Stocks finished lower Friday, one day after the S&P 500 closed at a fresh record high, as investors parsed details of a key February jobs report.

The Dow Jones Industrial Average lost 68 points, or 0.18%, to 38,772.69, while the S&P 500, which had reached a fresh intra-day record high earlier in the session, slipped 0.65% to 5,123.69.

The tech-heavy Nasdaq tumbled 1.16% to 16,085.11.

Atificial-intelligence-market leader Nvidia (NVDA) lost ground, losing 5.6% by the end of the session.

The Dow and Nasdaq are down 0.93% and 1.17%, respectively, on the week, while the S&P 500 was essentially flat, CNBC reported.

The U.S. economy added 275,000 new jobs last month, the Bureau of Labor Statistics said Friday, a tally that once again topped Wall Street forecasts and the running six-month average.

Slower-than-expected wage gains, however, as well as a downward revision to the January total (which was pegged at 229,000 from an original estimate of 353,000) took the edge off an otherwise hot report.

“The stronger than expected jobs number for February was really outweighed by downward revisions from the prior two months,” said Rob Swanke, senior equity strategist for Commonwealth Financial Network. “The jobs number beat expectations for February by 75,000, however the prior two months were revised downward by 167,000 jobs."

"This is what led to the increase in unemployment as we’ve also seen no change in the participation rate," he added.

Although there was some increase in transportation and warehousing jobs after seeing losses for the prior three months and a small increase in retail jobs, Swanke said that “we’re not seeing a lot of excess hiring in some of those sectors that would indicate an economy that is picking up steam."

"This will be a key data point for the Fed to watch as they look out over the next few meetings to determine when to cut rates," he said.

Updated at 10:46 AM EST

Bitcoin 70K

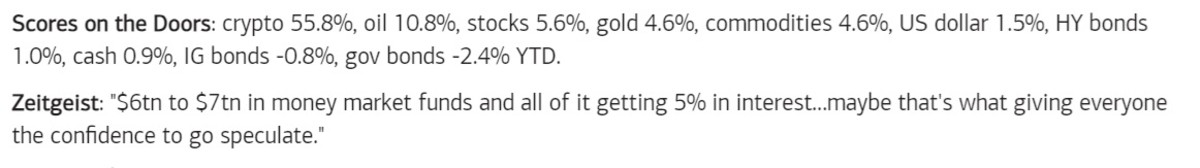

Bitcoin prices topped the $70,000 mark for the first time record, extending its year-to-date gain past 55%, as the impact of a SEC ruling allowing for the launch of exchange traded funds continues to lift the broader crypto market.

Updated at 10:34 AM EST

Tesla weight loss

Novo Nordisk (NVO) , the Denmark-based drugmaker overtook Tesla (TSLA) in terms of market value late Thursday after it said a new oral treatment could outperform its blockbuster drug Wegovy in terms of weight loss.

Novo said new GLP-1 agonist, known as amycretin, could be formally launched before the end of the decade.

The group's Denmark-listed shares closed 1.36% lower Friday at 906.70 krnoer each, giving it a market value of $604 billion, compared to Tesla's $560 billion.

Updated at 9:55 AM EST

Records everywhere

The S&P 500 hit a fresh intra-day record high of 5,181.34 points in early Friday trading, and was last marked 22 points, or 0.43%, from last night's record close.

The Dow was last seen 130 points higher while the Nasdaq gained 104 points, or 0.64%, after printing a new intra-day peak of 16,378.77 points.

"February’s hot payrolls total may have looked like a 180-degree reversal of the soft jobs data we saw the past two days, but the sharp downward revision to January’s number paints a cooler overall picture," said Chris Larkin, managing director for trading and investing at E*Trade from Morgan Stanley.

"The report didn’t necessarily amount to an “all-clear” signal for the Fed, but there also didn’t appear to be anything in it that would derail its plan to cut rates in the second half of the year," he added.

S&P 500 all-time high.$SPX @CNBC 🇺🇸 pic.twitter.com/A57J6RyoCN

— Carl Quintanilla (@carlquintanilla) March 8, 2024

Updated at 8:49 AM EST

Hot jobs, cool wages

The U.S. economy added 275,000 new jobs last month, the Bureau of Labor Statistics said Friday, a tally that once again topped Wall Street forecasts and the running six-month average.

Slower-than-expected wage gains, however, as well as a downward revision to the January total (which was pegged at 229,000 from an original estimate of 353,000) took the edge off an otherwise hot report.

Stocks turned higher, with the S&P 500 called 21 points higher while the Dow is set for a 90 point advance.

Benchmark 10-year note yields were marked 4 basis points lower at 4.056% while 2-year notes were 6 basis points lower at 4.421%.

February nonfarm payrolls +275k vs. +200k est. & +229k in prior month (rev down from +353k) … however, revisions for prior two months totaled a significant -167k pic.twitter.com/qVR6ZF5PVY

— Liz Ann Sonders (@LizAnnSonders) March 8, 2024

Stock Market Today

Stocks powered to a record for the 17th time this year, supported by yet another firm rally in AI-related chip stocks and testimony from Powell that indicated the central bank is "not far" from having the confidence that inflation is slowing to its 2% target.

Powell's remarks, which came amid two days of appearances on Capitol Hill, pulled Treasury bond yields notably lower and dragged the U.S. dollar index to a six-week trough against its global peers.

Benchmark 10-year note yields were last marked at 4.071%, the lowest in two months, while 2-year notes were pegged at 4.492%.

The moves in both rates and stocks will be tested today, however, by the Labor Department's February employment report, which is expected to show the economy added around 200,000 new jobs last month.

A faster-than-expected reading, including any uptick in average hourly earnings, could extend the time in which the Fed will find the confidence on inflation it's seeking before initiating rate cuts.

Conversely, a softer reading could signal both broader economic weakness and easing price pressures, both of which could compel the Fed to begin lowering rates in the late spring or sooner.

At present, CME Group's FedWatch suggests little chance of a move on rates in either this month's policy meeting or the following gathering in May. The odds of a June cut are holding at around 56.7%.

On Wall Street, stocks are set for a muted open ahead of the jobs-report release at 8:30 am Eastern Time, with futures contracts tied to the S&P 500 suggest a 5 point opening-bell gain while those linked to the Dow Jones Industrial Average are indicating a 15 point dip.

The tech-focused Nasdaq, meanwhile, is set for a 10 point decline, although artificial-intelligence-market leader Nvidia (NVDA) is set for another record open and was last marked 3% higher in premarket dealing.

In Europe, the Stoxx 600 was marked 0.21% higher, after hitting another all-time high earlier in the session, as investors extracted a dovish tone from yesterday's European Central Bank policy meeting.

Overnight in Asia, the regionwide MCSI ex-Japan benchmark was carried to a firm 1.17% gain by last night's rally on Wall Street, while Japan's Nikkei 225 added 0.19% to close at 39,688.94 points.

Related: Veteran fund manager picks favorite stocks for 2024