The U.S. stock market is still sitting near all-time highs… but beneath the surface, some cracks may be forming. In a recent Market on Close discussion, hosts John Rowland and “Twitter Tom” debated whether we’re on the verge of a pullback, or if the rally still has legs.

Here’s what they’re seeing in the data:

1. Sector Momentum is Flashing Divergence

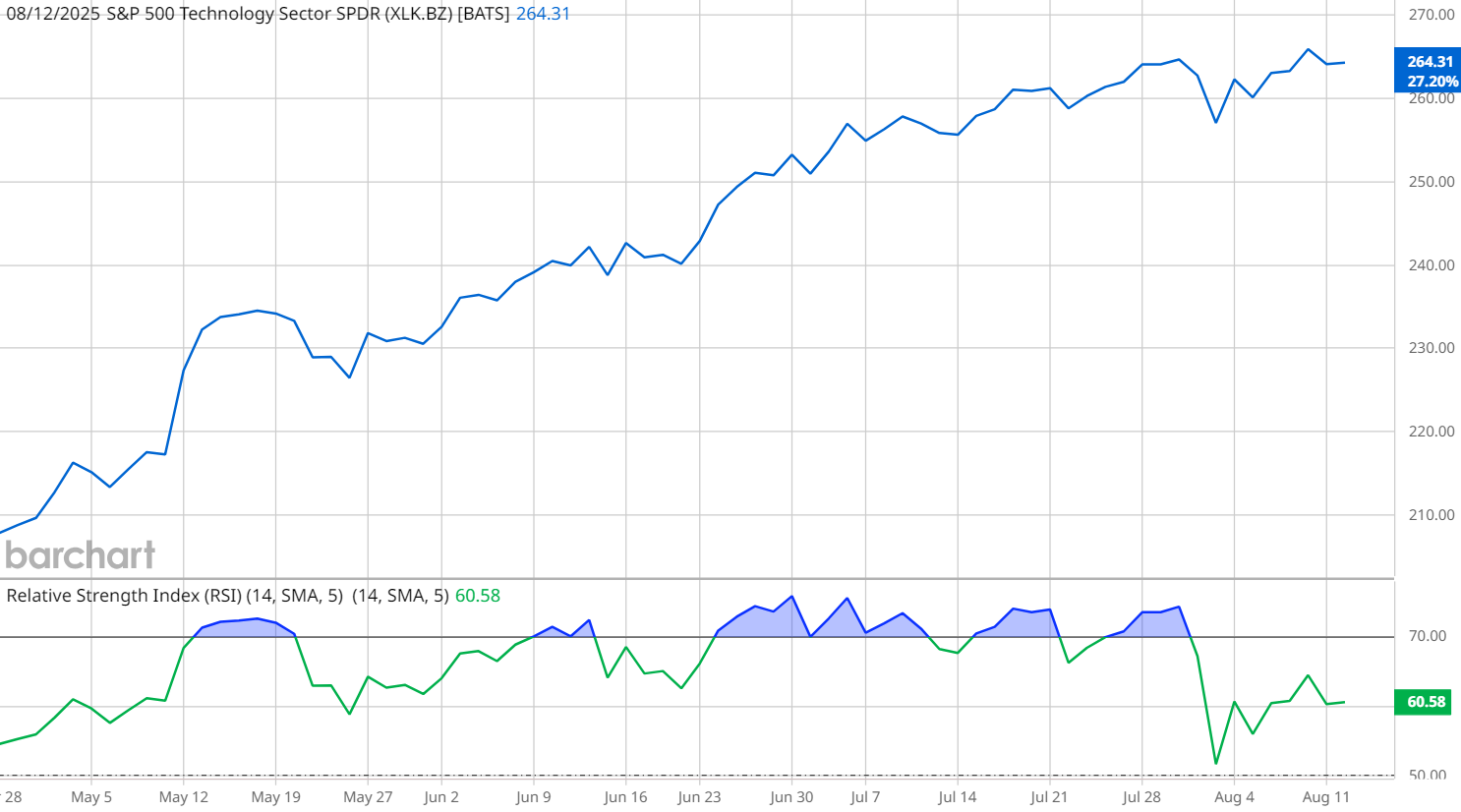

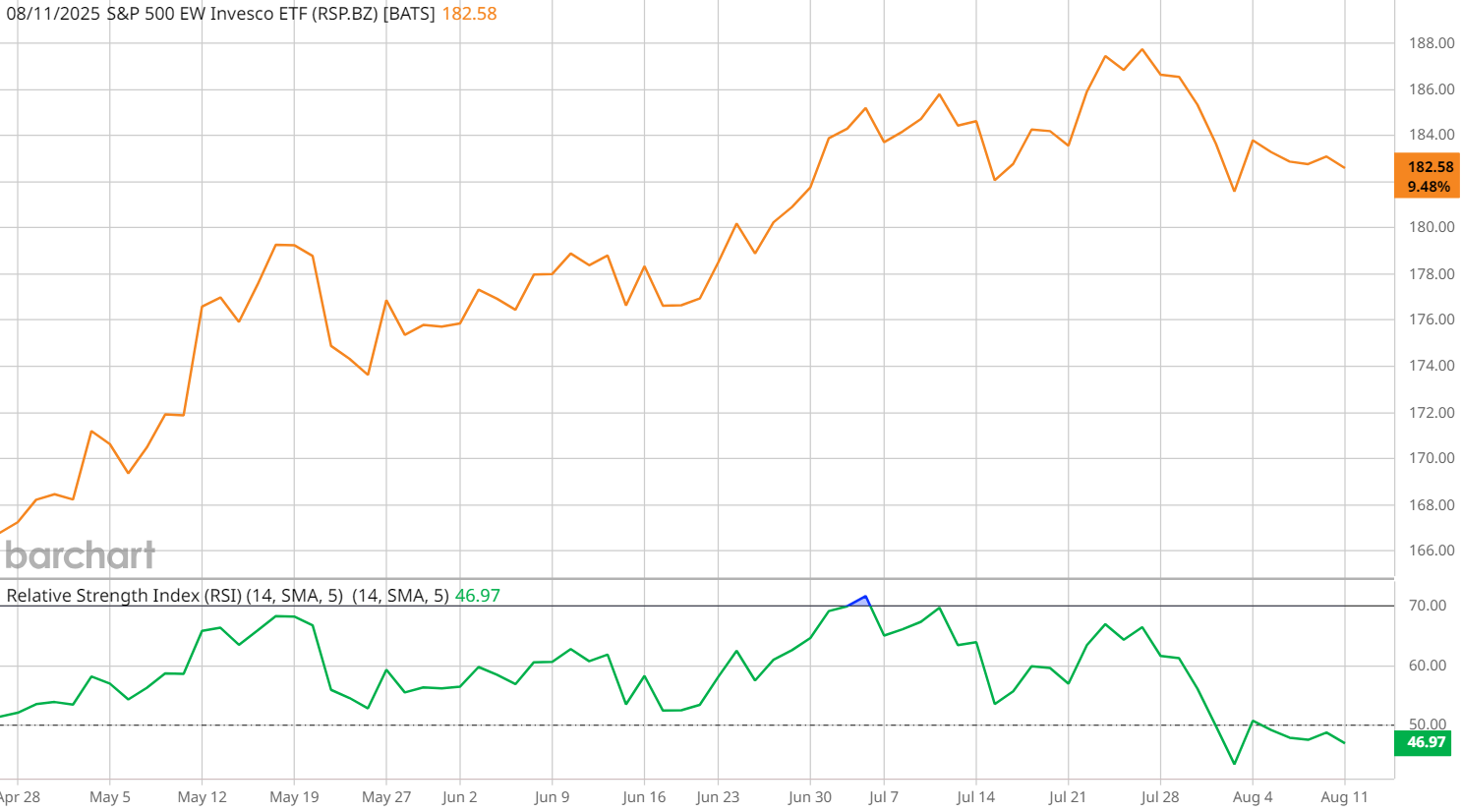

The S&P 500 Tech Sector ETF (XLK) Relative Strength Index (RSI) is above 60, signaling strong momentum.

On the other hand, the S&P 500 Equal Weight ETF (RSP) RSI is moving lower, beneath 50, suggesting broader market participation is more subdued.

Historically, this setup has appeared six times since 2006. In five of those cases, the market saw a 10% or greater correction shortly after.

2. A Contrarian Take

Tom sees the widespread expectation of an August pullback as a reason to be cautious about betting against the market. If “everyone” is bracing for a drop, markets sometimes do the opposite.

John, however, leans on the historical data — which currently tilts toward a downside move — and says this divergence between tech leadership and equal-weight performance shouldn’t be ignored.

3. Options Traders Are Getting Bearish

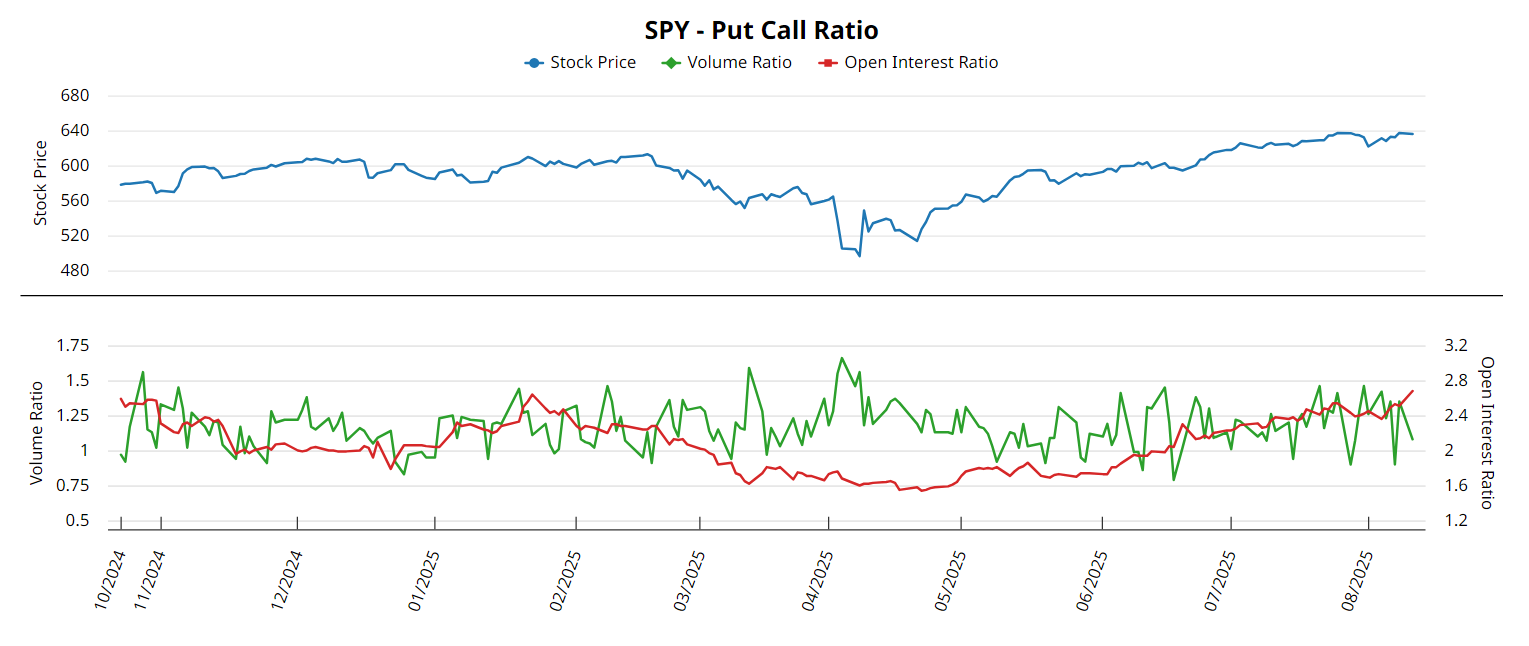

The put/call ratio on the SPY ETF is climbing, meaning more traders are buying puts (bearish bets) than calls.

For this week’s monthly August options expiration, the SPDR S&P 500 ETF (SPY) put/call ratio is above 4.0 — meaning there are four times as many puts in open interest as calls. That’s a rare level of bearish positioning and can sometimes precede sharp moves.

What’s at Stake?

Some analysts point to valuation extremes that now surpass the late-90s tech boom. Others note macro risks — tariffs, stagflation concerns, and global uncertainty — that could act as catalysts for a correction.

But for now, the market is balancing two narratives:

- The Bear Case: Overbought tech, narrowing breadth, and rising bearish options positioning could trigger a correction.

- The Bull Case: Strong large-cap leadership, resilient earnings, and contrarian sentiment might keep the rally alive.

Watch the reel to see John and Tom argue their cases:

Then, check out the full episode of Market on Close to see what they’re watching next.