State Street Corporation (NYSE:STT) will release earnings results for the third quarter, before the opening bell on Friday, Oct. 17.

Analysts expect the Boston, Massachusetts-based company to report quarterly earnings at $2.65 per share, up from $2.26 per share in the year-ago period. The consensus estimate for State Street's quarterly revenue is $3.47 billion, compared to $3.26 billion a year earlier, according to data from Benzinga Pro.

On Sept. 17, State Street elected Brian Porter to its board of directors.

State Street shares fell 3.2% to close at $112.95 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

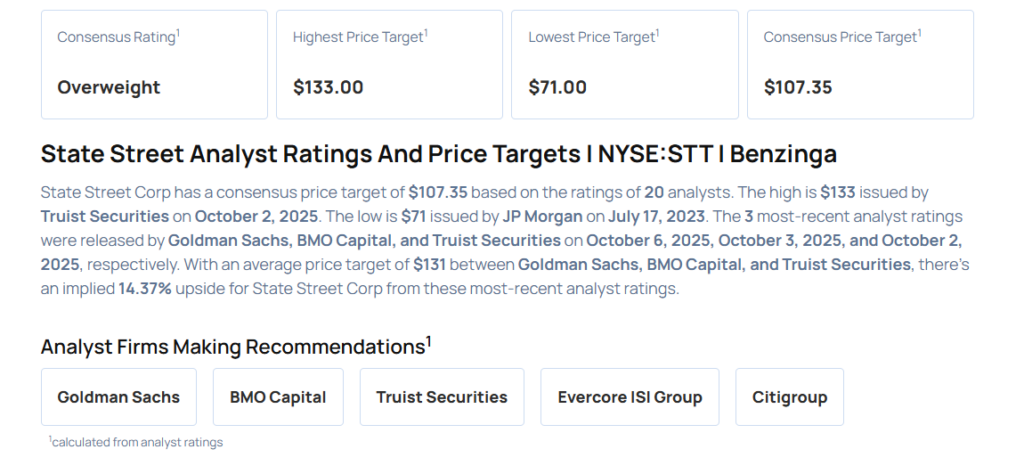

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Goldman Sachs analyst Alexander Blostein maintained a Buy rating and raised the price target from $109 to $130 on Oct. 6, 2025. This analyst has an accuracy rate of 69%.

- BMO Capital analyst Brennan Hawken initiated coverage on the stock with an Outperform rating and a price target of $130 on Oct. 3, 2025. This analyst has an accuracy rate of 71%.

- Truist Securities analyst David Smith maintained a Buy rating and raised the price target from $125 to $133 on Oct. 2, 2025. This analyst has an accuracy rate of 64%.

- Evercore ISI Group analyst Glenn Schorr maintained an Outperform rating and increased the price target from $117 to $128 on Sept. 30, 2025. This analyst has an accuracy rate of 67%.

- B of A Securities analyst Ebrahim Poonawala maintained an Underperform rating and raised the price target from $106 to $109 on July 16, 2025. This analyst has an accuracy rate of 66%.

Considering buying STT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock