If you’re investing in individual stocks, it can pay to listen to highly successful people who have been-there-and-done-that, including Stanley Druckenmiller.

Druckenmiller is one of the most successful hedge fund managers of our generation. His hedge fund, Duquesne Capital Management, managed $12 billion when Druckenmiller shut it down to manage his personal wealth. However, Druckenmiller is likely best known for “breaking the Bank of England” with famed investor George Soros in 1992. Convinced the Bank of England didn’t have enough firepower to support its currency, the two investors successfully shorted the British pound sterling, reportedly profiting by over $1 billion.

Druckenmiller no longer manages money for others but regularly shares his views on the market. In a wide-ranging interview on Wednesday, he covered much ground, including opinions on the stock market that are likely to raise eyebrows.

Druckenmiller has a dire take on the market

Last year, the S&P 500 index took a beating as the US economy delivered negative economic growth in the first half of the year, the war in Ukraine increased global geopolitical risk, and the Federal Reserve embraced a hawkish stance on interest rates to wrestle inflation lower.

The Federal Funds Rate has increased by 5% since March 2022. As a result, the Fed’s preferred inflation measure, the core Personal Consumption Expenditures Price Index, has fallen to 4.7% from nearly 5.2% last September. That's good, but unfortunately, inflation remains too high, given the Federal Reserve’s 2% inflation target.

Inflation’s stickiness puts the Fed in a tough position. If it continues increasing rates to lower inflation, it risks spiraling the U.S. economy into recession. Manufacturing activity has already contracted in seven consecutive months, and the latest ISM data shows services PMI is similarly flirting with levels that signal contraction.

It hasn’t helped the economy that banks have grown increasingly nervous about lending in the wake of three of the largest bank failures in U.S. history. The Fed’s interest rate policy led to a devaluation of longer-term bonds held on the balance sheets of Signature Bank, Silicon Valley Bank, and First Republic Bank, contributing to a liquidity crisis caused by rising withdrawals.

Eager to avoid a similar fate, US banks have broadly shut off the lending spigot, tightening lending standards, increasing collateral, and shrinking loan sizes. The combination of higher rates and banks' reluctance to lend already has many, including Druckenmiller, debating if a recession is unavoidable.

DON'T MISS: Want A Loan? Don't Bank On It

At the Bloomberg Invest Conference, Druckenmiller provided a downbeat warning about the economy to investors:

“I would actually argue since it’s taken so long, the Fed has actually ended up with a higher terminal rate, and in fact, inflation gets stickier the longer it stays in the system; that it increases, not decreases, the probability of a hard landing.”

The higher probability of a hard landing wouldn’t be good news for investors because it would be bad news for corporate profits. The good news? The recession has been so well-forecast that profits may not fall the 40% plus Druckenmiller might usually expect. The bad news? Profits could still fall dramatically.

"I could see corporate profits down 20-30%... I don’t think a lot of corporations will be caught with their pants down...I'm worried about credit tightening over the next 6-9 months. Obviously, the banks are going into an economic period that if in fact, we get a recession, their balances are already impaired… If we get in a recession, then the real losses come, which is stuff like credit cards, commercial real estate, that kind of stuff. So those would be my worries,” said Druckenmiller.

A drop in corporate profit of that magnitude would pose a big challenge for investors, given valuation is arguably pricing in improving rather than deteriorating earnings.

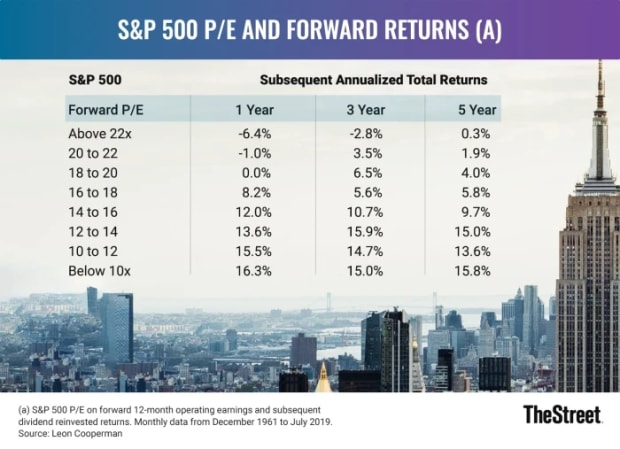

The S&P 500’s forward price-to-earnings ratio is 18. Historically, the S&P 500's return is flat one year after a P/E that's this high.

If investors hope to see additional gains, it will likely require better-than-hoped earnings, resulting in upside revisions for the coming quarters. As it stands, S&P 500 companies are expected to see earnings per share slip 6.7% in the second quarter, before rebounding to growth in the third and fourth quarters, according to FactSet.

Given that backdrop, ignoring Druckenmiller's warning may not be wise.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.