/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Activist Starboard Value has once again set its eyes on Salesforce (CRM). The hedge fund that first shook-up Salesforce management three years ago just doubled down hard, boosting its stake by nearly 50% in the second quarter, according to a regulatory filing on Aug. 14. Starboard now holds approximately 1.3 million shares as of June 30, a dramatic surge from 849,679 shares at the end of Q1, when it had already increased its position by a notable 52%. In fact, Starboard's latest move comes at a strategic time.

CRM stock has been battered this year as investors flee due to slowing revenue growth, shaky execution of artificial intelligence (AI) strategies, and aggressive acquisition spending. These are the exact same red flags that triggered the activist uprising in late 2022 and early 2023, when Starboard teamed up with Third Point, ValueAct, and Elliott Management to demand better margins and operational efficiency.

Most of those activists cashed out and disappeared by mid-2023 after Salesforce delivered improved results and added board oversight. But Starboard, which is known for circling back when companies backslide on their promises, appears ready to ramp up the pressure again. The hedge fund's latest aggressive stake increase sends a clear message that Salesforce still has some room to improve its efficiency and profitability. That said, would it be wise to load up on CRM shares now?

About Salesforce Stock

Based in California, Salesforce has been a powerhouse in cloud computing ever since its founding in 1999. Over the years, it has not only pioneered the software-as-a-service (SaaS) model but also secured its dominance in the customer relationship management (CRM) space. Now, Salesforce is busy doubling down on AI, channeling big investments into tools that enhance customer engagement and boost sales team productivity. At the heart of this strategy is Agentforce, unveiled at Dreamforce 2024.

The platform promises to automate customer interactions, enabling businesses to scale their services while reducing their reliance on human labor. To further strengthen this vision, Salesforce announced plans this May for an $8 billion all-cash acquisition of Informatica, a leader in AI-powered cloud data management. Informatica’s strength lies in bringing together and cleaning data across silos, exactly the kind of backbone Salesforce needs to unlock the full potential of agentic AI.

If completed, this would be Salesforce’s most significant buy since the $27.7 billion Slack deal in 2021. But not everyone is cheering. While the Informatica acquisition was well received in the analyst community, the company’s aggressive spending, coupled with slowing revenue growth, has made some investors uneasy.

Valued at about $235 billion by market capitalization, CRM stock has pulled back 33% from its 52-week high of $369 and is down almost 27% in 2025. By contrast, the broader S&P 500 Index ($SPX) has returned a modest 9% so far this year.

Salesforce Beats Q1 Estimates

Salesforce kicked off fiscal 2026 with an impressive start. The company’s first-quarter earnings report published on May 28 topped Wall Street’s expectations and underscored how central AI and Data Cloud have become to its growth story. Revenue climbed 8% year-over-year (YOY) to $9.8 billion, edging past consensus estimates of $9.7 billion. What really stood out, however, was the strength of its AI and Data Cloud business, which has quickly become a significant growth engine.

Annual recurring revenue from the unit surpassed the $1 billion milestone, surging more than 120% from last year, with nearly 60% of the company’s top 100 deals now including AI and Data Cloud. The momentum extended to Agentforce, which is already proving its worth. Since its launch, the AI platform has secured over 8,000 deals, with half of these being paid, while processing over 750,000 customer requests. By automating workflows, Agentforce has helped cut case volume by 7% YOY.

Profitability remained a steady anchor. GAAP operating margin rose to 19.8% from 18.7% a year ago, while non-GAAP margin held firm at 32.3%, slightly above last year’s 32.1%. Adjusted EPS shot up 6% annually to $2.58, comfortably beating estimates of $2.54. Salesforce also prioritized shareholder returns, distributing $3.1 billion through $2.7 billion in buybacks and $402 million in dividends, signaling confidence in its long-term growth prospects.

Looking ahead, management is staying upbeat. For fiscal Q2, Salesforce is guiding for adjusted EPS of $2.76 to $2.78 on revenue between $10.11 billion and $10.16 billion. For the full year, the company lifted its outlook, calling for $11.27 to $11.33 in adjusted EPS and revenue between $41 billion and $41.3 billion, implying 8% to 9% growth.

What Do Analysts Think About Salesforce Stock

After Starboard Value increased its stake in Salesforce, D.A. Davidson analyst Gil Luria upgraded CRM stock to “Neutral” from “Underperform”, maintaining a $225 price target. While still maintaining a cautious stance, Luria emphasized that Starboard’s increased presence could intensify pressure on Salesforce to focus on core growth, maintain margins on the upswing, and avoid expensive, dilutive acquisitions.

At the same time, Stifel analyst Parker Lane trimmed his price target to $325 from $375 but reiterated a “Buy” rating. Lane sees a path for the stock to regain momentum if Salesforce can deliver steadier core performance and lift its AI and Data Cloud contributions meaningfully above the $1 billion mark.

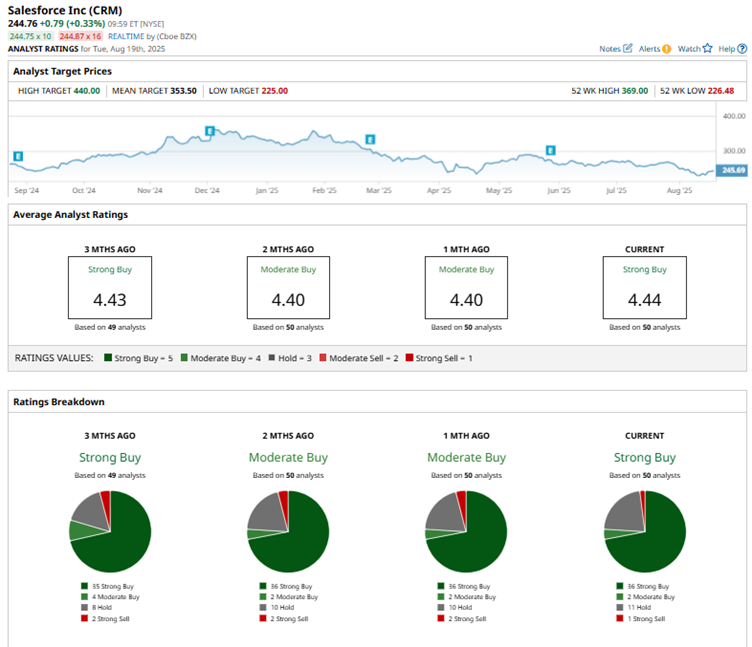

Overall, Wall Street appears highly bullish on CRM stock, with a consensus “Strong Buy” rating. Of the 50 analysts offering recommendations, a majority of 36 analysts advocate a “Strong Buy,” two give a “Moderate Buy,” 11 advise a “Hold,” and the remaining one suggests a “Strong Sell.” The average analyst price target of $349.69 represents potential upside of 42%, while the Street-high target of $440 suggests a 79% rally from current levels.

Final Thoughts

With activist pressure from Starboard Value back in the picture, Salesforce may once again find itself pushed to sharpen its focus and boost profitability. The hedge fund has previously forced the company to be more disciplined, and with its return, hopes are rising for better efficiency and stronger execution. Moreover, considering the company’s solid fundamentals, growing momentum in AI and Data Cloud, and Wall Street’s bullish outlook, Salesforce appears to be a stock worth keeping on the radar.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.