/Starbucks%20Corp_%20drive%20thru%20by-%20Sheila%20Fitzgerald%20via%20Shutterstock.jpg)

Seattle, Washington-based Starbucks Corporation (SBUX) roasts, sells and distributes high-quality coffee globally. Valued at $90.7 billion by market cap, the company offers packaged and single-serve coffees and teas, beverage-related ingredients, and ready-to-drink beverages, as well as produces and sells bottled coffee drinks and a line of ice creams through over 40,000 stores worldwide under the brands Starbucks Coffee, Teavana, Seattle's Best Coffee, Ethos, and Starbucks Reserve. The coffee giant is expected to announce its fiscal fourth-quarter earnings for 2025 in the near future.

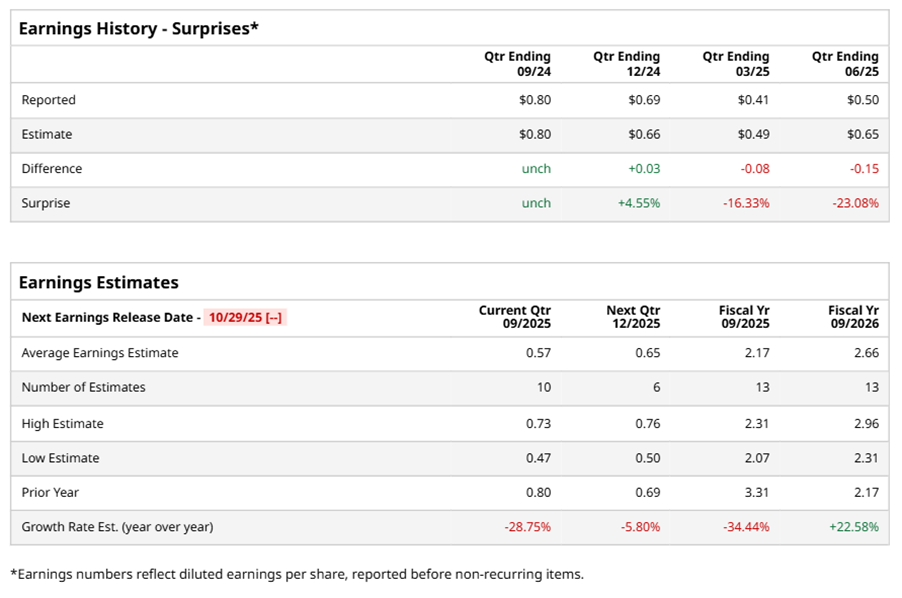

Ahead of the event, analysts expect SBUX to report a profit of $0.57 per share on a diluted basis, down 28.8% from $0.80 per share in the year-ago quarter. The company beat or matched the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect SBUX to report EPS of $2.17, down 34.4% from $3.31 in fiscal 2024. However, its EPS is expected to rise 22.6% year over year to $2.66 in fiscal 2026.

SBUX stock has underperformed the S&P 500 Index’s ($SPX) 16.3% gains over the past 52 weeks, with shares down 15% during this period. Similarly, it underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 19.1% gains over the same time frame.

SBUX's underperformance is due to weak same-store sales and transaction volume in its core U.S. market, which are being impacted by its costly "Back to Starbucks" revival strategy. Heavy investments in labor and store redesign have weighed on margins and earnings, leading to a sharp contraction in operating margins. The company's recovery hinges on the success of its Green Apron Service and future innovations, but execution risks and competition remain concerns.

On Jul. 29, SBUX shares closed down marginally after reporting its Q3 results. Its adjusted EPS of $0.50 fell short of Wall Street expectations of $0.65. The company’s revenue was $9.5 billion, topping Wall Street's $9.3 billion forecast.

Analysts’ consensus opinion on SBUX stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 33 analysts covering the stock, 16 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” 11 give a “Hold,” two advocate a “Moderate Sell,” and two recommend a “Strong Sell.” SBUX’s average analyst price target is $97.23, indicating an ambitious potential upside of 21.9% from the current levels.