Stocks finished mixed on Tuesday, as investors experienced another muted session on Wall Street ahead of tomorrow's key March inflation reading.

The Dow Jones Industrial Average inched down 9 points or 0.02% to 38,883.67, while the S&P 500 gained 0.14% to 5,209.91, while the tech-heavy Nasdaq rose 0.32% to 16,306.64.

The March consumer price index report is slated for release Wednesday at 8:30 a.m. ET. A Reuters survey of economists are calling for the index to rise 0.3% in March after advancing 0.4% in February.

“The markets are nervous about tomorrow's CPI report and buying protection (amid) a growing perception that it could be an uncomfortably high inflation reading,” Michael Green, chief strategist at Simplify Asset Management in Philadelphia, told Reuters. “The market is moving to hedge itself.”

Updated at 1:11 PM EDT

Bonds aways ...

The Treasury sold $58 billion in new 3-year notes Tuesday in an auction that drew limp overall demand ahead of tomorrow's March inflation report.

Investors placed bids worth around $145 billion, with so-called indirect bidders, comprised mostly of foreign central banks, taking down around 60.3% of the sale, a 2.5 bid-to-cover ratio that compared to the 2.6 level recorded last month.

The sale is the first of the Treasury's effort to raise $119 billion in three benchmark auctions this week, including a $39 billion 10-year auction tomorrow and a $22 billion 30-year bond sale Thursday.

3-Year Note Auction

— HaiKhuu (@HaiKhuuTrading) April 9, 2024

Bid-to-cover ratio 2.50

High Yield Actual 4.548% vs. 4.528% wi

US sells $58 bln

Awards 34.81% of bids at high

Primary dealers take 19.31%

Direct 20.43%

Indirect 60.26%

Updated at 11:42 AM EDT

Intel challenge

Intel (INTC) shares were active in late-morning trading after the chipmaker unveiled a new AI processor, the Gaudi 3, that it says will outperform, and cost less, than market leader Nvidia's NVDA H100.

Intel said the new accelerator processor will be available for sale in the third quarter of this year, and will have a 50% performance premium, with less energy usage, than Nvidia's AI benchmark

Intel shares were last marked 0.05% higher on the session at $38.00 each, a move that still leaves the stock down more than 20% for the year.

Intel $INTC just unveiled its new AI accelerator processor called Gaudi 3

— Evan (@StockMKTNewz) April 9, 2024

Intel says the accelerator delivers "50% on average better inference and 40% on average better power efficiency than Nvidia H100 – at a fraction of the cost" pic.twitter.com/XGd0ag3kiV

Updated at 11:08 AM EDT

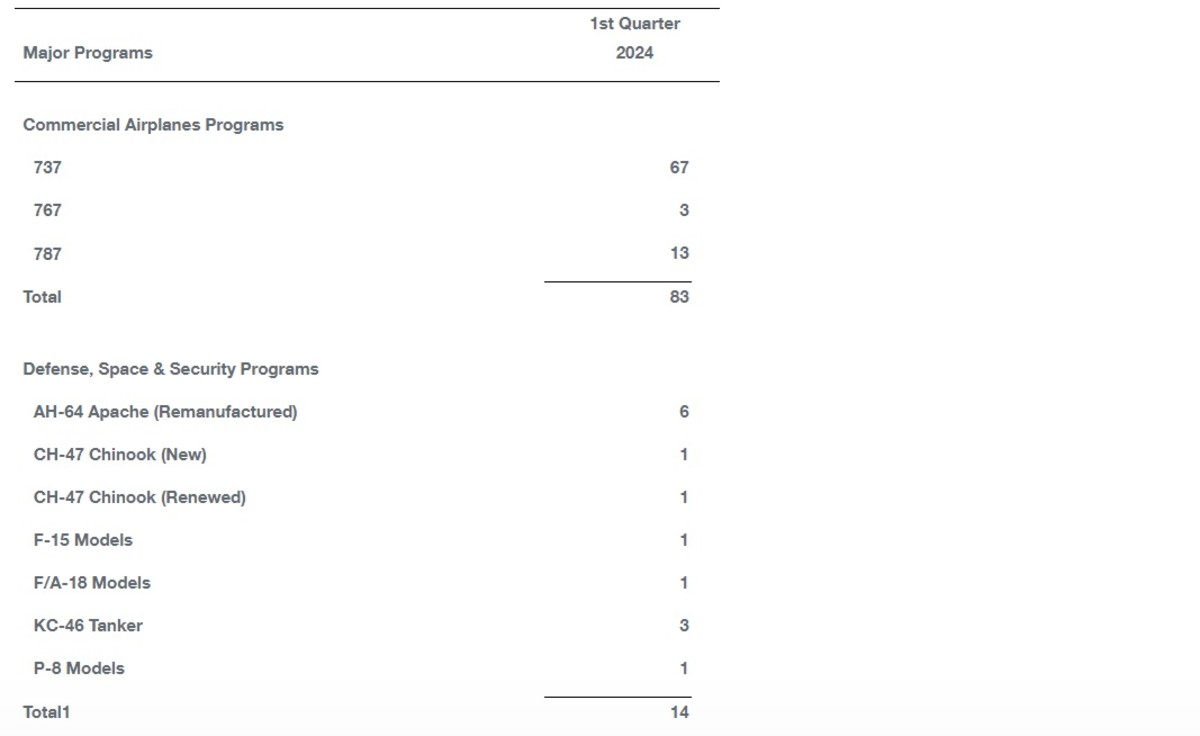

Boeing orders slump

Boeing (BA) shares slipped lower after the planemaker posted its weakest first quarter delivery totals in nearly three years following a series of production hits and safety probes into its 737 MAX jet program.

Boeing delivered a total of 83 commercial planes over the first three months of the year, the company said, down 36% from 2023 levels and nearly half the tally recorded over the final three months of last year.

The group will publish first quarter earnings on April 24.

Boeing shares were marked 0.52% lower in mid-day trading at $180.67 each, extending their year-to-date decline to around 28.1%

Updated at 10:50 AM EDT

Tesla run

Tesla (TSLA) shares extended their recent run of gains Tuesday, taking the stock's five-day advance to around 6.7%, as investors snap-up shares in the EV maker following one the longest drawdowns since going public in 2010.

Elon Musk is trying highlight the value that robotaxis could bring, says RBC Capital's Tom Narayan$TSLA's Robotaxi unveiling on August 8th has driven a 5% jump in stock prices

— Herbert Ong (@herbertong) April 9, 2024

Video: CNBC Television pic.twitter.com/vB7TxbBzq3

Tesla shares were marked 2.23% higher in early trading to change hands at $176.76 each, a move that still leaves the stock down around 28.8% for the year.

Updated at 9:58 AM EDT

Firmer open

Stocks are booking modest early gains in the openings half hour of trading, with the S&P 500 rising 4.2 points, or 0.08%, and the Nasdaq up 58 points, or 0.36%. The Dow was last marked 72 points lower

S&P 500 Opening Bell Heatmap (Apr. 09, 2024)$SPY +0.32% 🟩$QQQ +0.54% 🟩$DJI +0.21% 🟩$IWM +0.55% 🟩 pic.twitter.com/mlveDY5HA2

— Wall St Engine (@wallstengine) April 9, 2024

Updated at 8:20 AM EDT

Alphabet chips in

Alphabet (GOOG) shares jumped higher in early trading after the Wall Street Journal reported that the Google parent is rolling out an in-house made chip, called Axion, to power its AI ambitions.

Using technology and circuitry from Britain's Arm Holdings (ARM) , Google hopes the Axion chips will reduce its reliance on Nvidia (NVDA) -made CPUs and accelerate the rollout of customer-facing, AI-powered products.

Google shares were marked 1.23% higher in pre-market trading to indicate an opening bell price of $158.06 each.

$GOOGL

— *Walter Bloomberg (@DeItaone) April 9, 2024

❖ ALPHABET SHARES UP 1.2% PREMARKET AFTER GOOGLE UNVEILS ARM-BASED DATA CENTER PROCESSOR, NEW AI CHIP

Stock Market Today

Stocks have largely been in a holding pattern since last Friday's close, with investors focused on the March inflation report to either challenge or cement the Federal Reserve's baseline projection of around three quarter-point interest-rate cuts between now and the end of the year.

Traders suggest a 46.3% chance that the first of those cuts will come at the Fed's June policy meeting, according to CME Group data, but they remain divided with respect to the Fed's likely actions over the second half.

A key survey of small business optimism from the National Federation of Independent Business, meanwhile, showed sentiment at its lowest in more than 11 years, with most owners citing inflation concerns over the coming months.

Benchmark 10-year Treasury note yields were marked 2 basis points lower from last night's levels at 4.396% while 2-year notes held at 4.771%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.12% lower at 104.0.13 heading into the early New York session.

Stock markets are also keying on the start of the first-quarter earnings season, which unofficially begins Friday with updates from JP Morgan (JPM) , Citigroup (C) and Wells Fargo (WFC) .

Analysts see collective S&P 500 profits rising 5% from a year earlier to a share-weighted total of $457.4 billion. That figure is expected to improve to around $494.1 billon over the three months ending in June.

Away from equities, global metals prices were back on the march again Tuesday, with gold rising to a record for the eighth session in a row and trading at $2,365.09 per ounce.

Shanghai copper prices also hit a fresh all-time high of $10,500 per ton, tied to both supply constraints and bets on a China demand rebound, while iron ore topped the $1,000-per-ton level in overnight dealing.

Brent crude oil futures were also trading north of the $90 mark, rising 26 cents on the session to $90.64 per barrel. WTI futures for May delivery added 22 cents to trade at $86.65 per barrel, the highest since late October.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500 suggest a 6 point opening bell gain, while those tied to the Dow Jones Industrial Average are indicating a 17 point bump. The Nasdaq is called 35 points higher.

In overseas markets, Europe's Stoxx 600 slipped 0.2% in early Frankfurt trading with investors focused on Thursday's European Central Bank interest-rate decision. Britain's FTSE 100 gained 0.05% in London on the back of higher global commodity prices.

Overnight in Asia, Japan's Nikkei 225 rose 1.08% to close at 39,773.13 points after Bank of Japan Gov. Kazuo Ueda told lawmakers that its easy monetary policies would likely remain in place for the bulk of the year.

Related: Veteran fund manager picks favorite stocks for 2024