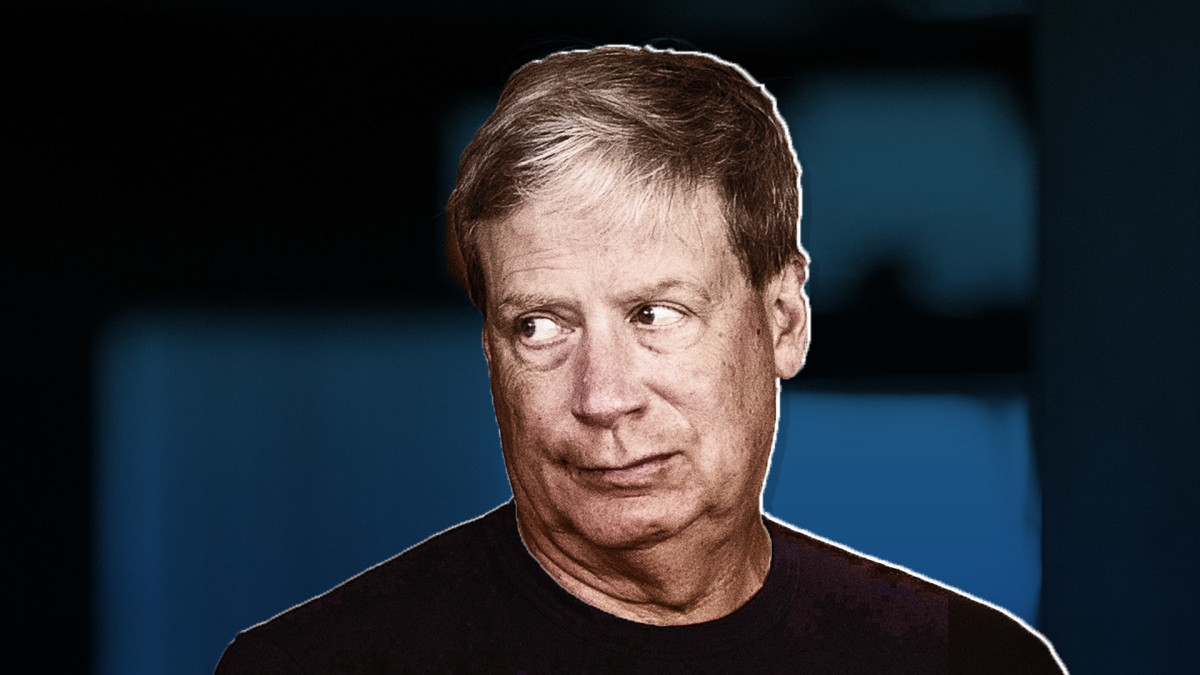

Stanley Druckenmiller is perhaps best known for breaking the Bank of England with famed investor George Soros in 1992. The duo successfully shorted the British pound sterling, pocketing over $1 billion. However, the track record at his own hedge fund, Duquesne Capital Management, turned him into a multi-billionaire, and one of the most successful hedge fund managers of his time.

Nowadays, Druckenmiller spends his time managing his wealth. His purchases and sales are worth watching, given his past success. Unfortunately, most investors don't have him on speed dial. However, his Duquesne Family Office is required to reveal all his buying and selling every quarter to the Securities and Exchange Commission.

Earlier this year, those reports revealed he’d taken a massive stake in chipmaker Nvidia (NVDA) -) to profit from booming interest in artificial intelligence. Now, they show he has set his sights on another technology titan.

TheStreet

Druckenmiller’s Nvidia bet pays off big

Last December’s successful launch of ChatGPT uncorked a flood of corporate interest in training and launching artificial intelligence solutions.

Generative AI applications like ChatGPT are useful for searching, parsing, and creating content. However, AI’s promise stretches far beyond that. Companies worldwide are knee-deep in evaluating how to use AI solutions in everything from financial hedging to drug development, to preventing cybercrime and retail theft.

Related: Analyst who forecast the S&P 500 correction has a new price target

AI's potential to reshape business operations has led to a rush of investment in technology infrastructure, including semiconductor chips, to train and operate AI applications. That’s been a boon to Nvidia because its high-end Graphic Processing Units (GPUs) are far more efficient at handling AI's heavy workloads than the Central Processing Units (CPUs) deployed in most enterprise and cloud networks.

Nvidia's H100 is the GPU most ideally suited to AI. Since it can cost over $30,000, Nvidia’s revenue and profit have skyrocketed.

In Q2, Nvidia sales totaled $13.5 billion, trouncing CEO Jensen Huang's $11 billion guidance. Meanwhile, the company’s earnings increased by an eye-opening 429% year-over-year to $2.70 per share, easily beating Wall Street estimates.

The company’s success has unsurprisingly caused surging interest in Nvidia’s stock, making it one of this year’s top performers. So far, Nvidia shares are up 234% in 2023. It's unlikely that even CEO Huang’s most ardent fans expected the company’s performance this year, but it probably didn’t surprise Druckenmiller.

Druckenmiller’s family office acquired over 950,000 Nvidia shares earlier this year, making it the billionaire’s largest position. According to fund tracker Whale Wisdom, his average cost on his Nvidia shares is about $184, suggesting Druckenmiller is up an impressive 165% on his position.

Druckenmiller unveils a new stock target

Nvidia remains Druckenmiller’s largest position at nearly 875,000 shares, but he did sell about 75,000 shares last quarter, according to his latest 13-F filing.

He hasn’t said publicly why he sold his shares or if he plans to sell more, but his decision suggests that, at a minimum, he’s uninterested in adding to his stake.

More Business of AI:

- Here's the startup that could win Bill Gates' AI race

- Meet your new executive assistant, a powerful AI named atlas

- The company behind ChatGPT is now facing a massive lawsuit

Instead, Druckenmiller has set his sights on another large-cap technology titan, Google’s parent company, Alphabet (GOOGL) -).

In Q3, his fund acquired 838,375 shares in Alphabet, valued at roughly $110 million. That’s big enough for Alphabet to rank as Druckenmiller’s seventh largest position, accounting for about 4% of his assets under management.

Druckenmiller’s interest in Alphabet could stem from its own AI ambitions. After Microsoft (MSFT) -) cut a deal to use ChatGPT to power its Bing search engine, Alphabet launched its generative AI solution to protect Google’s market share.

Alphabet also benefits from AI activity because it operates one of the world’s largest cloud-computing networks, where much of the training and running of AI programs is occurring.

We won't know if Druckenmiller added additional shares this quarter until the fourth quarter 13-F is filed in February, but if he did, it wouldn’t be surprising.

Alphabet shares tumbled to $120 last month following third-quarter financial results showing revenue grew 11% to $76.7 billion and earnings improved 42% to $1.56. Both beat Wall Street analysts' estimates. However, some investors were disappointed that its cloud revenue growth slowed to 22% from 28% in Q2.

According to Whale Wisdom, Druckenmiller’s average cost on his Alphabet shares is about $128. Unless he quickly reversed course and sold his shares, he may have used the drop to buy more, especially since Alphabet is arguably inexpensive compared to the other "magnificent seven" big-cap technology stocks, including Apple (AAPL) -) and Microsoft.

Alphabet is expected to earn $6.72 per share in 2024, giving it a relatively tame price-to-earnings ratio of 19. That's at the low end of its 5-year P/E range of between 17 to 44. It's also cheaper than Apple and Microsoft, which boast forward P/E ratios of 28 and 32, even though each is expected to grow earnings next year more slowly than Alphabet.

Forget Alphabet – Sign up to see what stocks we’re buying now