/Solventum%20Corp%20logo%20on%20phone-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

Solventum Corporation (SOLV), based in Maplewood, Minnesota, is a healthcare company that develops, manufactures, and commercializes a portfolio of solutions to address critical customer and patient needs. With a market cap of $12.8 billion, the company’s broad portfolio of solutions leverages material and data science, clinical research, and digital capabilities. Solventum operates in the areas of separation and purification, health information, medical solutions, medical device components, and the oral care market.

Shares of this leading global healthcare company have underperformed the broader market over the past year. SOLV has gained 4.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.5%. In 2025, SOLV stock is up 11.8%, compared to SPX’s 16.5% rise on a YTD basis.

Narrowing the focus, SOLV’s outperformance is apparent compared to the SPDR S&P Health Care Equipment ETF (XHE). The exchange-traded fund has declined about 9.2% over the past year. Moreover, SOLV’s low double-digit returns on a YTD basis outshine the ETF’s 5.1% losses over the same time frame.

On Nov. 6, SOLV reported its Q3 results, and its shares closed up by 7.9% in the following trading session. Its adjusted EPS of $1.50 exceeded Wall Street expectations of $1.43. The company’s revenue was $2.10 billion, beating Wall Street forecasts of $2.09 billion. SOLV expects full-year adjusted EPS in the range of $5.98 to $6.08.

For the current fiscal year, ending in December, analysts expect SOLV’s EPS to decline 9.9% to $6.04 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

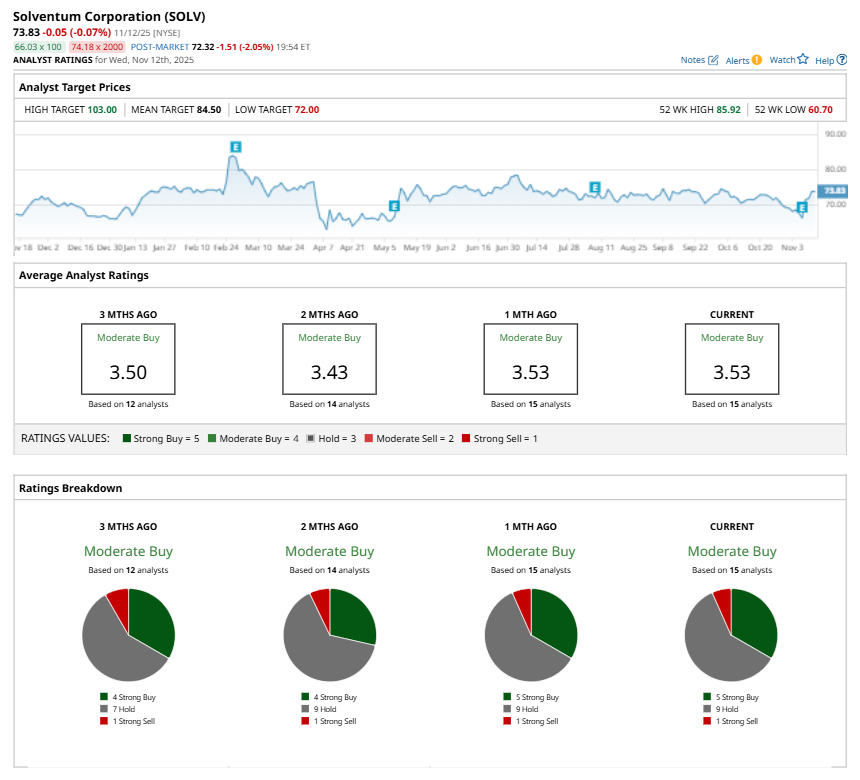

Among the 15 analysts covering SOLV stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, nine “Holds,” and one “Strong Sell.”

This configuration is more bullish than two months ago, with four analysts suggesting a “Strong Buy.”

On Nov. 10, UBS kept a “Neutral” rating on SOLV and raised the price target to $79, implying a potential upside of 7% from current levels.

The mean price target of $84.50 represents a 14.5% premium to SOLV’s current price levels. The Street-high price target of $103 suggests an ambitious upside potential of 39.5%.