Shares of SoundHound AI (SOUN) climbed 5.2% on Thursday, Aug. 28, after the company announced a significant milestone in its automotive end market. The company revealed that its generative AI-powered voice assistant, SoundHound Chat AI Automotive, is now live in production across select Jeep vehicles in several European markets.

This rollout is the latest step in SoundHound’s collaboration with Stellantis (STLA), the parent company of Jeep, and highlights how demand for advanced voice AI technology continues to build momentum across industries. For SoundHound, the automotive partnership strengthens its credibility in a highly competitive industry. It opens the door to broader adoption as carmakers race to integrate smarter, hands-free digital assistants into vehicles.

Beyond the automotive space, SoundHound has been steadily growing its presence in other areas where conversational AI is gaining traction. Its solutions are already being applied in enterprise customer service and restaurant automation, two sectors where voice-enabled AI can cut costs, improve efficiency, and enhance user experience.

With its technology now deployed across multiple industries and its addressable market projected to expand significantly in the years ahead, SoundHound is poised to deliver solid growth, which could drive its share price higher.

SoundHound Poised for Solid Growth

SoundHound is seeing strong demand for its voice AI technology. Thanks to strong demand, the company consistently delivers solid growth quarter after quarter. After reporting 101% year-over-year growth in its revenue in the fourth quarter of 2024, SoundHound followed it up with an even more impressive 151% increase in the first quarter of 2025, hitting $29.1 million in revenue. But the second quarter was even stronger. Its top line surged 217% from the prior year to $42.7 million, driven by strong demand, new customer wins, and effective cross-selling.

This acceleration in its top-line growth rate reflects the growing appetite for conversational AI solutions. Across industries, from automotive to restaurants and hospitality, businesses are embracing AI-powered voice technology to improve customer experiences and drive efficiency. That broader adoption is strengthening SoundHound’s position in the voice AI space and provides a solid runway for long-term growth.

By end market, trends across the automotive sector have been encouraging in recent years. In the second quarter, SoundHound secured a new original equipment manufacturer (OEM) partnership in China. In addition, it is witnessing improved pricing due to the expansion of its generative AI solutions. Meanwhile, the company’s restaurant business is expanding at an impressive pace. More than 14,000 restaurant locations now use SoundHound’s Voice AI ordering solutions, with 1,000 new locations added during the last quarter.

Another promising catalyst is the rollout of its Agentic AI platform, which has been gaining traction across multiple industries. This platform strengthens existing customer relationships and opens the door to meaningful upsell opportunities.

Diversification is also helping de-risk the business. In the first half of the year, no single customer accounted for more than 10% of revenue, indicating a more balanced and resilient revenue base. At the same time, SoundHound is keeping a firm focus on efficiency. By leveraging cloud integrations, workforce optimization, and generative AI enhancements, the company aims to scale while maintaining cost control.

SoundHound closed several large deals in the second quarter, a trend that management believes will continue in the months ahead. Reflecting its confidence, SoundHound raised its 2025 revenue outlook to between $160 million and $178 million, slightly above its earlier range.

Is SOUN Stock a Buy?

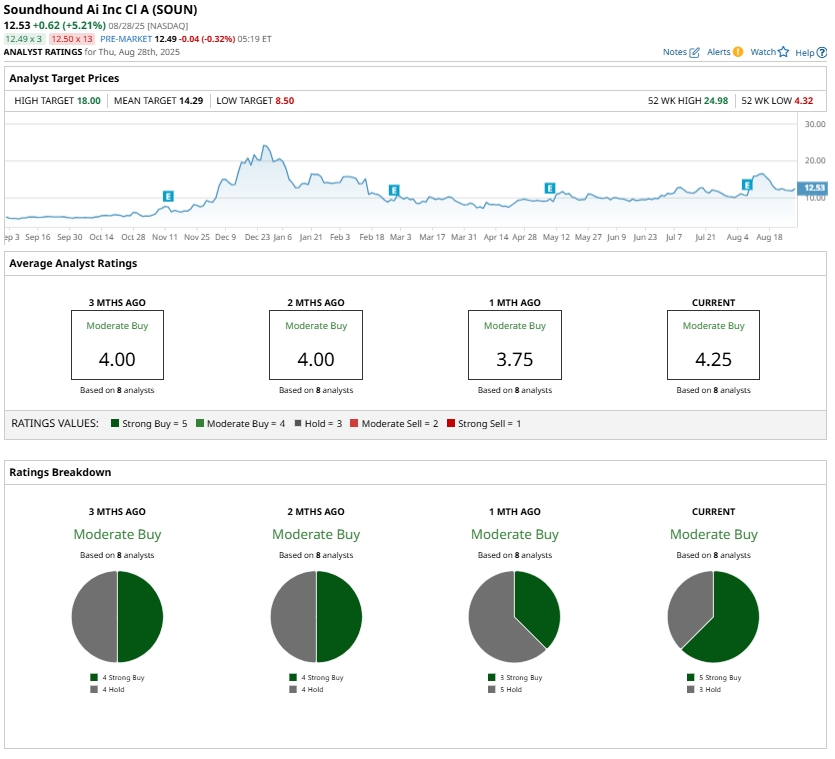

While analysts have a “Moderate Buy” consensus rating on SOUN stock, SoundHound’s accelerating revenue growth, expanding customer base, and deepening industry partnerships reflect the company’s strengthening position in the voice AI market.

With momentum across automotive, restaurants, and enterprise sectors, along with its Agentic AI platform driving new opportunities, SoundHound appears well-positioned to deliver solid growth. Adding to the appeal, SOUN shares are currently trading 50% below their 52-week high of $24.98, providing a compelling entry point.