Just when you thought passive investing couldn’t get any cheaper -- it did.

State Street Global Advisors slashed fees on 15 of their exchange-traded funds to as low as 3 basis points, according to a company statement on Monday. The ETFs are now the least expensive U.S. equity funds, along with one product from BlackRock Inc. and two from Charles Schwab Corp. that capture similar segments of the U.S. stock market.

Seeking out less costly ways to build the indexes that ETFs track has become increasingly important in the race to cut fees. For the three cheapest funds State Street announced Monday, the firm developed proprietary mid-cap, large-cap and broad-market U.S. equity indexes to replace FTSE Russell benchmarks.

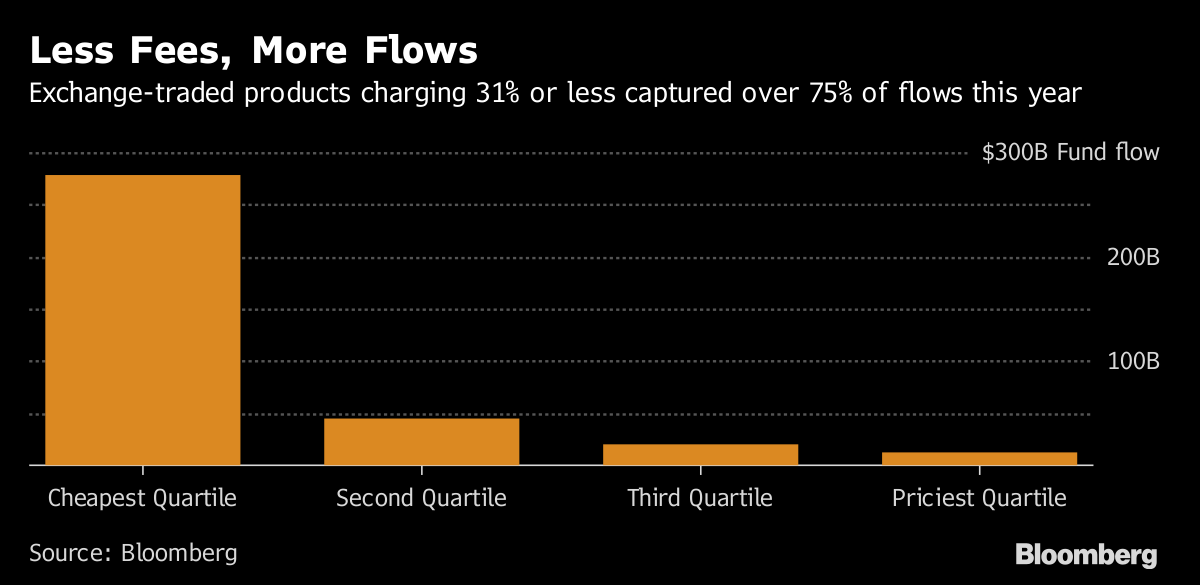

Low fees have proven essential to winning assets in the passive world, as the least expensive products are winning the lion’s share of flows. Over 75 percent of exchange-traded product flows have come from the lowest quartile of funds based on expense ratios, data compiled by Bloomberg show

The Boston-based firm contends that it won’t lose money on the cheap funds. Though its margins may take a hit, the firm hopes the ETFs act as a gateway to different and more complex products and offerings, Noel Archard, State Street’s global head of SPDR product, said.

“This creates another entry point into the SPDR range,” Archard said during an interview in Bloomberg’s New York headquarters. “When our clients have an investment question or problem that they’re trying to solve, we want to be their first call. We want various ways that they can come into the lineup.”

The funds will also be offered through a strategy that some of its quickest-growing competitors, such as Schwab, have successfully leveraged: a commission-free ETF superstore. The suite of freshly lowered-fee State Street funds will be offered on TD Ameritrade’s ETF platform without trading commissions.

“Demand for low-cost ETFs has accelerated in recent years, as advisers and investors have replaced mutual funds in asset allocation models or shifted to buying ETFs from commission free platforms,” Todd Rosenbluth, director of ETF & Mutual Fund Research at CFRA research, wrote in a note Monday. “SSGA has lost market share to iShares, Vanguard and Schwab as its more expensive products were not well suited to a fee-based approach.”

--With assistance from Rachel Evans and James Seyffart

To contact the reporter on this story: Dani Burger in New York at dburger7@bloomberg.net.

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Eric J. Weiner, Andrew Dunn

©2017 Bloomberg L.P.