Spotify (SPOT) shares have been on a tear lately and on Monday they are in focus once again.

The music-streaming major's stock was up more than 2% at last check and was up more than 6% at one point after the company announced it would reduce its headcount.

As reported by TheStreet:

“Spotify said it would slash around 6% of its global workforce, or 600 jobs, in a move that will likely bring a $40 million hit in "severance related charges" to its current quarter earnings. Spotify's chief content officer, Dawn Ostroff, is also set to leave the group following a restructuring of its senior management.”

It’s the latest headcount reduction hitting the news, particularly in the tech space. Recent examples: Alphabet (GOOGL) (GOOG) joined Microsoft (MSFT) and Amazon (AMZN) last week.

It’s easy to assume that more job cuts are coming throughout the economy. But these reductions also seem to be sparking rallies in the respective stocks.

While SPOT shares are up about 50% from the low, the stock has been crushed.

Spotify stock suffered a peak-to-trough decline of 82% and is still 74% below the all-time high.

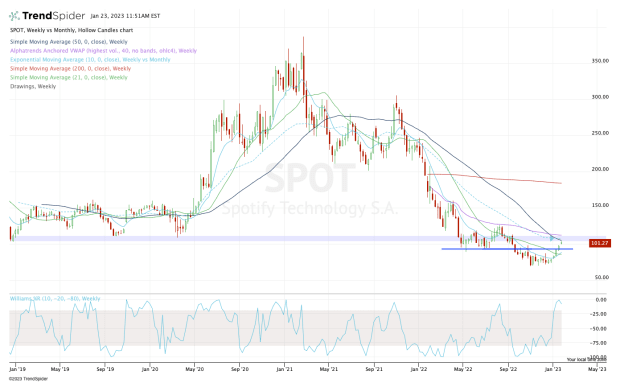

Let’s take a close look at the chart.

Trading Spotify Stock

Chart courtesy of TrendSpider.com

While it’s still early in the week, Spotify stock is going for its sixth straight weekly gain.

It’s been a pretty impressive push from the lows near $70 and Spotify stock has done a great job by reclaiming the 10-week and 21-week moving averages.

Further, the stock made a powerful push through the key $95 level, as well as the $100 mark. Now, though, it’s into a potential area of resistance.

Looking at the weekly chart, traders can see that the $105 to $112-ish zone was significant support in 2019 and even during the selloff in early 2020. Now that Spotify stock is below this prior support level, the odds favor that it could become resistance.

Additionally, there’s also the declining 50-week and 10-month moving averages in this area, as well as the weekly VWAP measure. This VWAP measure has been resistance for about a year now.

So what’s the bottom line? Spotify stock has traded tremendously well. But to continue higher, it must clear these measures. That could open the door to $125, then $140.

On the downside, the bulls want to see Spotify stock hold $95 and the 10-week and 21-week moving averages. Below these measures and $75 could be in play.