Shares of SoundHound AI (NASDAQ:SOUN) are falling sharply Tuesday afternoon, sinking amid a broader market downdraft that saw the Nasdaq-100 tumble 1.5%. Here’s what investors need to know.

- SOUN shares are retreating from recent levels. Get the inside scoop here.

The negative sentiment, attributed to investors taking profits after strong year-to-date rallies, has overshadowed several months of positive momentum for the conversational AI specialist. Weakness in shares of Palantir, which is falling despite a strong earnings report, appears to be dragging down sentiment for the entire AI sector.

The sell-off comes just two days before the company's critical third-quarter 2025 earnings report, which is scheduled for after the market close on Thursday.

The report follows a record-breaking second-quarter, where SoundHound beat estimates with $42.7 million in revenue and raised its full-year outlook. Recent company wins include new partnerships with Red Lobster and French insurer Apivia Courtage.

Heading into the third-quarter report, consensus estimates are for a loss of 6 cents per share on $40.33 million in revenue. Despite Tuesday’s drop, Wall Street analysts remain largely bullish. H.C. Wainwright recently maintained its Buy rating, while Wedbush and DA Davidson also maintain Outperform and Buy ratings, respectively.

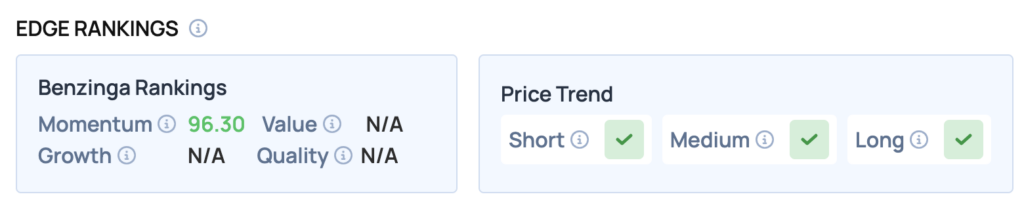

Benzinga Edge Rankings: Reflecting its strong recent performance, the stock carries a high Benzinga Edge Rankings Momentum score of 96.30.

SOUN Price Action: SoundHound AI shares were down 10.93% at $15.24 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Uber’s Strong Performance Gets Overshadowed By CEOs Robotaxi Comment

How To Buy SOUN Stock

By now you're likely curious about how to participate in the market for SoundHound AI – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock