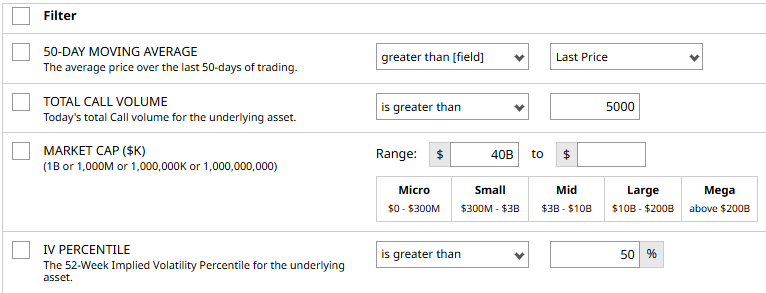

Starbucks (SBUX) stock was a bearish candidate that came up on one of my Barchart Stock Screeners that searches for stocks trading below their 50-day moving average and having a high IV Percentile.

Here are the full parameters for the screener and the results.

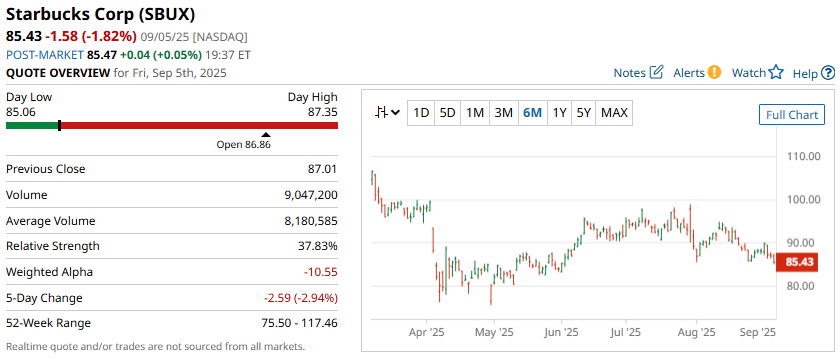

Today, we’re going to look at a Bear Call spread trade that assumes SBUX will struggle to get back above the 95 level in the next few months.

A Bear Call spread is a bearish trade that also can benefit from a drop in implied volatility.

The maximum profit for a Bear Call spread is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

SBUX BEAR CALL SPREAD

To create a Bear Call spread, we sell an out-of-the-money call and then by another call further out-of-the-money.

Selling the November 21 call with a strike price of $95 and buying the $100 call would create a Bear Call spread.

This spread was trading for around $0.90 yesterday. That means a trader selling this spread would receive $90 in option premium and would have a maximum risk of $410.

That represents a 21.95% return on risk between now and November 21 if SBUX stock remains below $95.

If SBUX stock closes above $100 on the expiration date the trade loses the full $410.

The breakeven point for the Bear Call spread is $95.90 which is calculated as $95 plus the $0.90 option premium per contract.

COMPANY DETAILS

The Barchart Technical Opinion rating is a 72% Sell with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Starbucks Corp. is a roaster and retailer of specialty coffee globally. Besides its fresh, rich-brewed coffees, the company's offerings include many complimentary food items and a selection of premium teas and other beverages, sold mainly through the company's retail stores.

The company's popular brands include Starbucks coffee, Teavana tea, Seattle's Best Coffee, La Boulange bakery products and Evolution Fresh juices.

Other than the company's own retail stores, it generates revenues through licensed stores, consumer packaged goods and foodservice operations.

The company receives royalties and license fees from the U.S. and international licensed stores.

Under its consumer packaged goods operations, Starbucks sells packed coffee and tea products as well as a variety of ready-to-drink beverages and single-serve coffee and tea products to grocery, warehouse clubs and specialty retail stores.

The company's latest reportable operating segments comprise North America, International and Channel Development.

Conclusion And Risk Management

One way to set a stop loss for a Bear Call spread is based on the premium received. In this case, we received $90, so we could set a stop loss equal to the premium received, or a loss of around $900.

Another stop loss level could be if the stock broke above $92.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

.jpg?w=600)