Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures rose on Monday following Friday’s sell-off. Futures of major benchmark indices were higher.

Magnificent 7 stocks surged in premarket following President Donald Trump‘s de-escalation on Sunday, saying, "Don’t worry about China, it will all be fine," adding that the "Highly respected President Xi just had a bad moment."

Asian markets tumbled in trade on Monday, with major Chinese technology and auto stocks falling sharply in trade in Hong Kong.

The 10-year Treasury bond yielded 4.03% and the two-year bond was at 3.50%. The CME Group's FedWatch tool‘s projections show markets pricing a 96.2% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.96% |

| S&P 500 | 1.33% |

| Nasdaq 100 | 1.84% |

| Russell 2000 | 1.61% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Monday. The SPY was up 1.14% at $660.47, while the QQQ advanced 1.71% to $599.59, according to Benzinga Pro data.

Stocks In Focus

Magnificent 7 Stocks

- Nvidia Corp. (NASDAQ:NVDA) advanced 3.57%, Tesla Inc. (NASDAQ:TSLA) was up 2.70%, Microsoft Corp. (NASDAQ:MSFT) gained 1.51%, Apple Inc. (NASDAQ:AAPL) was higher by 1.75%, whereas Amazon.com Inc. (NASDAQ:AMZN) rose by 2.09% and Alphabet Inc. (NASDAQ:GOOG) and Meta Platforms Inc. (NASDAQ:META) gained 1.52% and 1.56%, respectively.

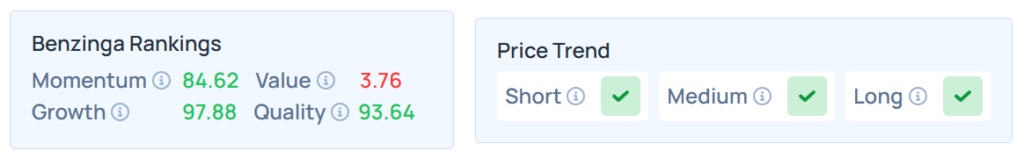

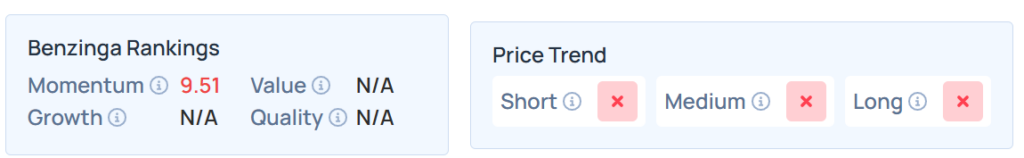

- NVDA maintained a stronger price trend over the short, medium, and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Fastenal

- Fastenal Co. (NASDAQ:FAST) jumped 2.57% ahead of its earnings before the opening bell. Analysts estimate earnings of 30 cents per share on revenue of $2.13 billion.

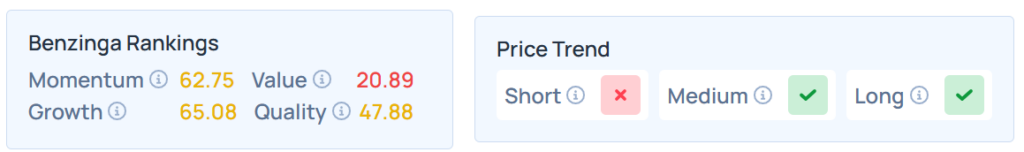

- Benzinga’s Edge Stock Rankings indicate that FAST had a weaker price trend in the short term but a strong trend in the medium and long terms, with a moderate quality ranking. Additional performance details are available here.

Faraday Future Intelligent

- Faraday Future Intelligent Electric Inc. (NASDAQ:FFAI) gained 2.96% after the company signed a deposit agreement for 1,000 units of FX Super One with ZEVO.

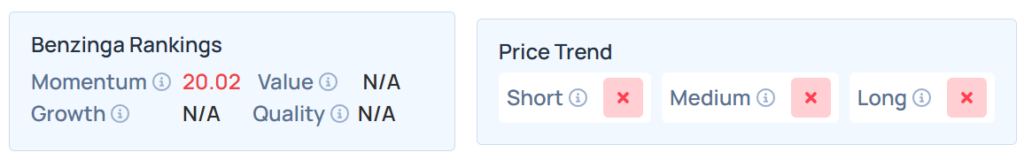

- FFAI maintained a weaker price trend over the short, medium, and long terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Vince Holding

- Vince Holding Corp. (NYSE:VNCE) tumbled 3.15% after announcing that it will transfer to the Nasdaq from the NYSE.

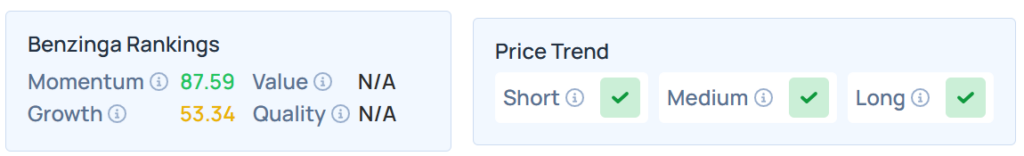

- Benzinga’s Edge Stock Rankings indicate that VNCE maintains a stronger price trend over the short, medium, and long terms, with a moderate growth ranking. Additional performance details are available here.

Lucid Group

- Lucid Group Inc. (NASDAQ:LCID) shares climbed 1.95% as the electric vehicle maker said it had begun customer deliveries of the Lucid Gravity Grand Touring SUV in Canada.

- LCID maintained a weaker price trend over the short, medium, and long terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

With information technology, consumer discretionary, and energy stocks posting the biggest losses, most sectors on the S&P 500 closed Friday on a negative note. However, consumer staples stocks managed to buck the broader market trend, ending the session with gains.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -3.56% | 22,204.43 |

| S&P 500 | -2.71% | 6,552.51 |

| Dow Jones | -1.90% | 45,479.60 |

| Russell 2000 | -3.01% | 2,394.60 |

Insights From Analysts

Crescat Capital warned that “speculative complacency” has pushed top technology stock valuations significantly past the 2000 dot-com bubble. The firm advocates for a “great rotation” from overvalued AI stocks into assets like gold miners.

Kevin C. Smith, Crescat’s Chief Investment Officer’s analyzed that the enterprise value of the top 10 U.S. mega-caps is 76.8% of GDP, 270% higher than the 28.4% peak during the internet bubble. Chief Investment Officer Kevin C. Smith stated that investing in tech-dominated index funds now “assumes that gravity no longer applies."

Meanwhile, Economist Justin Wolfers issued a stark warning, arguing that the U.S. is effectively operating as "two economies" where a massive artificial Intelligence boom is concealing significant weakness in all other sectors.

"If you took that out of the numbers and you just looked at the non-AI parts of the economy, it's basically flatlining." In a social media post sharing the clip, Wolfers credited the insight to fellow economists Natasha Sarin and Jason Furman.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on this week;

- On Monday, Philadelphia Fed President Anna Paulson will speak at 12:55 p.m. ET.

- On Tuesday, September’s NFIB optimism index data will be released by 6 a.m. ET.

- Fed governor Michelle Bowman will speak at 8:45 a.m., Fed governor Christopher Waller will speak at 3:25 p.m., and Boston Fed President Susan Collins will speak at 3:30 p.m. ET.

- On Wednesday, October’s Empire State manufacturing survey will be out by 8:30 a.m. ET.

- Atlanta Fed President Raphael Bostic will speak at 12:10 p.m., Fed Governor Stephen Miran will speak at 12:30 p.m., Fed Governor Christopher Waller will speak at 1:00 p.m., and Fed Beige Book data will be released at 2:00 p.m. ET.

- On Thursday, Richmond Fed President Tom Barkin will speak at 8:00 a.m. ET. September’s U.S. retail sales, initial jobless claims, August’s business inventories, and headline and core PPI data will be delayed because of the shutdown.

- Philadelphia Fed manufacturing survey data for October will be out by 8:30 a.m.

- October’s home builder confidence index data will be released at 10:00 a.m., Fed Governor Stephen Miran will speak at 9:00 a.m. and 4:15 p.m., Christopher Waller will speak at 9:00 a.m., Michelle Bowman will speak at 10:00 a.m., and Richmond Fed President Tom Barkin will speak at 12:45 p.m. and 4:30 p.m. ET.

- On Friday, September’s housing starts, building permits, import price index, industrial production, and capacity utilization data will be delayed because of the impending government shutdown.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.94% to hover around $60.04 per barrel.

Gold Spot US Dollar rose 1.32% to hover around $4,071.30 per ounce. Its last record high stood at $4,079.81 per ounce. The U.S. Dollar Index spot was 0.14% higher at the 99.1160 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 3.03% higher at $115,212.40 per coin.

Asian markets closed lower on Monday as South Korea's Kospi, India’s NIFTY 50, Hong Kong's Hang Seng, China’s CSI 300, Australia's ASX 200, and Japan's Nikkei 225 fell. European markets were higher in early trade.

Read Next:

Photo courtesy: Shutterstock