Starbucks (SBUX) has had a mixed run of late.

While the shares boast a one-year gain of 46%, the stock is up just 6.5% so far in 2023. Further, it's down 8.5% from this month's high.

The stock's year-to-date gain slightly lags the S&P 500 and sharply lags the Nasdaq, which are up 7.35% and 18.2%, respectively.

Starbucks stock was trading better coming into this month. Then the coffee-bar giant reported earnings and the shares fell more than 9% in the May 3 session.

Don't Miss: Fixer Upper? How to Trade Home Depot Stock After Earnings Dip

It’s not as if the report was horrible: The company beat earnings and revenue expectations with sales growing 14.5% year over year. But concerns about China seem to have weighed on the stock.

And investors aren’t getting very encouraging news from retailers right now. While TJX Cos. (TJX) is moving higher on earnings, Target (TGT) did little to impress investors and Home Depot (HD) was a disappointment too.

When to Buy the Dip in Starbucks Stock

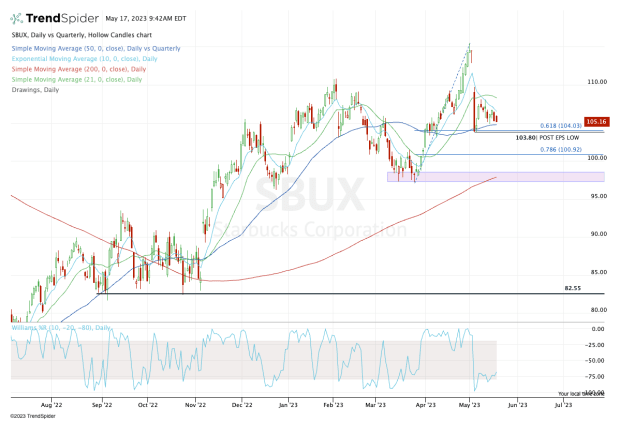

Chart courtesy of TrendSpider.com

Starbucks shares rallied almost 20% from the mid-March low to the recent high, gaining in five straight weeks.

The post-earnings pullback sent the shares below the 10-day and 21-day moving averages. Starbucks then found support at the 61.8% retracement and the 50-day.

Following a mild bounce — and rejection from the 10-day moving average — the shares are starting to roll over again as we near the post-earnings low at $103.80.

This area is now vital for active bulls and it’s a zone that will likely attract aggressive buyers who are looking for a bounce.

Don't Miss: Trading Cathie Wood's ARKK as It Tries to Break Out Over Resistance

But I think the bulls ought to use a little caution. If this zone fails to hold as support, it opens the door down to the 78.6% retracement near $100.

If that area fails as support, it puts an attractive risk/reward buying opportunity on the table in the $97 to $98 area. Not only has this zone been strong support, but it’s where we find the 200-day moving average.

For the bulls to regain control of Starbucks, they need the stock to regain the 10-day and 21-day moving average. For the former, that requires only a move over $107.

To regain the 21-day, they’ll need Starbucks to clear $108.50, a level that has also been resistance.

With a move over $110, Starbucks stock could begin to fill the earnings gap. For now, though, keep an eye on $103.50 to $104 on the downside.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.