The U.S. stock market meandered through the past year, ending this May less than 3% ahead of the same date in 2022. The Japanese market, however, returned more than 15%. Even the war-troubled European market returned nearly 5%.

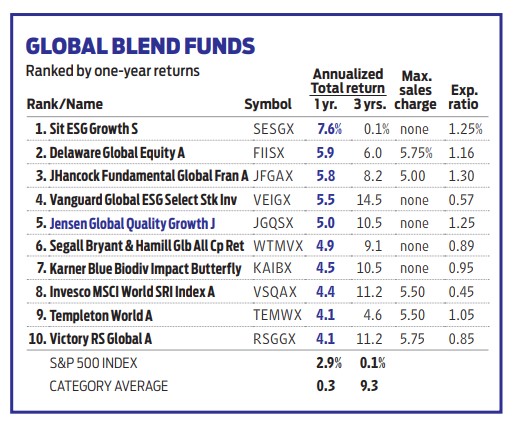

Global blend funds invest the world over, in both bargain-price stocks and faster-growing fare. The category has lagged the U.S. market recently, but some top-performing funds have maneuvered smartly through geopolitical challenges such as COVID and trade tensions.

The Jensen Global Quality Growth Fund (JGQSX) notched a 5% return in the year ending May 31, putting it in the top 10% of its category, according to research firm Morningstar. As the fund's name suggests, the managers are focused on two main factors: strong growth prospects and healthy finances, demonstrated by competitive advantages and good cash flows, says Allen Bond, a co-manager of the fund and head of research for Jensen.

Managers look for proven gems

The managers start by screening for companies that have achieved a return on equity (a measure of profitability) of at least 15% for the past 10 years, which generally limits them to large, well-established companies.

"We are not trying to find hidden gems that have yet to prove themselves as viable businesses," Bond says. Then, they zero in on companies with strong growth in free cash flow (cash left over after operating expenses and spending on assets such as buildings and equipment). Because of the focus on quality and growth, the average price-earnings ratio for fund holdings was about 23 recently, compared with a P/E of 19 for the S&P 500 Index. The concentrated portfolio held only 35 stocks at last report.

The fund's top holding is Dow stock Microsoft (MSFT), which gets about half of its revenue outside the U.S. Bond is bullish on the company's growing cloud-computing services. He also likes AstraZeneca (AZN), the European pharmaceutical giant, with some cancer and diabetes drugs in the pipeline that could boost sales.

The fund aims to make international stocks about 40% of its portfolio. Among its domestically focused holdings is blue chip stock UnitedHealth Group (UNH), which should benefit from higher demand for healthcare as the nation ages, says Bond.

The fund charges expenses of 1.25% annually, slightly above average for its category.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.