Shares of Dell Technologies Inc. (NYSE:DELL) are consolidating Thursday. Yesterday, the company raised its long-term revenue and profit forecast. This drove the shares higher by more than 9%.

Now they are overbought and may be on the verge of a reversal. This is why Dell is our Stock of the Day.

Many trading strategies and methods are based on the concept of reversion to the mean. If a stock gets over extended in one direction, traders will enter the market because they will be anticipating a reversion or reversal.

Their actions could influence the price. Buyers can push it higher, and sellers can move it lower.

Most of the time a stock stays within its usual or typical trading range. If aggressive and emotional buyers push the price above this range, traders will say the stock is overbought.

Read Also: PepsiCo Signals Strong Pipeline And Cost Discipline Driving Future Profit

Numerous tools can be used to determine whether a stock is overbought. These are momentum oscillators or indicators.

One problem newer traders can have, is using too many of these indicators. They believe that the more information they consume, the better off they will be.

But, many successful traders prefer to use just two or three indicators, and to master them and understand their nuances.

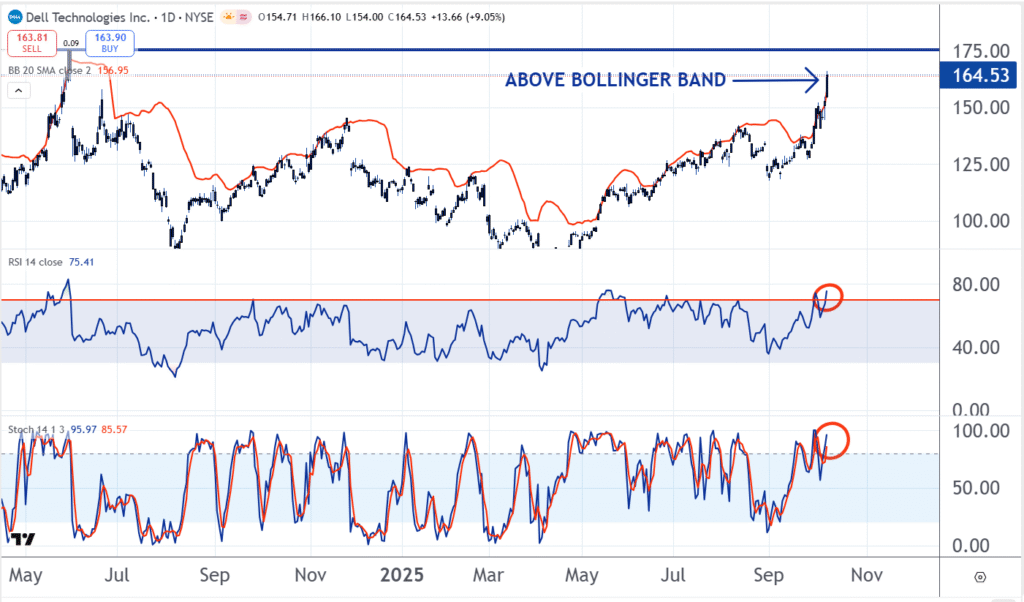

Three popular indicators are on Dell’s chart. The red line is a Bollinger Band. It is two standard deviations above the 20-day moving average. See below.

Statistics and probability theory suggest that 95% of trading should be within two standard deviations of the mean.

If a stock exceeds this band to the upside, like Dell has, it’s considered overbought.

The lower part of the chart shows two other popular momentum indicators. The top one is called the Relative Stregth Index (RSI) and one on the bottom is the Stochastics Indicator. When the lines on the indicators reach the top of their ranges it indicates overbought conditions.

There are dozens if not hundreds of momentum indicators. Traders would be well-off to just learn a couple of them and develop a proficiency

and expertise in them.

But regardless of the indicators used, there is a good chance Dell reverses.

Read Next:

Image: Shutterstock