Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures rose on Friday after closing lower on Thursday’s. Futures of major benchmark indices were higher.

Despite the market decline on Thursday, corporate earnings provided bright spots. Delta Air Lines Inc. (NYSE:DAL) jumped 4.3% after beating estimates, and PepsiCo Inc. (NASDAQ:PEP) gained 4.2% after posting an adjusted EPS of $2.29, slightly above expectations but down 2% from a year earlier.

Meanwhile, President Donald Trump hinted that he was gearing up to discuss soybeans and other trade issues with Chinese President Xi Jinping ahead of a potential in-person meeting later this month.

The 10-year Treasury bond yielded 4.11% and the two-year bond was at 3.58%. The CME Group's FedWatch tool‘s projections show markets pricing a 94.6% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.10% |

| S&P 500 | 0.10% |

| Nasdaq 100 | 0.11% |

| Russell 2000 | 0.37% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and the Nasdaq 100 index, respectively, rose in premarket on Friday. The SPY was up 0.17% at $672.33, while the QQQ advanced 0.19% to 611.85, according to Benzinga Pro data.

Stocks In Focus

Applied Digital

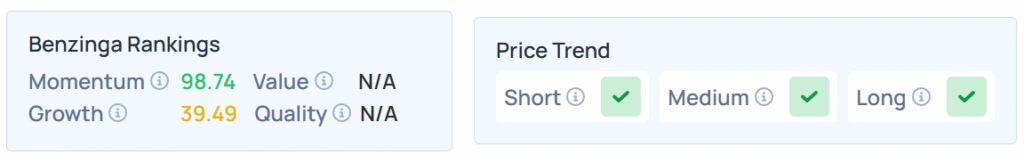

- Applied Digital Corp. (NASDAQ:APLD) jumped 25.74% in premarket on Friday, after it reported $64.2 million in revenue for its fiscal first quarter, a sharp increase from $34.8 million during the same period last year.

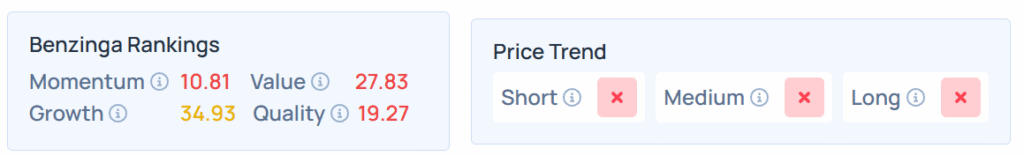

- APLD maintained a stronger price trend over the short, medium, and long terms, with a moderate growth ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

USANA Health Sciences

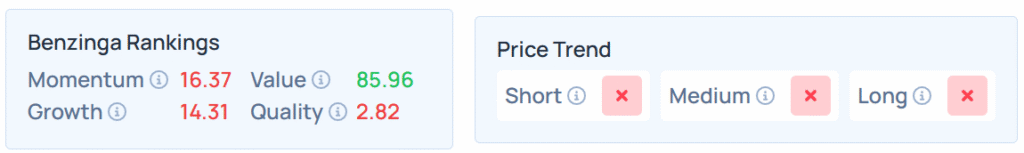

- USANA Health Sciences Inc. (NYSE:USNA) tumbled 13% after reporting preliminary results for the third quarter, seeing an adjusted loss of 15 cents per share and sales of $214.00 million.

- Benzinga’s Edge Stock Rankings indicate that USNA had a weaker price trend in short, medium, and long terms, with a robust value ranking. Additional performance details are available here.

Elastic

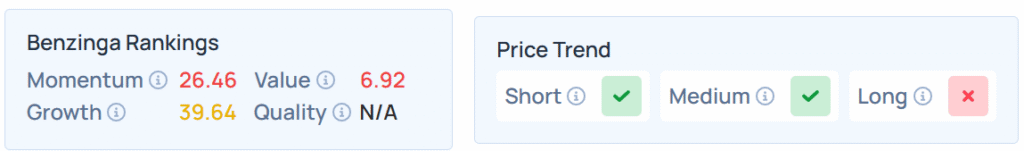

- Elastic NV (NYSE:ESTC) gained 10.12% after the company announced three major updates: it finalized the acquisition of Jina AI, rolled out a new GPU-powered inference service, and approved a $500 million stock buyback program.

- ESTC maintained a stronger price trend over the short and medium terms but a weaker trend in the long term, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Stellantis

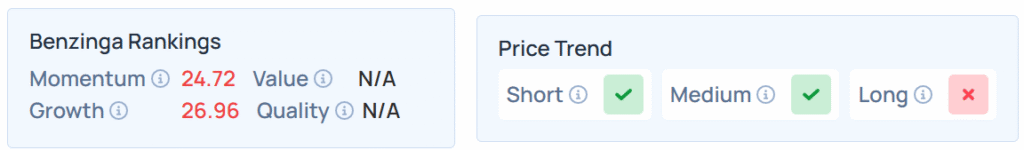

- Stellantis NV (NYSE:STLA) rose 2.64% after its consolidated shipments for the third quarter reached an estimated 1.3 million units, representing a 13% increase compared to the same period last year.

- Benzinga’s Edge Stock Rankings indicate that STLA maintains a stronger price trend over the short and medium terms but a weaker trend in the long term, with a poor growth ranking. Additional performance details are available here.

Amcor

- Amcor PLC (NYSE:AMCR) shares climbed 4.60% as the company announced changes to its executive leadership and reaffirmed its financial outlook for fiscal year 2026.

- AMCR maintained a weaker price trend over the short, medium, and long terms, with a poor quality ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Industrials, materials, and energy stocks recorded Thursday’s biggest losses as most sectors on the S&P 500 closed negatively. Consumer staples stocks, however, bucked the overall market trend and finished the session higher.

This was part of a broader downturn in which U.S. stocks settled lower, with the Dow Jones index falling more than 240 points and the S&P 500 and Nasdaq Composite retreating from record highs.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.081% | 23,024.62 |

| S&P 500 | -0.28% | 6,735.11 |

| Dow Jones | -0.52% | 46,358.42 |

| Russell 2000 | -0.61% | 2,468.85 |

Insights From Analysts

According to Scott Wren, Senior Global Market Strategist at Wells Fargo Investment Institute, viewing the current S&P 500 through the lens of historical price-to-earnings (P/E) ratios is not an “apples to apples comparison”. While acknowledging that stocks aren’t cheap, Wren argues that the makeup of the index has fundamentally changed.

“Today’s S&P 500 Index is built around high-quality, high-growth companies that have been producing strong revenue and earnings streams,” Wren states. Over 40% of the index’s value now consists of high-growth technology and tech-like companies, a significant shift from the slower-growth industrial companies that once dominated. These modern companies naturally command higher P/E ratios.

Wren cautions that “using the P/E ratio is not a reliable gauge to time when to buy or sell,” noting that expensive markets can continue to rise. Instead of fixating on the headline P/E number, he advises investors to look for value in different ways. This includes exploring the S&P 500 equal-weighted index, which has a more reasonable P/E of 18.9x, and finding less costly avenues to invest in major trends like artificial intelligence.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Friday;

- Chicago Fed President Austan Goolsbee will speak at 9:45 a.m., preliminary consumer sentiment data for October will be out by 10:00 a.m., and September’s monthly U.S. federal budget data will be delayed because of the shutdown.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.50% to hover around $61.20 per barrel.

Gold Spot US Dollar rose 0.43% to hover around $3,993.32 per ounce. Its last record high stood at $4,059.34 per ounce. The U.S. Dollar Index spot was 0.28% lower at the 99.2610 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.04% lower at $121,563.08 per coin.

Asian markets closed lower on Friday, except South Korea's Kospi and India’s NIFTY 50 indices. Hong Kong's Hang Seng, China’s CSI 300, Australia's ASX 200, d Japan's Nikkei 225 fell. European markets were mixed in early trade.

Read Next:

Image Via Shutterstock