Editor’s note: The future prices of benchmark tracking ETFs, the lede, earnings, and the latest economic releases were updated in the story.

U.S. stock futures advanced on Friday following Thursday's positive moves. Futures of major benchmark indices were higher.

U.S. inflation moderated slightly in September, with the Consumer Price Index for All Urban Consumers (CPI-U) rising 0.3% on a seasonally adjusted basis after a 0.4% increase in August.

The U.S. Bureau of Labor Statistics reported Friday that over the last 12 months, the all-items index increased 3.0%. A sharp 4.1% rise in the gasoline index was the largest factor in the monthly increase, driving the overall energy index up by 1.5%.

Meanwhile, trade relations with America's closest ally cratered, with President Donald Trump stating on social media, "ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED," over a dispute involving an anti-tariff advertisement by Canada.

The 10-year Treasury bond yielded 4.01% and the two-year bond was at 3.49%. The CME Group's FedWatch tool‘s projections show markets pricing a 98.9% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.04% |

| S&P 500 | 0.23% |

| Nasdaq 100 | 0.41% |

| Russell 2000 | 0.27% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Friday. The SPY was up 0.38% at $674.31, while the QQQ advanced 0.53% to $613.82, according to Benzinga Pro data.

Stocks In Focus

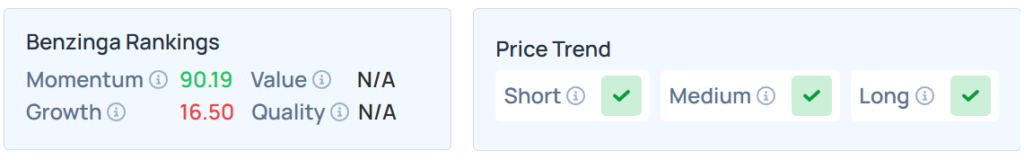

Intel

- Intel Corp. (NASDAQ:INTC) jumped 6.89% in premarket on Friday after reporting stronger-than-expected financial results for the third quarter. Its revenue of $13.65 billion beat analyst estimates of $13.14 billion and earnings of 23 cents per share beat estimates of one cent per share.

- INTC maintained a stronger price trend over the short, medium, and long terms, with a poor growth ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

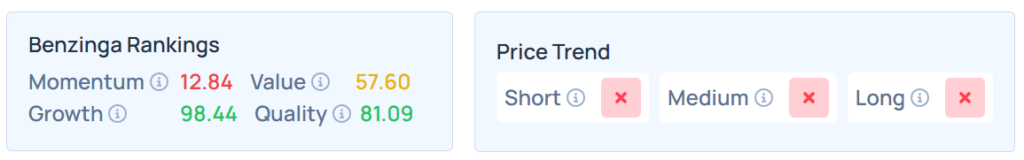

Ford Motor

- Ford Motor Co. (NYSE:F) jumped 3.65% after reporting better-than-expected financial results with a quarterly earnings of 45 cents per share, which beat the analyst estimate of 36 cents and revenue of $47.18 billion, above the $43.07 billion estimate.

- Ford maintained a stronger price trend over short, medium, and long terms, with a strong value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Deckers Outdoor

- Deckers Outdoor Corp. (NYSE:DECK) dropped 11.64% despite better-than-expected financial results as it issued disappointing full-year sales guidance.

- DECK maintained a weaker price trend over the short, medium, and long terms, with a strong quality ranking. Additional information is available here.

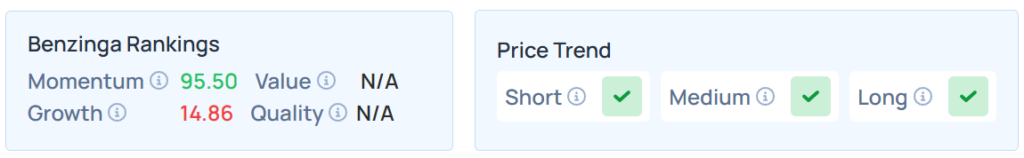

Plug Power

- Plug Power Inc. (NASDAQ:PLUG) rose 3.12% after it announced a milestone deployment of its GenDrive hydrogen fuel cell systems and GenFuel infrastructure at Floor & Decor Holdings, Inc.‘s (NYSE:FND) distribution center in Frederickson, Washington.

- Benzinga’s Edge Stock Rankings indicate that PLUG maintains a stronger price trend over the short, medium, and long terms, with a weak growth ranking. Additional performance details are available here.

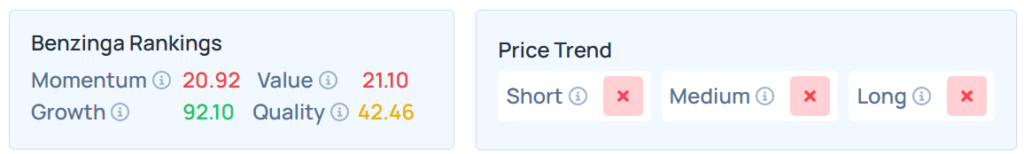

Procter & Gamble

- Procter & Gamble Co. (NYSE:PG) shares were 3.31% higher as it reported diluted earnings of $1.95 per share, beating the estimate of $1.90, and revenue of $22.4 billion, above the estimated $22.17 billion, according to Benzinga Pro.

- PG maintained a weaker price trend over short, medium, and long terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Based on the sector performance data from Wednesday, the market saw broad gains, with the all sectors weighted average up 0.58%.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.89% | 22,941.80 |

| S&P 500 | 0.58% | 6,738.44 |

| Dow Jones | 0.31% | 46,734.61 |

| Russell 2000 | 1.27% | 2,482.66 |

Insights From Analysts

While the artificial intelligence (AI) boom has captured headlines and fueled much of the S&P 500 Index’s rally this year, the resulting infrastructure demands are creating major opportunities in “periphery plays,” according to a Wells Fargo Investment Institute commentary.

Scott Wren, Senior Global Market Strategist, wrote that long before AI, “the U.S. power grid was in dire need of upgrading in many, if not most, areas of the country”.

The emergence of power-intensive AI data centers has been a “game changer,” forcing the massive grid upgrades that were already necessary. Wren argues that investors should look beyond just the Technology sector.

“That means we believe our favored sectors beyond just Technology, such as Industrials and Utilities, are also set to benefit,” Wren noted. These sectors are essential for building the data centers, manufacturing components, upgrading the grid, and providing electricity.

Citing estimates that $3 will be spent on supporting infrastructure for every $1 spent on AI, Wren believes this is just the beginning. “We are now only in the early innings of what in our view is a longer-term secular trend”.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Friday;

- Consumer Price Index for September 3.0% YoY Vs. 3.1% Estimate; Core CPI 3.0% YoY Vs. 3.1% Expected.

- October's S&P flash U.S. services PMI and manufacturing PMI will be out by 9:45 a.m., and September's new home sales data will be delayed due to the impending shutdown.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.21% to hover around $61.67 per barrel.

Gold Spot US Dollar fell 1.38% to hover around $4,068.69 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.11% higher at the 99.0400 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.96% higher at $111,370.38 per coin.

Asian markets closed higher on Friday, except India’s NIFTY 50 and Australia's ASX 200 indices. South Korea's Kospi, Japan's Nikkei 225, Hong Kong's Hang Seng, and China’s CSI 300 rose. European markets were lower in early trade.

Read Next:

Photo courtesy: Shutterstock