More than 40 million student loan borrowers received a rude awakening when the Supreme Court struck down President Biden's student loan forgiveness plan earlier this summer. Following the ruling, those borrowers must grapple with the reality of resuming their student loan payments as of October 2023.

WalletHub's new national student loan debt study reveals the states where the payment reality check will hit hardest, as well as those where borrowers will be in much better shape.

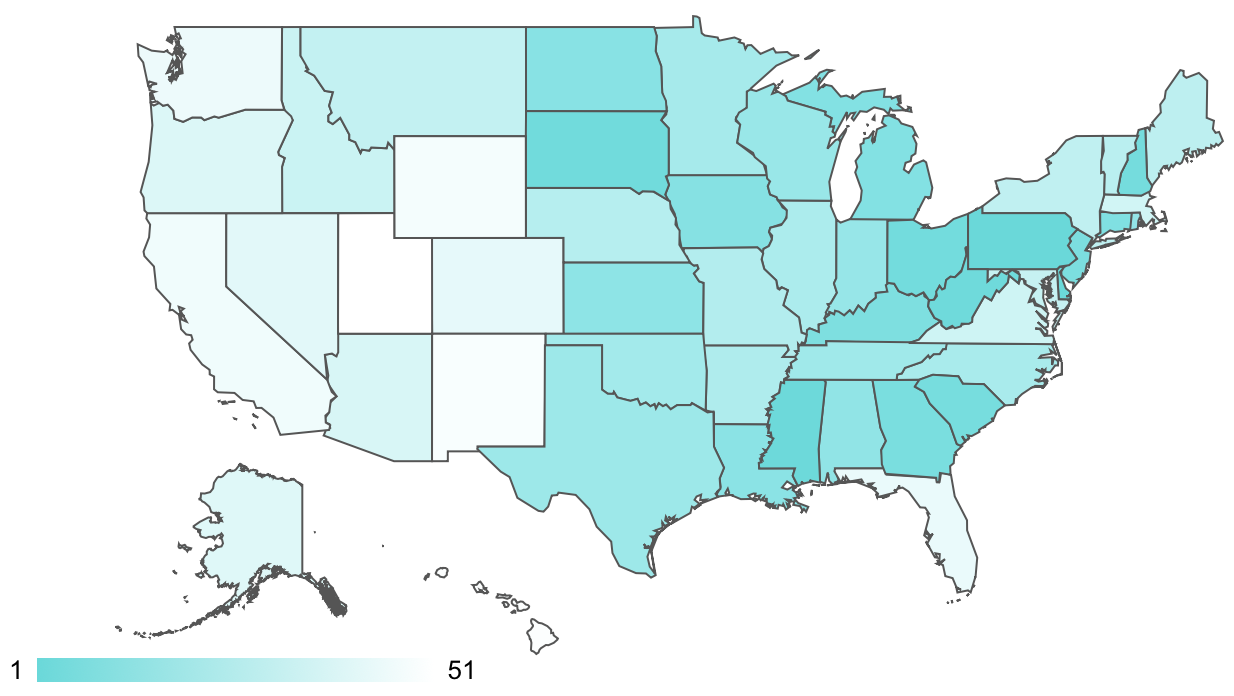

Student loan debt, state by state

According to WalletHub, student loans are the largest component of Americans' household debt after mortgages. Total college-loan balances were $1.64 trillion after the first quarter of 2023. This burden is spread unevenly throughout the country, however.

WalletHub graded all 50 states and Washington, DC on 12 metrics falling under the offsetting categories of A) student loan burden and B) grants and work opportunities. Student debt received 85 percent of the weighting in WalletHub's rankings, while grants and work opportunities received the remaining 15 percent.

The company compiled data from a variety of sources including the U.S. Census Bureau, Bureau of Labor Statistics, The Pew Charitable Trusts, and Indeed.

The resulting state by state rankings defy clear regional patterns, outside the general over-performance of states to the west of Kansas.

Highest student debt burden

The ten states likely to be hit hardest by resumption of student loan payments crisscross the eastern half of the United States.

Lowest student debt burden

On the other end of the ranking, the bottom 10 states' residents and economies could weather the resumption of loan payments more easily, given their combination of lower debt burdens and financial benefits for students.

Borrowers' best next moves

If you're a borrower hunkering down in Pennsylvania's student loan ground-zero, sitting pretty in Utah, or just getting by somewhere in between, you have some work to do. Many things have changed since the loan pause began in 2020, including 17 million borrower accounts changing loan servicers or platforms, according to the Consumer Financial Protection Bureau.

Now is the time to get up to date on your loan details, revisit your budget, review repayment options, and take other key steps to brace for financial impact. Consider our full breakdown of steps you can take to prepare for the end of the payment pause.