U.S. stock futures are inching lower on Wednesday, following a mixed session on Tuesday, with major benchmark indices in the red pre-market.

This comes amid President Donald Trump hinting at a de-escalation in the tariff situation with India, following his conversation with Indian Prime Minister Narendra Modi. Trump called Modi “a great person” and “a great friend of mine over the years,” while addressing the media from the Oval Office on Tuesday.

Investors on Wednesday will be closely watching the earnings results of several prominent companies, such as Tesla Inc. (NASDAQ:TSLA), SAP SE (NYSE:SAP) and International Business Machines Corp. (NYSE:IBM), among several others.

Meanwhile, the 10-year Treasury bond yielded 3.957% and the two-year bond was at 3.449%. The CME Group's FedWatch tool‘s projections show markets pricing a 98.9% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.0042% |

| S&P 500 | 0.030% |

| Nasdaq 100 | -0.19% |

| Russell 2000 | -0.40% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, are up in premarket on Wednesday. The SPY is up 0.09% at $671.92, while the QQQ is up 0.01%, trading at $611.43, according to Benzinga Pro data.

Stocks In Focus

Tesla

-

Tesla Inc. (NASDAQ:TSLA) shares are up 0.07% overnight, ahead of the company’s much-anticipated third-quarter results after markets close on Thursday.

- The stock scores high in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, the company, its finances and operations.

SAP SE

-

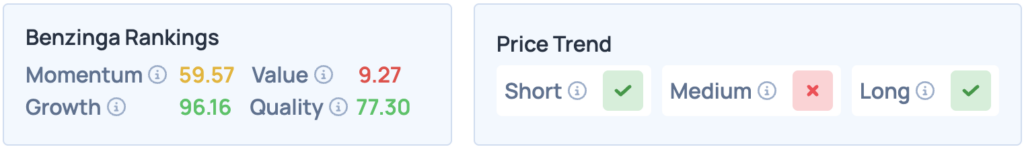

SAP SE (NYSE:SAP), the German software giant, is set to release its third-quarter results after markets close on Wednesday. The stock is currently down 1.74% in overnight trade.

- The stock scores high on Momentum and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short and long terms. Click here for deeper insights into the stock, its peers and competitors.

International Business Machines Corp

-

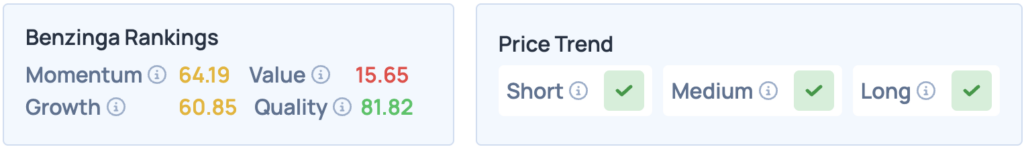

IBM (NYSE:IBM) shares are up 0.22% in overnight trade, ahead of the company’s third-quarter results after markets close on Wednesday.

- The stock scores poorly in Benzinga’s Edge Stock Rankings, but does well on Quality, and has a favorable price trend in the short, medium and long-term. Click here for more insights into the stock, the company, its operations and finances.

Thermo Fischer Scientific

-

Thermo Fischer Scientific Inc. (NYSE:TMO) is rallying by 2.17% in overnight trade, just hours before the company’s third-quarter results, before markets open on Wednesday.

- According to Benzinga’s Edge Stock Rankings, the stock does poorly on most metrics, but has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, alongside various other facts and figures.

AT&T

-

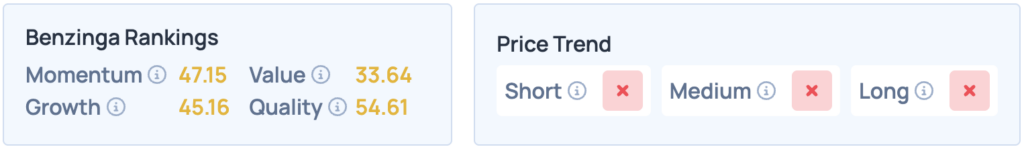

AT&T Inc. (NYSE:T) shares are up 0.23% pre-market, ahead of the company’s third-quarter earnings release on Wednesday morning, before markets open.

- The stock does poorly across the board in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long-term. Click here for deeper insights into the stock, its peers and competitors.

Cues From Last Session

The markets had a fairly mixed performance on Tuesday, with no clear trend visible across most sectors or indices throughout the day.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | +0.16% | 22,953.67 |

| S&P 500 | +0.003% | 6,735.35 |

| Dow Jones | +0.47% | 46,924.74 |

| Russell 2000 | +0.49% | 2,487.69 |

Insights From Analysts

According to The Kobeissi Letter on X, foreign investors have been pouring into U.S.-listed stocks in recent months, with the figure touching $22 billion “so far in October,” which it says is the highest since June, according to data by Goldman Sachs.

The post notes that this is the “3rd consecutive monthly inflow,” with the year-to-date figure at a net $316 billion. According to the post, “foreign holdings of US equities rose to a record $20 trillion last quarter,” concluding that “Everyone wants to enter the US stock market.”

Upcoming Economic Data

Investors on Wednesday will be keeping an eye on the following events,

- Fed Governor Michael Barr is set to give a speech at 4 P.M. on Wednesday.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures are trading up in the early New York session by 1.87% hovering around $58.31 per barrel.

Gold Spot US Dollar is down 0.90%, hovering around $4,087.97 per ounce. Its last record high stood at $4,379.29 per ounce. The U.S. Dollar Index spot was up 0.07% at 99.001.

Meanwhile, Bitcoin is trading 0.05% lower at $108,327.80 per coin.

Most Asian markets are in the red on Wednesday, barring India’s Nifty 50, South Korea’s KOSPI and Singapore’s Straits Times Index. Australia’s ASX 200 and New Zealand’s NZX 50 are down as well, with European markets too primarily in the red, with a few exceptions being London’s FTSE and Spain’s IBEX.

Read More:

Photo courtesy: Shutterstock