Stocks finished higher Wednesday as Wall Street looked to shake off recent losses.

The Dow Jones Industrial Average gained 75 points, or 0.20% to 38,661.05, while the S&P 500 advanced 0.51% to 5,104.76 and the tech-heavy Nasdaq rose 0.58% to 16,031.54.

Federal Reserve Chair Jerome Powell said Wednesday that he still expected the Fed to cut rates and that the U.S. economy appeared nowhere near a recession although he shied away from committing to a timetable for rate cuts as progress on inflation was not assured, Reuters reported.

In prepared remarks ahead of his congressional testimony, Powell said inflation had "eased substantially" since hitting 40-year highs in 2022, but that policymakers still needed "greater confidence" in its decline before rate cuts.

Updated at 2:41 PM EST

A New York minute?

New York Community Bancorp quickly wrapped-up a $1 equity capital raising, led by former U.S. Treasury Secretary Steven Mnuchin's Liberty Strategic Capital, just hours after reports suggested it was ready to tap markets to shore up its balance sheet.

Mnuchin, the bank said, will sit on its board while Joseph Otting, the former U.S. comptroller of the currency, will serve as CFO.

“In evaluating this investment, we were mindful of the bank’s credit risk profile,” Mnuchin said in a statement. “With the over $1 billion of capital invested in the bank, we believe we now have sufficient capital should reserves need to be increased in the future to be consistent with or above the coverage ratio of NYCB’s large bank peers.”

Share remain halted at $1.86 each on the NSYE.

$NYCB

— Ripster📈📉 (@ripster47) March 6, 2024

In connection with the equity capital raise transaction, NYCB will sell and issue, in the aggregate, to the Investors shares of common stock of the Company at a price per share of $2.00 and a series of convertible preferred stock with a conversion price of $2.00, for an…

Updated at 12:42 PM EST

New York state of mind

New York Community Bancorp (NYCB) share plunged lower in mid-day dealing, amid multiple trading halts by officials on the NYSE, following reports that the troubled lender is seeking to raise capital to shore up its balance sheet.

The Wall Street Journal said the bank, which has notable exposure to the commercial real estate sector, is looking to raise money in the equity market in order to firm up investor confidence.

The move comes at an awkward time for Fed Chairman Jerome Powell, who is indirectly tasked with banking system oversight (Michael Barr is the Fed's Vice Chair for bank supervision), as he takes questions on financial sector stability on Capitol Hill.

NYCB shares were last marked 41.88% lower at $1.86 each but remain halted on the NYSE.

$NYCB halted as the bank considers options to raise capital, shares traded down 40.99% prior to the halt 🚨 pic.twitter.com/rzKF9WJFyy

— Markets & Mayhem (@Mayhem4Markets) March 6, 2024

Updated at 11:18 AM EST

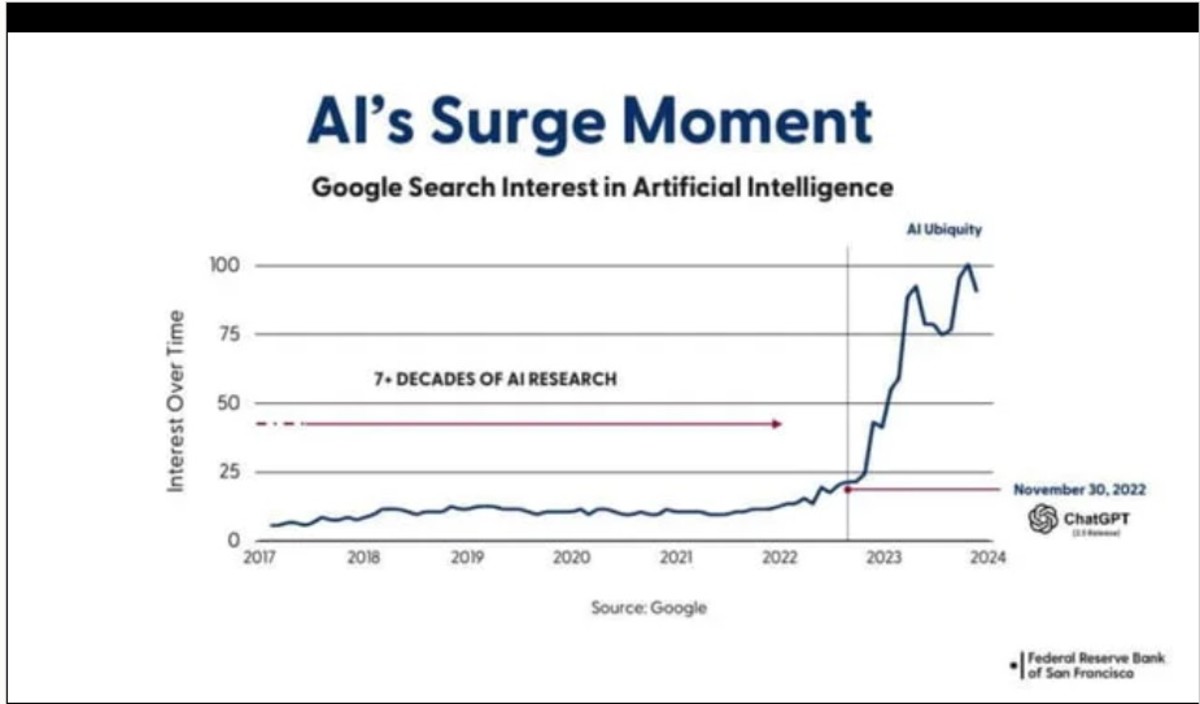

Fed eyeing AI

AI technologies, which have powered much of this year's tech-led rally and have infused investor enthusiasm across a host of related sectors, is also firmly on the radar of central bank policymakers in Washington.

Fed Chair Jerome Powell, taking questions from the House Financial Services Committee on Capitol Hill, said he and his colleagues were "very focused" on AI, but noted that assessing its ultimate impact is "very challenging".

Updated at 10:16 AM EST

Jolted

The BLS said just under 8.87 million jobs went unfilled in January, a modest tick down from the December tally of 8.889 million, suggesting the labor market entered the year with solid momentum, adding to the Fed's concern that inflation pressures could remain elevated over the coming months.

The so-called quits rate, meanwhile, fell to 2.1%, the lowest since August of 2020, suggesting at least some loosing of labor market pressures.

"The openings point to strong hiring continuing, which means more paychecks and good spending," said Robert Frick, corporate economist with Navy Federal Credit Union. "At this point, openings look like they’re supporting a soft landing in the jobs market, where monthly hiring hovers between 100,000 and 200,000, a sustainable zone for a sustainable expansion."

January job openings, hires, and total separations change little #JOLTS #BLSdata https://t.co/1SRAm0teYe

— BLS-Labor Statistics (@BLS_gov) March 6, 2024

Updated at 10:02 AM EST

Firmer open

Stocks are getting a solid boost from tech stocks in the opening hour of trading, with the Nasdaq rising 108 points, or 0.68%, and the S&P 500 up 27 points, or 0.53%.

Benchmark 10-year note yields, meanwhile, extended their recent pullback to 4.106% as investors judged Powell's opening remarks to Congress as having no material impact on rate forecasts.

“No news is good news from Powell. He confirmed that the bias from here is likely toward lower rates and emphasized potential risks from not cutting," said David Russell, global head of market strategy at TradeStation. We’re still in wait-and-see mode, but at least there’s a broad consensus about where we’re going. Higher rates are becoming less of a danger.”

❖ Powell's Remarks Doesn't Change Expectation of June Rate Cut

— *Walter Bloomberg (@DeItaone) March 6, 2024

Chair Powell's remarks to be delivered this morning in Congress "do not change our view that the Fed is likely to start cutting rates in June," Capital Economics' Andrew Hunter says in a report. Powell says in his…

Updated at 8:35 AM EST

Patient Powell

Fed Chair Powell will tell lawmakers that while the path to returning inflation to the central bank's 2% target "is not assured", he still feels its likely that rate cuts will begin later this year.

In prepared remarks for his first of two days of testimony before lawmakers on Capitol Hill, set to begin at 10:00 am Eastern time, Powell said "greater confidence" in the slowing inflation path is needed before committing to interest rate reductions.

Powell repeats the fact that rates have peaked and that it is likely the Fed will reduce rates this year. He was careful to note that inflation has eased without causing an increase in unemployment. So, no major change in the Fed stance in his prepared statement.

— Joseph Brusuelas (@joebrusuelas) March 6, 2024

Updated at 8:20 AM EST

Paycheck

ADP, the payroll processing group, said the economy created 140,000 jobs last month, a 39,000 increase from the upwardly-revised 111,000 tally in January, thanks to solid gains in the services sector.

Pay levels, as well, were also robust, with job-changers seeing a 7.6% increase in salary, compared to the 5.1% gain for those remaining in place.

“Job gains remain solid. Pay gains are trending lower but are still above inflation,” said ADP's chief economist Nela Richardson. “In short, the labor market is dynamic, but doesn't tip the scales in terms of a Fed rate decision this year.

US ADP Employment Change Feb: 140K (est 150K; prev 107K)

— LiveSquawk (@LiveSquawk) March 6, 2024

Updated at 7:11 AM EST

Best Foot forward?

Foot Locker shares slumped 6.7% in pre-market trading after the sportswear retailer, which is heavily-reliant on Nike NKE products, posted better-than-expected fourth quarter profits but issued a muted 2024 forecast.

Foot Locker said it sees adjusted earnings in the region of $1.50 to $1.70 per share this year, with overall sales largely flat to 2023 levels, as it pushes its goal for profit margin improvement two years forward into 2028.

$FL Q4 '23:

— FwdQuarter (@FwdQuarter) March 6, 2024

Net loss $4.13 EPS, Non-GAAP EPS income $0.38

Sales up 2.0%, comp sales down 0.7%

Inventory down 8.2%

'24 outlook: Pos. comp sales growth & EBIT margin expansion expected. Non-GAAP EPS guide $1.50-$1.70, includes non-recurring charge of $0.10. pic.twitter.com/e5dCXuPbnU

Stock Market Today

Stocks ended sharply lower Tuesday, with losses for nearly all the so-called Magnificent 7 tech stocks dragging the Nasdaq into a 1.65% decline, the worst since early January, as investors booked profits from the benchmark's recent gains ahead of Powell's semiannual appearance before lawmakers today.

Powell, who will first face the House Financial Services Committee, is likely to be grilled on the state of the economy and prospects for inflation, which have slowed notably over the past year but remain some distance from the Fed's preferred 2% target.

The Fed chairman is also expected to comment on the prospect of a soft landing for the U.S. economy, where inflation is tamed without inducing recession.

A key component of that aim will come from resilience in the job market, where unemployment remains close to the lowest levels in five decades and wages are rising faster than the pace of inflation.

The Bureau of Labor Statistics will publish its closely tracked estimate of job openings for the month of January at 10 am Eastern Time. Payroll-processing group ADP releases its National Employment report on private-sector hiring at 8:15 am Eastern Time.

Benchmark 10-year Treasury note yields were marked 2 basis points lower from last night's levels at 4.161% heading into the New York trading session. Two-year notes were little changed at 4.568%.

On Wall Street, investors will be looking for a rebound in Magnificent 7 tech stocks, as well as solid updates from Foot Locker (FL) and Campbell Soup (CPB) prior to the opening bell.

Among premarket movers, CrowdStrike (CRWD) shares soared 23%. The cybersecurity group forecast stronger-than-expected full-year profit as it takes on larger rival Palo Alto Networks (PANW) .

In broader markets, futures contracts tied to the S&P 500 suggest a 17 point opening-bell gain for the benchmark, with those linked to the Dow Jones Industrial Average indicating an 85 point advance.

The tech-focused Nasdaq, meanwhile, is set for a firmer 116 point gain thanks in part to premarket advances for Tesla (TSLA) , Nvidia (NVDA) and Advanced Micro Devices (AMD) .

In overseas markets, Europe's Stoxx 600 was marked 0.24% higher in Frankfurt, and close to the all-time highs it reached earlier this week, ahead of a key European Central Bank policy meeting Thursday.

Britain's FTSE 100, meanwhile, was marked 0.34% higher prior to the government's annual budget statement from Finance Minister Jeremy Hunt later today in London.

Overnight in Asia, losses on Wall Street failed to hold down gains for regional benchmarks. The MSCI ex-Japan index rose 0.59% thanks in part to solid gains in Hong Kong and Taiwan. Japan's Nikkei 225, meanwhile, ended 0.017% lower as the yen firmed to 149.72 against the U.S. dollar.

Related: Veteran fund manager picks favorite stocks for 2024