For a country that saw 86 percent of its currency sucked out overnight, India’s economy is proving surprisingly resilient. At least on paper.

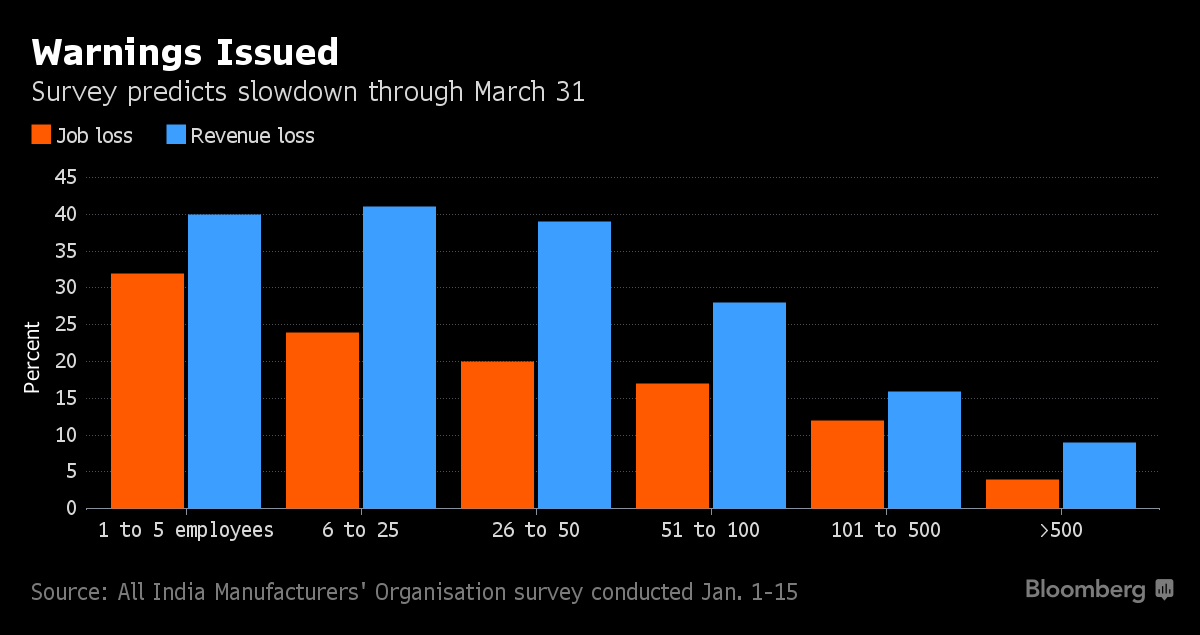

Gross domestic product will expand 6.8 percent in the year through March -- the slowest pace since 2014 but still among the fastest in the world -- according to the median of 29 estimates in a Bloomberg survey of economists before an official forecast due Tuesday. However, analysts and lobby groups say the data mask job losses at small companies, which employ as much as 40 percent of India’s workforce and are the secret to the nation’s growth.

The slowdown will be evident once the fiscal year is done and balance sheets are unfurled, said K. Raghunathan, president of the All India Manufacturers’ Organisation which claims to represent as many as 100,000 small firms, adding that the government has been ignoring its warnings. "What can I say? You can wake a guy who’s sleeping. But not someone who’s pretending to sleep."

While opinions are mixed about the impact on the political fortunes of Prime Minister Narendra Modi -- who staked his personal credibility on the demonetization experiment -- foreign investors may opt to wait out the uncertainty. Asia’s widest budget deficit denies Indian policy makers room for a fiscal stimulus and this month they signaled an end to monetary easing.

The Statistics Office is due to publish growth data at 5:30 p.m. in New Delhi

- GDP slowed to 6 percent in October-December from a year earlier, the Bloomberg survey predicts, from 7.3 percent the previous quarter

- Gross value added -- a key input of GDP -- is seen at 6 percent versus 7.1 percent

- The full-year estimate of 6.8 percent marks a slump from 7.9 percent

The figures may not fully capture the impact of Modi’s cash clampdown "since these numbers rely heavily on data from the formal sector, which is expected to have weathered the note ban better than the informal sector," said Aditi Nayar, principal economist at ICRA Ltd., the local unit of Moody’s Investors Service. "Subsequent estimates that draw from wider data sources, may well revise October-December growth downward."

Growth in loans to industry slumped to a record low of 4.96 percent as on Feb. 3. A private purchasing managers’ index signaled a contraction in business activity for a third straight month, with figures for February due this week.

On the surface, the outlook appears bright. As many as 20 of the 30 companies in India’s benchmark equity gauge have beaten or matched their October-December earnings estimates, according to data compiled by Bloomberg. In its budget for the year starting April 1, the government also announced tax cuts for small companies, without linking it directly to the demonetization.

Growth will rebound after the slowdown, Reserve Bank of India Governor Urjit Patel told CNBC-TV18 this month. The view was echoed by the Finance Ministry’s advisers in a pre-budget report last month, though they also warned of "real and significant" costs that "may be minimized in official GDP."

While the RBI governor is probably correct, investors should watch for domestic private consumption and investment trends in Tuesday’s data to assess India’s prospects, said NR Bhanumurthy, professor at Delhi-based National Institute of Public Finance and Policy.

"The exports figures may not be great and nor will job losses be reflected," he said. "In one sense, the picture won’t be complete."

--With assistance from Santanu Chakraborty Manish Modi and Cynthia Li

To contact the reporter on this story: Archana Chaudhary in New Delhi at achaudhary2@bloomberg.net.

To contact the editors responsible for this story: Ruth Pollard at rpollard2@bloomberg.net, Jeanette Rodrigues

©2017 Bloomberg L.P.