SoFi Technologies (SOFI) isn't a stock for the faint of heart. It's a leader in next-generation banking, operating an online source for savings, checking, and loans, including credit cards and student loans.

Its status as one of the largest student loan players was an overhang last year because of COVID-era delayed payment program and President Joe Biden's student debt forgiveness plan. Alongside economic worries, wages growing more slowly than inflation, and a broad-based stock market sell-off, investors abandoned SoFi stock.

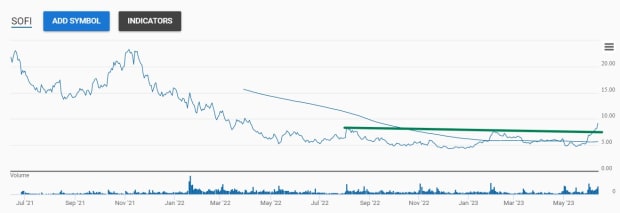

SoFi's stock price fell from a peak above $28 in February 2021 to below $5 as recently as last month -- more than an 80% drop.

Fortunately, there appears to be light at the end of the tunnel, and optimism has caused shares to do something investors shouldn't ignore.

Image source: Shutterstock

SoFi's Shrinking Student Loan Overhang

There's still a lot going wrong that's likely to weigh down on banks, including SoFi. The economy is still uncertain, with signs of unemployment emerging. Inflation, while shrinking, remains high, pressuring the Federal Reserve to keep interest rates elevated, reducing loan demand. And credit card debt has grown to nearly $1 trillion as interest rates on credit cards reach all-time highs above 20%, according to CreditCards.com.

DON'T MISS: How Far Can SoFi Stock Rally? Chart Provides a Clue.

Nevertheless, a key reason for SoFi Technologies' weakness last year could soon disappear. Millions of student loan borrowers who had previously been able to suspend making their payments will need to begin paying their monthly bills in October. Moreover, interest will start accruing again on September 1.

In March, SoFi sued the Department of Education to stop forbearance. However, it withdrew that lawsuit on June 5, after a bipartisan debt ceiling deal included language ending the policy earlier this month. In its suit, SoFi said forbearance had cost it $300 million in revenue since March 2020.

The end of forbearance isn't the only thing that could go SoFi's way. The Supreme Court is reviewing President Biden's student loan forgiveness plan, and the odds seem to be against signing off on it. The plan was to eliminate up to $20,000 in student loan debt from the books of people earning less than $125,000. A decision is expected later in June or July.

SoFi Stock Does Something Impressive

Investors haven't ignored the improving outlook for its student loan business. A potential resurgence in demand to refinance student loans could support future revenue and profit growth at the online bank, so investors have been buying shares, sending prices sharply higher.

In turn, those who were betting against SoFi because of student loan risks are now scurrying to cover short positions. The combination has resulted in SoFi's shares more than doubling since mid-May.

Importantly, the move higher has happened on robust volume. SoFi's trading volume has been above average every day since May 30, and its shares have gained in nine of the past 10 trading days.

The move up in SoFi's stock could continue, too. The rally took SoFi' above critical resistance on Monday, suggesting that buyers may emerge on future pullbacks in its share price.

What's Next For SoFi Shares

The pressure on consumer budgets won't get any easier once student loan forbearance ends. As a result, lenders could still see delinquency and default rates increase if unemployment trends worsen.

Nevertheless, SoFi's CEO, Anthony Noto, appears unfazed. The former COO of Twitter took the reins at SoFi in 2018. Noto's been buying SoFi shares as they sold off, acquiring 108,000 on May 14 to bring his total shares owned to nearly 6.5 million.

The show of support doesn't guarantee higher stock prices, but it is encouraging. Also encouraging is that revenue continues to grow quickly. Last quarter, SoFi revenue rose 72% to $608 million, while its loss per share improved to $0.05 from -$0.14.

How SoFi Technologies shares trade from here will likely depend on the economy side-stepping the worst of a recession and the Supreme Court tossing out student loan forgiveness. Regardless, it appears the best move is to buy down days now that SoFi's stock has broken out.

Forget SoFi -- This Could Be The Next Stock To Go