Billionaire investor Chamath Palihapitiya, often dubbed the “SPAC King,” recently celebrated a successful venture on X, highlighting MP Materials Corp. (NYSE:MP) as its stock price nears the $100 mark.

SPAC Deal That Created ‘Largest Source Of Rare Earth’ Outside China

His post lauded the rare earth mining company’s journey since its merger, noting it as “one of the few SPAC deals of that era that worked!”

This triumph underscores MP Materials’ strategic importance, particularly its ties to the U.S. Department of Defense under the Donald Trump administration’s initiative to secure domestic rare earth supplies.

Palihapitiya's original X post from Nov. 18, 2020, which he reshared, announced the closing of Fortress Value Acquisition Corp.'s merger with MP Materials, emphasizing his role in leading the PIPE (Private Investment in Public Equity) and the company's potential to create the “largest source of rare earth metals outside of China.”

These materials are critical for climate change technologies, batteries, and military defense systems.

See Also: From Defense to Dollars: The Government’s Play to Rebuild the Domestic Rare Earths Supply Chain

Government’s Play To Rebuild Domestic Rare Earths Supply Chain

The stock’s ascent reflects MP Materials’ pivotal role in national security. The U.S. Department of Defense recently entered a public-private partnership with the company, committing $400 million in preferred shares and guaranteeing a 10-year price floor for magnetic products from MP Materials’ upcoming “10X Facility.”

This initiative aims to reduce America’s near 100% reliance on foreign sources, primarily China, for processed rare earth materials. MP Materials CEO James Litinsky praised the deal as a “decisive action by the Trump administration to accelerate American supply chain independence.”

Apple Commits To Purchase From MP Materials

Further bolstering its market position, Apple Inc. (NASDAQ:AAPL) also committed $500 million to purchase American-made rare earth magnets from MP Materials, partnering to expand its Texas facility.

Price Action

MP stock surged 21.34% Monday to end at $95.06 per share. It has risen 584.87% over the last five years since 2020, with a 509.36% year-to-date gain and 244.55% returns over the last six months.

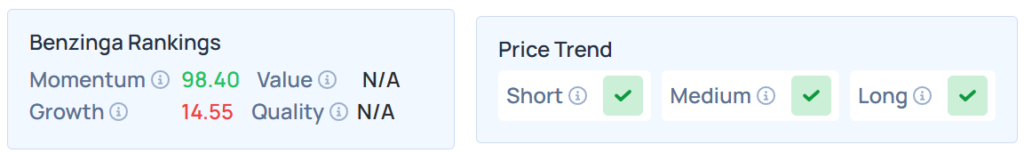

It maintained a stronger price trend over the short, medium, and long terms, with a poor growth ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

On Monday, the S&P 500 index ended 1.56% higher at 6,654.72, whereas the Nasdaq 100 index advanced 2.18% to 24,750.25. Dow Jones also gained 1.29% to 46,067.58.

The futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading lower on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock