/A%20corporate%20sign%20for%20SoundHound%20by%20Tada%20Images%20via%20Shutterstock.jpg)

SoundHound (SOUN) shares are down more than 2% on Tuesday after the artificial intelligence (AI)-enabled voice recognition company confirmed it has acquired “Interactions” for $60 million in cash.

Interactions is an AI firm that specializes in customer service and workflow orchestration. It has a portfolio of over 130 patents spanning adaptive understanding and human-in-the-loop systems.

SoundHound has been a major money maker for its shareholders this year. At the time of writing, the voice AI firm is trading well over 100% above its year-to-date low set in early April.

Interactions Deal Could Unlock Upside in SOUN Shares

Despite a muted response to the Interactions announcement today, the transaction is strategically bullish for SOUN stock since it expands the company’s enterprise footprint and accelerates its leadership in agentic AI.

The deal adds Fortune 100 clients across retail, insurance, and automotive to SoundHound’s roster, unlocking immediate cross-sell and upsell potential.

Plus, it strengthens the AI firm’s IP moat and adds advanced workflow orchestration to its long list of capabilities, enabling full-stack automation beyond voice.

Most importantly, SOUN’s management expect this transaction to be immediately accretive to the company’s profitability.

Following the Interactions deal, SoundHound has over 400 patents under its belt, positioning it well for long-term growth.

Is Valuation a Concern for SoundHound Stock

While SoundHound shares aren’t inexpensive to own at a price-sales (P/S) ratio of about 68x, H.C. Wainwright analyst Scott Buck continued to recommend owning them for the long term.

In his latest research note, Buck cited accelerating revenue growth, expanding enterprise footprint, and strong liquidity position for his bullish view on SOUN stock.

SoundHound’s revenue more than tripled on a year-over-year basis to a record $43 million in its fiscal Q2.

The Santa Clara-headquartered artificial intelligence firm is seeing a rapid increase in adoption across sectors like retail, healthcare, and automotive as evidenced in it processing nearly 3 billion conversational queries a quarter, he concluded.

SoundHound May Already Be Priced to Perfection

Not all Wall Street analysts, however, are as bullish on SoundHound stock as Scott Buck.

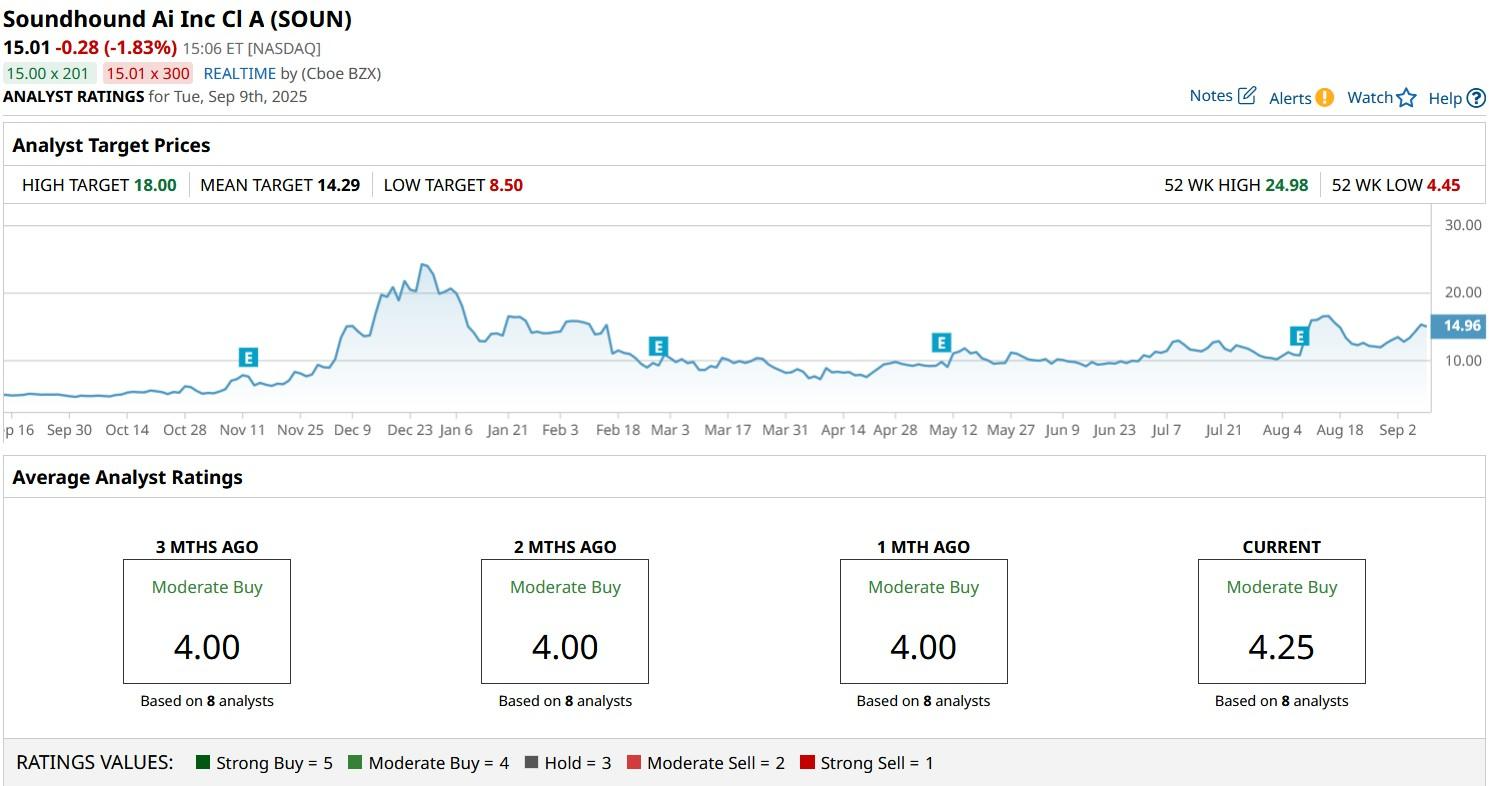

While the consensus rating on SOUN shares remains at “Moderate Buy,” the mean target of about $14.29 indicates potential downside of more than 4% from here.