U.S. stock futures rose on Monday following Friday’s positive moves. Futures of major benchmark indices were higher.

Investors are eyeing multiple developments this week, which include the earnings report of five firms among the Magnificent 7 constituents. Microsoft Corp. (NASDAQ:MSFT), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), and Meta Platforms Inc. (NASDAQ:META) will announce results on Wednesday, whereas Apple Inc. (NASDAQ:AAPL) and Amazon.com Inc. (NASDAQ:AMZN) will report on Thursday.

The Federal Reserve Open Market Committee will announce its decision on interest rates on Wednesday, and President Donald Trump will meet his Chinese counterpart, Xi Jinping, on Thursday in South Korea to finalize the deal framework reached by both sides to avert the looming 100% additional tariff threat.

The 10-year Treasury bond yielded 4.03% and the two-year bond was at 3.50%. The CME Group's FedWatch tool’s projections show markets pricing a 96.7% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.56% |

| S&P 500 | 0.78% |

| Nasdaq 100 | 1.14% |

| Russell 2000 | 1.03% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Monday. The SPY was up 0.78% at $682.52, while the QQQ advanced 1.16% to $624.23, according to Benzinga Pro data.

Stocks In Focus

Avidity Biosciences And Novartis

- Avidity Biosciences Inc. (NASDAQ:RNA) surged 42.56% in premarket on Monday after Novartis AG (NYSE:NVS), which was down 1.04%, decided to acquire the former for $12 billion to strengthen its late-stage neuroscience pipeline and expand its RNA therapeutics portfolio.

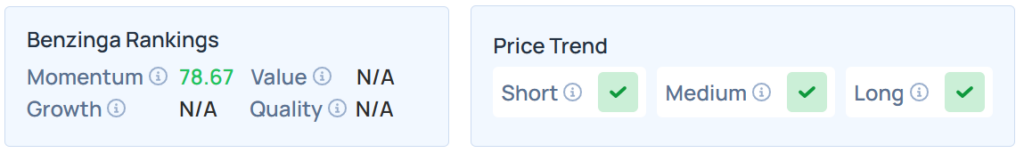

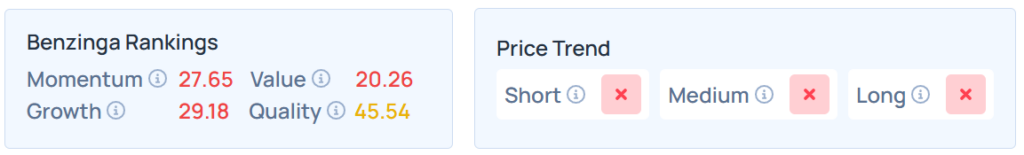

- RNA maintained a stronger price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Plymouth Industrial REIT

- Plymouth Industrial REIT Inc. (NYSE:PLYM) was 1.45% lower as it agreed to be acquired by Makarora Management LP, along with Ares Alternative Credit Funds, in an all-cash transaction valued at around $2.1 billion

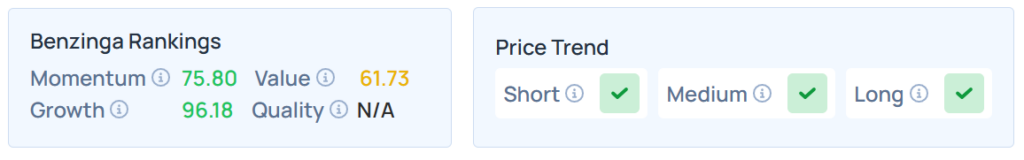

- PLYM maintained a stronger price trend over short, medium, and long terms, with a strong growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Nucor

- Nucor Corp. (NYSE:NUE) rose 1.07% ahead of its earnings, slated to be released after the closing bell. Analysts expect earnings of $3.70 per share on revenue of $12.57 billion for the latest quarter.

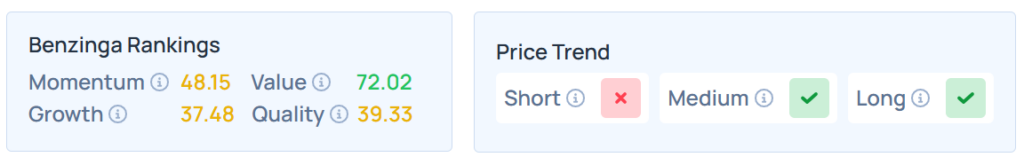

- NUE maintained a weaker price trend over the short term but a strong trend in the medium and long terms, with a strong value ranking. Additional information is available here.

Whirlpool

- Whirlpool Corp. (NYSE:WHR) advanced 1% as analysts expect it to report earnings of $1.41 per share on the revenue of $3.93 billion, after the closing bell.

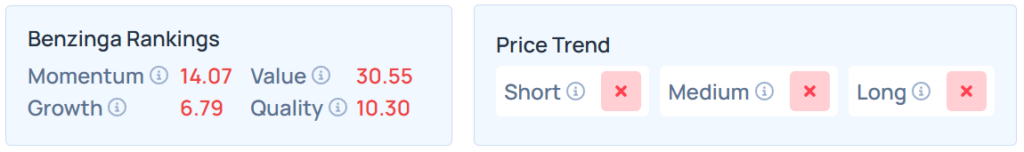

- Benzinga’s Edge Stock Rankings indicate that WHR maintains a weaker price trend over the short, medium, and long terms, with a poor quality ranking. Additional performance details are available here.

Waste Management

- Waste Management Inc. (NYSE:WM) shares were 0.26% higher as it is scheduled to report earnings after the closing bell. Analysts expect earnings of $2.02 per share on revenue of $6.50 billion.

- WM maintained a weaker price trend over short, medium, and long terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Most sectors on the S&P 500 closed on a positive note, with information technology, communication services, and utilities stocks recording the biggest gains on Friday.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 1.15% | 23,204.87 |

| S&P 500 | 0.79% | 6,791.69 |

| Dow Jones | 1.01% | 47,207.12 |

| Russell 2000 | 1.24% | 2,513.47 |

Insights From Analysts

The CEO of Unlimited Funds, Bob Elliott, warned in a Substack note that a "surge in tariff related price hikes" is keeping inflation "stuck above 3%," effectively wiping out any disinflationary relief consumers were seeing from falling rents.

He argued this dynamic is "creating a squeeze on household spending" as prices for goods soar.

According to him, the "steady disinflationary pressure coming from calculated rents… is being more than offset" by the new tariff-related inflation. His analysis points to data showing record-high new car prices and a "notable uptick in prices" for both domestic and imported goods.

Meanwhile, Charlie Bilello, the chief market strategist at Creative Planning, sharply criticized official government inflation data, calling its calculation for health insurance "absurd" and "clearly wrong."

He highlighted a stark contradiction between government claims and the financial reality American families face, arguing that when it comes to health costs, "costs only go in one direction, that's up."

The core of the issue, Bilello explained, is a government statistic claiming health insurance prices have fallen 18% over the last five years. He directly contrasted this with new data from KFF, a health policy research organization.

"If you look at this chart, you know, health insurance costs only go in one direction, that's up," Bilello said. "So, they're actually up 26% over the last 5 years [while] the government is saying they're down 18%."

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on this week;

- On Monday, September’s durable-goods orders, which were supposed to be released at 8:30 a.m. ET will be delayed because of the ongoing government shutdown.

- On Tuesday, August’s S&P Case-Shiller home price index for 20 cities will be out by 9:00 a.m., and October’s consumer confidence will be released by 10:00 a.m. ET.

- On Wednesday, September’s advanced U.S. trade balance in goods, advanced retail inventories, and wholesale inventories data will be delayed due to the shutdown. But, September’s Pending home sales data will be released by 10:00 a.m. ET.

- The Federal Reserve’s decision on interest rates will be announced by 2:00 p.m., and the Fed Chair Jerome Powell will address a press conference at 2:30 p.m. ET.

- On Thursday, the latest week’s initial jobless claims data and third-quarter GDP data will be delayed due to the shutdown, and Fed Vice Chair for Supervision Michelle Bowman will speak at 9:55 a.m. ET.

- On Friday, September’s personal income, consumer spending, headline, and core PCE Index data will all be delayed due to the shutdown. October’s Chicago Business Barometer (PMI) will be out by 9:45 a.m. ET.

- Dallas Fed President Lorie Logan will speak at 9:30 a.m., and Cleveland Fed President Beth Hammack and Atlanta Fed President Raphael Bostic will speak at 12:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 1.27% to hover around $60.72 per barrel.

Gold Spot US Dollar fell 2.06% to hover around $4,027.26 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.05% lower at the 98.90 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 2.85% higher at $114,994.00 per coin.

Asian markets closed higher on Monday as India’s NIFTY 50, Australia's ASX 200, South Korea's Kospi, Japan's Nikkei 225, Hong Kong's Hang Seng, and China’s CSI 300 indices rose. European markets were also higher in early trade.

Read Next:

Photo courtesy: godongphoto / Shutterstock.com