Awakn Life Sciences (OTC:AWKNF) is in the news after a respected analyst has upgraded the stock. Awakn is a publicly traded company which trades on the over-the-counter market with the symbol of AWKNF. Let’s take a look at the stock’s upgrade and long-term potential in the context of psychedelics investing.

Awakn’s Upgrade Explained

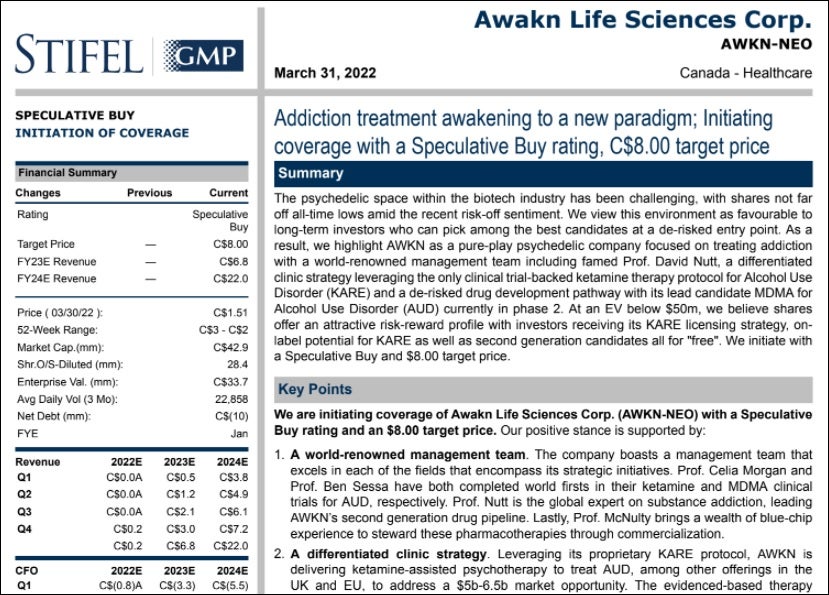

Stifel analyst Andrew Partheniou is predicting a bullish future for Awakn Life Sciences. The stock market analyst has initiated coverage of the psychedelics stock, grading it as a Speculative Buy. Partheniou also set an $8 price target for the stock.

Awakn, based in Toronto, Canada was founded in 2020. The company employs 18 people. Awakn’s umbrella includes the subsidiaries of Mandala Therapy Limited and Axonklinikken AS. Awakn’s stock is currently trading at $1.26. The stock was trading at $2.44 on January 11. Let’s shift gears to explain why analysts are becoming bullish on the stock.

The psychedelics industry is gradually making progress toward a mainstream tipping point. Fast forward a couple years into the future and it might be commonplace for those with post-traumatic stress disorder, depression, alcohol addiction and anxiety to self-medicate with psychedelics such as those made by Awakn.

Partheniou’s write-up of Awakn’s stock highlights the biotech industry’s difficulties in the previous year yet the fact that shares are near all-time lows presents a buying opportunity. In short, Partheniou believes now might be the optimal time for long-term investors to scoop up shares of Awakn and other psychedelics stocks. The challenge lies in handpicking the cream of the industry’s crop, choosing those with the optimal de-risk entry point.

Partheniou believes Awakn is one of the better psychedelics stocks to invest in for several reasons. The analyst’s recent report detailing the stock’s merits notes it is a “pure play” psychedelic business thriving in developing addiction treatments. Partheniou also highlighted Awakn’s elite management team including Professor David Nutt.

The analyst’s Awakn write-up also touches on its unique clinic strategy that makes use of a ketamine therapy protocol that is backed by a clinical trial. The hope is that Awakn’s ketamine will be used for treating individuals saddled by Alcohol Use Disorder. There is also anticipation that Awakn’s de-risked drug development will serve as a viable pathway to bring MDMA to market for the treatment of alcohol addiction in the near future. This effort is currently in its second phase.

Awakn’s Risk-Reward is Intriguing

Partheniou finished his Awakn report noting that the company’s risk-reward profile is attractive. Investors are learning more and more about Awakn’s licensing strategy to treat Alcohol Use Disorder as time progresses. The gradual trickle of new information is reason for hope. Add in the fact that the company’s treatment modalities have legitimate label potential and there is even more reason to be bullish on the stock.

All in all, the Alcohol Use Dependency market equates to $5 billion to $6.5 billion, meaning Awakn will thrive even if it only captures part of the market share. The hope is that Awakn makes significant headway in licensing its treatment modalities in the year ahead. As of today, Awakn has made meaningful progress in conducting the first-ever phase 2a trial of MDMA for treating patients who suffer from Alcohol Use Disorder. Partheniou has set an $8 price target for Awakn.

This article was originally published on The Dales Report and appears here with permission.