Bill Winters paid his first dividend as chief executive officer of Standard Chartered Plc, restoring the bank to growth after a chastening four-year slump. To stand a chance of hitting his targets, he needs to redouble his efforts.

The emerging-markets focused lender returned to profit for 2017 and announced a full-year dividend of 11 cents per share on Tuesday, helping the shares touch a 2 1/2-year high. However, revenue grew at half the pace Winters says is required to hit modest return targets, as income from trading plunged and it posted a loss at its private bank.

“They’re in a lot better shape and the path ahead is a clear one, albeit still a rocky one -- in private banking, they should be doing so much better,” said Hugh Young, head of Asia at Standard Life Aberdeen Plc, one of the bank’s shareholders. “It’s decent enough but still a slog.”

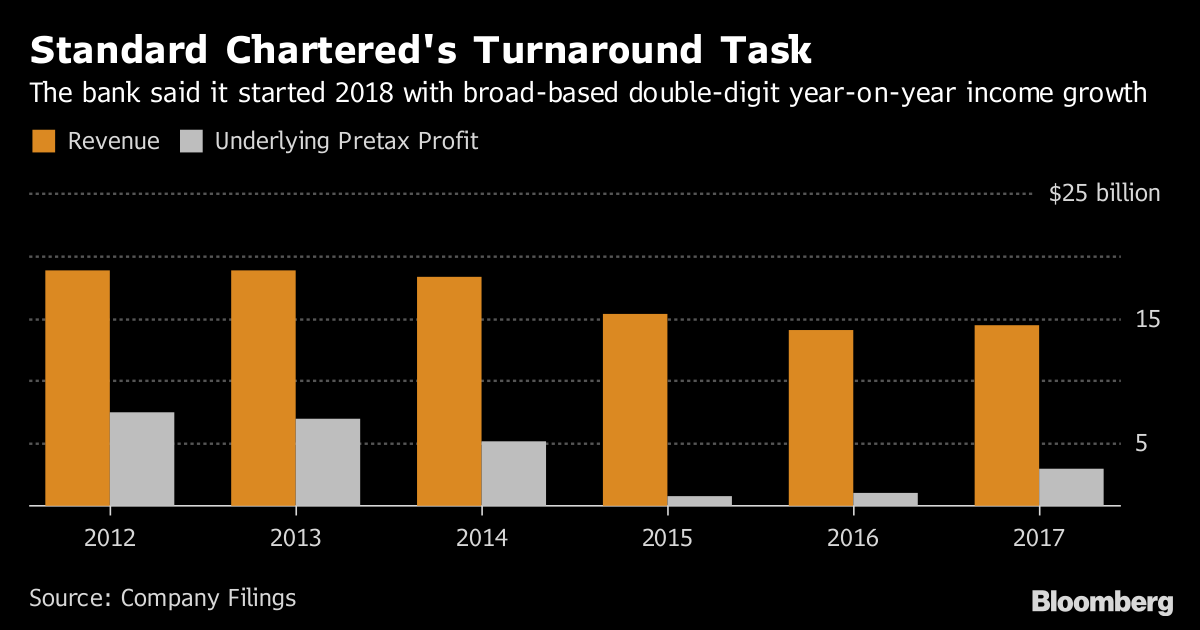

Former JPMorgan Chase & Co. executive Winters, 56, has to convince investors he can replace some of the $5 billion of revenue lost between 2012 and 2016, even after backing away from return-on-equity targets set only two years ago. He spent three years cleaning up the balance sheet and culture of the firm after an over-zealous push for growth.

Revenue rose 2.6 percent to $14.4 billion last year, narrowly missing the average estimate of 16 analysts surveyed by Bloomberg, and about half the bank’s targeted growth rate of 5 to 7 percent. Underlying pretax profit for 2017 almost tripled to $3 billion.

“We are no longer constrained in our ability to take risk,” Winters said on a call with reporters. “If we fail to hit the targets that we’ve stated quite publicly, something will have to change, but early indications are that there’s not going to be a fail.”

Revenue from financial markets fell 16 percent as its currency, rates and commodity traders all posted losses for the year. Winters said the results were hurt by extraordinarily low volatility last year, while the first two months of 2018 were more encouraging as client activity spiked.

Executives said the loss at the private bank was caused by spending on information technology and new staff, offsetting $500 million in operating income.

In 2016 Standard Chartered set a target for an 8 percent return on equity in 2018, rising to 10 percent by 2020. Executives have now formally abandoned these, and Chief Financial Officer Andy Halford said the 8 percent target is for the “medium term,” declining to be more specific. The lender made a 3.5 percent return last year, far below the minimum 10 percent level investors demand from banks, known as the cost of equity.

“The one bright spot is a particularly encouraging start to 2018,” said Ian Gordon, an analyst at Investec Plc with a sell rating on the stock. “We find the medium-term guidance somewhat more sobering.”

Psychic Toll

The lender’s shares rose as much as 4.3 percent in London before paring gains. They were 0.6 percent higher at 833.6 pence as of 11:22 a.m.

Executives said they plan to increase payouts as performance improves and the bank builds buffers above the minimum required to pass stress tests. The bank’s common equity Tier 1 capital ratio, a measure of financial strength, was 13.6 percent, matching estimates.

The bank is still battling allegations of misconduct. Regulators in Europe and Asia are investigating Standard Chartered over the role staff may have played in transferring $1.4 billion of private bank client assets from Guernsey to Singapore before new tax transparency rules were introduced, Bloomberg News reported in October.

"The bank has been through a lot over the past couple of years and it’s taken a toll on the psyche," Winters said. “We spent lot of time in 2017 and will do again in 2018 to focus on reinstalling the very strong performance culture that has differentiated Standard Chartered in the past."

As reward for the improved numbers, Winters’s compensation was boosted 38 percent to $6.5 million. CFO Halford got a 34 percent bump to $4 million.

To contact the reporters on this story: Stephen Morris in London at smorris39@bloomberg.net, Alfred Liu in Hong Kong at aliu226@bloomberg.net.

To contact the editors responsible for this story: Ambereen Choudhury at achoudhury@bloomberg.net, Marcus Wright at mwright115@bloomberg.net, Keith Campbell, Jon Menon

©2018 Bloomberg L.P.