(Editor’s note: The future prices of benchmark tracking ETFs, latest earnings, and the headline were updated in the story.)

U.S. stock futures pared losses to advance on Tuesday following Monday's positive moves. Futures of major benchmark indices were higher.

On Monday, the benchmark indices set a new record as the U.S. trade negotiators reached a "very successful framework" with their Chinese counterparts, according to statements by Treasury Secretary Scott Bessent. The development came ahead of a potential meeting between President Donald Trump and President Xi Jinping.

The Federal Reserve Open Market Committee will announce its decision on interest rates on Wednesday.

The 10-year Treasury bond yielded 3.48% and the two-year bond was at 3.50%. The CME Group's FedWatch tool‘s projections show markets pricing a 97.8% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.03% |

| S&P 500 | -0.05% |

| Nasdaq 100 | 0.03% |

| Russell 2000 | -0.41% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were mixed in premarket on Tuesday. The SPY was down 0.083% at $685.81, while the QQQ advanced 0.16% to $629.11, according to Benzinga Pro data.

Stocks In Focus

United Parcel Service

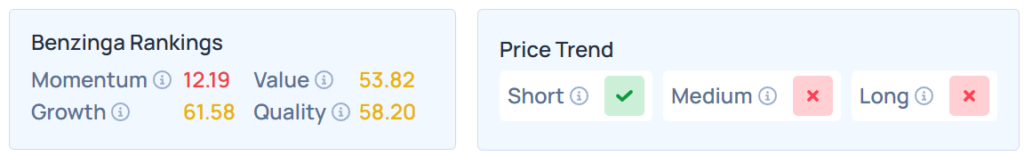

- United Parcel Service Inc. (NYSE:UPS) climbed 12.08% in premarket on Tuesday as it announced the diluted earnings of $1.55 per share, above the expected $1.31 per share for the third quarter. The revenue came in at $21.4 billion, beating $20.83 billion estimate, before the opening bell.

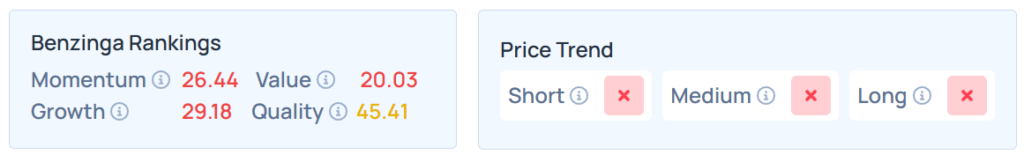

- UPS maintained a stronger price trend over the short term but a weak trend in the medium and long terms, as per Benzinga’s Edge Stock Rankings, with a moderate quality ranking. Additional performance details are available here.

UnitedHealth Group

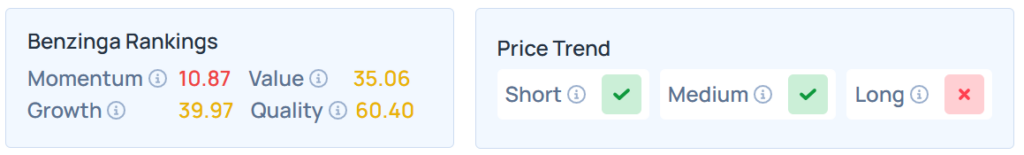

- UnitedHealth Group Inc. (NYSE:UNH) jumped 3.86% after reporting adjusted earnings of $2.92 per share, above expected earnings of $2.81, with a revenue of $113.2 billion, beating the $113.06 billion Benzinga Pro estimate.

- UNH maintained a weaker price trend over the long term but a strong trend in the medium and short terms, with a moderate quality ranking. Additional information is available here.

Cameco And Brookfield Asset Management

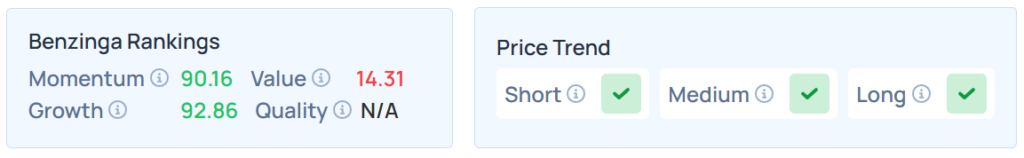

- Cameco Corp. (NYSE:CCJ) rose 15.68% and Brookfield Asset Management Ltd. (NYSE:BAM) advanced 7.64% after they announced a transformational partnership with the United States Government to construct at least $80 billion in new Westinghouse nuclear power reactors.

- CCJ maintained a stronger price trend over short, medium, and long terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

3D Systems

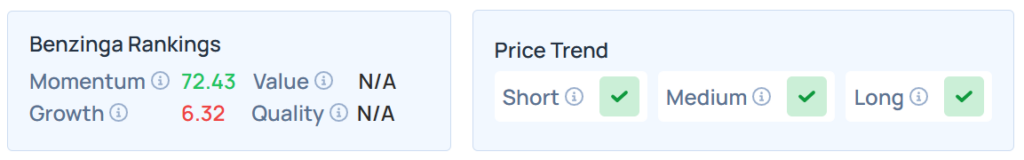

- 3D Systems Corp. (NYSE:DDD) rose 6.19% as its Saudi joint venture, NAMI, announced major milestones by securing a strategic investment from Saudi Electric Company, launching a collaboration with Lockheed Martin Corp. (NYSE:LMT) for aerospace components, and winning a $26 million manufacturing agreement with Modern Isotope Factory.

- Benzinga’s Edge Stock Rankings indicate that DDD maintains a stronger price trend over the short, medium, and long terms, with a poor growth ranking. Additional performance details are available here.

Waste Management

- Waste Management Inc. (NYSE:WM) shares are down by 3.03% following weaker-than-expected results for the third quarter, after the closing bell on Monday.

- WM maintained a weaker price trend over short, medium, and long terms, with a poor growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Sectors recording the biggest gains on Monday included information technology, communication services, and consumer discretionary, helping most sectors on the S&P 500 close on a positive note.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 1.86% | 23,637.46 |

| S&P 500 | 1.23% | 6,875.16 |

| Dow Jones | 0.71% | 47,544.59 |

| Russell 2000 | 0.28% | 2,520.44 |

Insights From Analysts

Professor Jeremy Siegel views the market setup heading into next week, driven primarily by robust corporate profits that are trumping tariff concerns. The key event will be the FOMC meeting, where Siegel “expect[s] a 25-basis point cut”.

This view is supported by last week's “cooler inflation print” and evidence that shelter costs, nearly 40% of core CPI, are “finally catching down to real world data”.

Siegel emphasizes that fundamentals remain solid. “Earnings are the market’s engine right now, and they’re running very strong,” he noted, pointing to strengthening breadth beyond mega-cap tech. While he anticipates some “tariff-related price noise,” he believes this is a “temporary relative-price shuffle” rather than a new inflation wave. The real economy also “continues to look good”.

Despite the market’s uptrend, Siegel finds that sentiment remains cautious. He observes that positioning is “still hedged and skeptical”. He sees this as a healthy sign, stating “this is not a blow-off environment,” and maintains his outlook that the S&P 500 can “press toward and over 7,000” as profits grow.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Tuesday;

- August’s S&P Case-Shiller home price index for 20 cities will be out by 9:00 a.m., and October’s consumer confidence will be released by 10:00 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 1.92% to hover around $60.13 per barrel.

Gold Spot US Dollar fell 2.03% to hover around $3,900.94 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.05% lower at the 98.7350 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.65% lower at $114,373.87 per coin.

Asian markets closed lower on Tuesday as India’s NIFTY 50, Australia's ASX 200, South Korea's Kospi, Japan's Nikkei 225, Hong Kong's Hang Seng, and China’s CSI 300 indices fell. European markets were mixed in early trade.

Read Next:

Photo courtesy: Shutterstock