Stock indexes finished the regular session lower Wednesday as investors looked toward the Federal Reserve's primary gauge for inflation later in the week — the personal consumption and expenditure index. Oracle fell after forging an artificial intelligence partnership. And traders awaited Costco's earnings report, due Thursday.

All three major indexes suffered back-to-back losses in the wake of hitting new highs Monday. The Dow Jones Industrial Average fell 0.4% while the S&P 500 and Nasdaq both dropped 0.3%.

Volume was lower on both the New York Stock Exchange and on the Nasdaq compared with the same time on Tuesday. Decliners outnumbered advancers on both exchanges — by more than 5-to-3 on the NYSE and more than 4-to-3 on the Nasdaq.

The 10-year Treasury yield moved higher to 4.15%. Small caps in the Russell 2000 retreated by 0.9%.

3:46 p.m. ET

Costco Earnings Loom

Costco traded nearly unchanged ahead of its fourth-quarter results, which are scheduled for Thursday. Earnings estimates sit at $5.80 per share on sales of $86 billion.

Accenture and Jabil are also due to report Thursday. Jabil reversed lower after breaking out of a cup base at a buy point of 232.84 on Monday.

3:03 p.m. ET

S&P Sectors: Materials Lag; Four Sectors Gain

Among the S&P 500 sectors, consumer discretionary, consumer staples, utilities and energy gained between 0.2% and 1.4%. Materials and communication services lagged the most. Materials fell more than 1%.

1:57 p.m. ET

Economic Data On Tap

In economic news, new-home sales soared past estimates for August to 800,000. Economists had targeted 649,000.

Two other economic events Thursday and Friday are expected to move stocks. On Thursday, second-quarter GDP from the Commerce Department is seen showing a 3.3% reading.

On Friday, the Fed's preferred inflation gauge, the personal consumption and expenditure index for August is expected to tick higher to 0.3% from July and rise 2.7% annually. Core inflation is seen rising 0.2% on a monthly basis and 2.9% annually.

Stock Market Today: Biotech Triples In Value

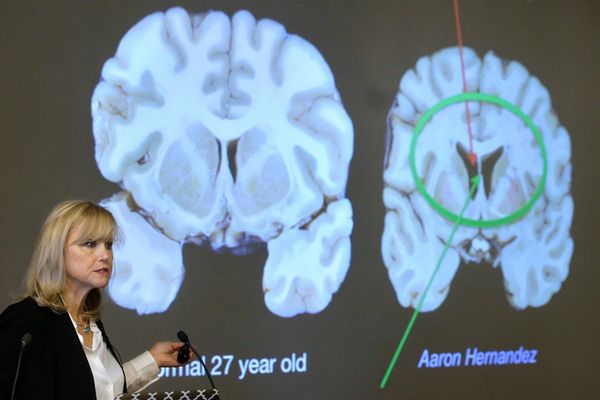

Uniqure rocketed more than 200% after the gene therapy company announced positive results for a clinical study to slow down the progression of Huntington's disease.

Huntington's disease is caused by an abnormal protein that destroys brain cells and leads to physical and mental deterioration in patients.

Market Looks Fine But Several Hot Stocks Skid

12:35 p.m. ET

Cintas Edges Past Views For Its August Quarter

Cintas inched lower after reporting results for its August-ended fiscal first quarter. The stock undercut its flat base at one point in the session but pared losses and moved back above the base's floor.

Earnings of $1.20 per share edged past analyst predictions of $1.19 per share while sales grew to $2.72 billion. Analysts had called for sales of $2.69 billion. Cintas makes uniforms and workplace supplies and equipment.

More earnings reports on Wednesday include K.B. Home. Shares are hovering above their 50-day moving average.

11:50 a.m. ET

Data Project Expands; Mining Stock Soars On Trump Plans

Oracle, OpenAI and SoftBank announced five new data centers under the Stargate data centers project. Stargate aims to build 10 gigawatts of artificial intelligence capacity in the U.S. through a $500 billion investment over four years.

The announcement had diverging effects on the stocks involved. Oracle stock was down 3% in recent trades while SoftBank shares jumped more than 3%.

Elsewhere, Lithium Americas nearly doubled in value amid news from Reuters that the Trump administration may take a 10% stake in the mineral miner. Shares broke out of a cup base at a buy point of 3.46 and were more than 98% higher in recent action

Volume is tracking more than 4,500% higher than average. The stock is on track for its largest percentage increase on record, according to Dow Jones Market Data.

Also in the mining and metal ores group, Freeport-McMoRan triggered a sell signal after the company lowered its third-quarter sales outlook by 4% for copper and 6% for gold from its July outlook.

Shares were in a cup with handle with a buy point of 47.02 but fell more than 10% on Wednesday. The stock also undercut its 50-day moving average in higher volume — a sell signal.

10:58 a.m. ET

Stock Market Today: Thor Shares Break Out Of Base

Thor Industries jumped 7% after fourth-quarter results. Earnings came in at $2.36 per share on sales of $2.52 billion. Analysts had called for earnings of $1.28 per share on sales of $2.32 billion. Thor makes towable and motorized recreational vehicles. In the fourth quarter of 2024, the company earned $1.68 per share on revenue of $2.53 billion.

For 2026, Thor noted a "challenging year" ahead and gave earnings guidance of $4 per share at the midpoint, below analyst expectations of $4.25 per share. Shares broke out of a cup-with-handle base at a buy point of 97.32 in August and had pulled back to their 50-day moving average on Tuesday before rebounding. On Wednesday, the stock extended gains.

9:55 a.m. ET

Nasdaq 100 Winners, Losers: Marvell, AMD, Adobe

Among the Nasdaq 100 stocks, Marvell Technology rallied more than 4% while Advanced Micro Devices gained 1.5%, making them some of the best performers at the market open. Marvell is nearing an 85.27 buy point, while AMD stock is facing resistance at the 50-day moving average.

On the downside, Adobe sold off more than 3%, breaching its 50-day moving average.

9:23 a.m. ET

Dow Jones Movers: Chevron, Nvidia, UnitedHealth

Inside the blue chip index, Chevron, Nvidia and UnitedHealth Group were among the biggest gainers in the premarket session.

Chevron shares climbed 0.5%, trying to find support at the 50-day moving average. Nvidia stock gained 0.5%, looking to bounce back from heavy losses Tuesday. And UnitedHealth eyed a four-day winning streak, with a 1.2% rally Wednesday morning.

8:32 a.m. ET

Stock Market Today: Alibaba Soars On AI Spending Plans

Chinese stock Alibaba surged nearly 9% premarket Wednesday after the company said it will open new data centers and hike spending on AI initiatives. Shares are extended above a 148.43 buy point.

Alibaba expects to spend more than its previously announced target of $53 billion for AI infrastructure, Chief Executive Eddie Wu said at an industry conference in China Wednesday. The announcement comes a day after Alibaba rolled out a large update to its Qwen open-source large language model.

8:20 a.m. ET

Micron Falls On Earnings

Artificial intelligence stock Micron Technology dropped more than 1% in premarket trading even after the company easily beat analyst estimates for its fiscal fourth quarter and with its outlook, thanks to strong AI data center growth. Shares set new highs last week.

The memory-chip maker earned an adjusted $3.03 a share on sales of $11.32 billion in the quarter ended Aug. 28. Analysts polled by FactSet had expected Micron earnings of $2.86 a share on sales of $11.22 billion. On a year-over-year basis, Micron's earnings soared 157% while sales increased 46%.

Amazon Stock Breaks Key Level

Amazon stock looked to snap a two-day losing streak Wednesday, rising more than 1% premarket.

On Tuesday, Amazon stock tumbled 3% in heavy volume, breaking below its 50-day moving average line, a critical support level. That's a sell signal. Meanwhile, shares are also nearly 7% below a 236.53 buy point, per IBD MarketSurge. Further weakness would trigger another sell signal.

Stock Market Today: New Home Sales

Due out at 10 a.m. ET, the Commerce Department's new home sales for August are expected to ease to an annual rate of 649,000 vs. 652,000 in July.

For July, new home sales dropped 0.6% from the prior month and 8.2% year over year. Higher mortgage rates and a weakening labor market are hampering sales.

Be sure to follow Scott Lehtonen on X at @IBD_SLehtonen for more on growth stocks, the Dow Jones Industrial Average and the stock market today.

Please follow VRamakrishnan on X/Twitter for more news on the stock market today.