We recently took a long call position in Arcelor Mittal (NYSE:MT) in the POWR Options program on November 24. MT stock was nearing major support at $29 at the time and was in deeply oversold territory. It also carried an A-Strong Buy-POWR Rating as well as a high ranking within the A Rated Steel industry.

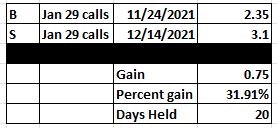

The trade worked out well and it was closed for a nearly 32% profit 20 days later as MT stock rose $2.10 (7.2%) as shown in the table below. It also highlights the power of POWR Options as the option gain was more than 4 times that of the stock gain.

On Monday, POWR Options took a fresh position in the MT for almost the identical reasons as the first trade-Strong A Rated POWR Stock with attractive fundamental, technical and implied volatility backdrop.

Here is a snapshot of the POWR Rating for Arcelor Mittal (MT) at the time of the latest trade.

Fundamentals

MT is Rated A -Strong Buy. It is ranked number 4 in the A Rated Steel Industry. Value carries a component grade of A which is a plus given the outperformance of value based lower beta names in this recent market environment. This value component ranks ahead of 97% of U.S stocks in that category.

Growth is solid as well with a B component rating. It is also the strongest trending metric. This combination of deep value and improving growth bodes well for higher prices in MT stock.

The trough multiples of a current P/E under 3 and P/S of just .54 may serve to staunch any meaningful downside.

Technicals

MT stock once again reached deeply oversold readings as it neared major support at $29. 9-day RSI was below 30 while MACD printed at the lowest levels of the past 12 months. Bollinger Percent B went briefly negative while Momentum cratered to new yearly lows. Shares were trading at a major discount to the 20-day moving average.

The prior three times all these indicators aligned in a similar fashion marked significant short-term lows in MT stock as highlighted in the chart. More importantly, Friday saw a reversal day in MT. Shares opened lower and at new recent lows only to reverse course and close higher on the day.

This type of price action is many times emblematic of a trend change. It is an even more powerful signal given that it took place at major support following a prolonged and deep sell-off. A rally back to the 20-day moving average near $33 is the initial price target.

Implied Volatility

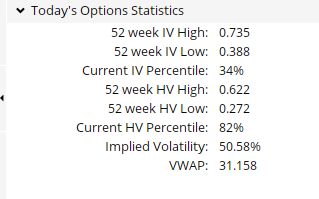

Implied volatility (IV) analysis is a cornerstone of the POWR Options trade selection methodology. While eyes many times glaze over when people hear the term “implied volatility”, it is really just the price of the option. Higher implied vol means higher option prices. Lower IV equates to cheaper option prices.

Option implied volatility (IV) is at just the 34th percentile for MT. This means option prices are comparatively cheap, especially given how dramatically IV generally has risen over the past month. Implied volatility is also well below the historic, or actual, volatility of 82%.

Putting it all together, MT is a Strong Buy POWR Rated stock with attractive fundamentals, bullish technicals and cheap options. The combination of those three factors sets up ideally to once again buy some bullish upside calls in MT. The latest trade is off to a good start with MT stock rallying to close at $31.49 and the June $27 calls showing open gains of over 23%.

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

MT shares . Year-to-date, MT has declined -1.07%, versus a -4.63% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

Steel Is Looking Like A Steal Once Again StockNews.com