the 21st century"

Headline U.S. inflation surged to a four-decade high of 8.6% last month, according to the Commerce Department, as the ongoing surge in global energy prices crushed the 'peak inflation' theory heading into the summer months.

Record high gasoline prices, which nudged past the $5 a gallon mark this week, according to data from AAA, will continue to drive headline inflation rates as crude oil holds firmly above the $120 per barrel mark, while food prices extend their recent run-up amid transport snarls and uneven planting seasons.

President Biden rejected the notion, however, that last year's pandemic support stimulus added to overall price pressures.

"You could argue whether it had on the margin a minor impact on inflation," the President said. "I don't think it did. And most economists do not. But the idea that it caused inflation is bizarre."

3. -- Twitter Shares Higher After Elon Musk Town Hall

Twitter TWTR shares moved higher in pre-market trading following the first face-to-face meeting between staff and the microblogging website and billionaire Tesla TSLA CEO Elon Musk.

Musk, who is planning to purchase the group for $44 billion before taking it private, said staff cuts would likely be needed in order to control costs, and held to his recent view on working from home, suggesting only 'exceptional' staff would be permitted to do so remotely.

The moderated question-and-answer session, however, did little to alter investor perception for Musk's ability -- or willingness -- to close the deal, particularly after he said fake and bot accounts were his "biggest concern" on the platform.

And with market value of Twitter sitting some $16 billion south of Musk's "best and final" offer, most analysts assume the deal price will need to be changed in order for Musk -- who has said he won't go forward until he's satisfied on fake account data -- to complete it.

Wedbush analyst, however, Dan Ives said the meeting was a “clear step in the right direction towards the chances of a deal happening and a smart strategic move as Twitter employees have been left in the dark over the past few months and have many questions during this volatile period of uncertainty”.

Twitter shares were marked 3% higher in premarket trading to indicate an opening bell price of $38.10 each.

4. -- Adobe Shares Slump After Muted Cloud Sales Outlook

Adobe (ADBE) shares slumped lower in pre-market trading after the world's third-largest cloud software group forecast weaker-than-expected near-term revenues thanks in part to headwinds linked to the strength of the U.S. dollar.

Adobe posted record revenues of $4.39 billion for the three months ending on June 3, the group's fiscal second quarter, with an adjusted non-GAAP bottom line of $3.35 per share, both of which topped Street forecasts.

Looking into the current quarter, however, Adobe said it sees revenues of around $4.43 billion, with a tally of $17.65 billion for the full year, each of which fell shy of forecasts from Refinitiv.

While Adobe continues to offer leading products in the Creative, Document, and Experience Clouds that target a $205 billion total addressable market, there are a number of areas where investors are likely to have lingering questions this quarter," said JMP Securities analyst Patrick Walravens, who carries a market perform rating on the stock, citing macro-economic challenges and recent price hikes.

Walravens also asked it the group's creative cloud express will "enable Adobe to blunt the competitive challenge from Canva, the privately-held, template-driven design and publishing tool for the masses that now exceeds $1 billion in annualized revenue"

Adobe shares were marked 3.3% lower in premarket trading to indicate an opening bell price of $353.00 each, a move that would extend the stock's year-to-date decline to around 37.7%.

5. -- Golden State Warriors Win Fourth NBA Title In Eight Years

The Golden State Warriors won their fourth NBA title in eight years last night after defeating the Boston Celtics on their home court to take the seven game series by a score of four games to two.

The Warriors, lead by a 34-point night from their star point guard Stephen Curry, topped the Celtics 103 to 90 to take their seventh overall title for the Bay Area franchise - but the first re-designed Larry O’Brien Trophy that marks the league's championship.

Golden State controlled most of the sixth game of a hard-fought series, using their deadly three-point shooting to open an early lead, which expanded to as much as 22 points, before the Celtics clawed their way thanks to spirited play from shooting guard Jaylen Brown. That rally was ultimately snuffed out by the disciplined play of Golden State and its seasons coach, Steve Kerr, who won five championships as a player with the Chicago Bulls in the early 1990s.

"We found a way to just get it done,” said Curry, was named finals MVP for the first time in his career. “It’s part of a championship pedigree, our experience,” he said. “We built this for 10-11 years. That means a lot when you get to this stage.”