SoFi Technologies Inc (NASDAQ:SOFI) shares are trading lower on Tuesday, despite a lack of company-specific news for the session. The downward momentum continues a difficult five-day period for the fintech company, which has seen its stock slide over 12%. Here’s what investors need to know.

What To Know: While Morgan Stanley on Tuesday raised its price target on SoFi to $18, the firm maintained its Underweight rating on the stock. This bearish stance from a major Wall Street firm may be fueling investor concerns and contributing to the pullback.

SoFi has an average price target of $14.86, well below current levels. The stock has rallied approximately 68% year-to-date, according to Benzinga Pro.

Broader market jitters surrounding a potential government shutdown could also be weighing on the stock. With lawmakers at an impasse, the resulting “data blackout” from a shutdown would suspend the release of crucial economic statistics.

This uncertainty directly impacts the Federal Reserve’s ability to make informed decisions on interest rates, a key factor for financial companies like SoFi. The lack of clear economic data could potentially lead investors to pull back from growth-sensitive stocks amid worries of broader market volatility.

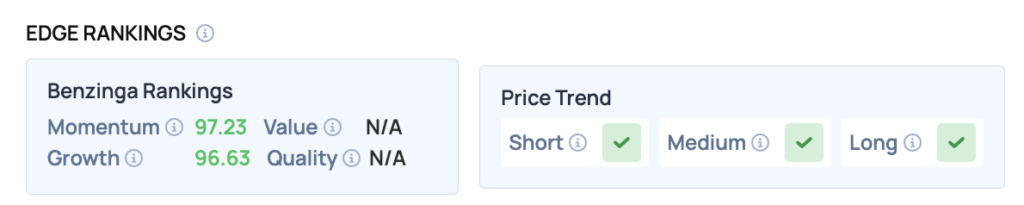

Benzinga Edge Rankings: Despite the recent pullback, Benzinga Edge rankings underscore the stock’s recent strength, assigning it a Momentum score of 97.23 and a Growth score of 96.63.

SOFI Price Action: SoFi Technologies shares were down 5.89% at $25.94 at the time of publication Tuesday, according to Benzinga Pro. Over the past month, SoFi has gained about 6.1% versus a 3.9% rise in the S&P 500. The stock is trading near its 52-week high of $30.30.

SoFi stock is trading above its 50-day moving average of $24.57, indicating a potential support level, while the 100-day and 200-day moving averages at $20.21 and $17.07, respectively, suggest longer-term bullish trends. Resistance is observed near the recent high of $30.30, while the recent low of $25.70 may serve as a short-term support.

Read Also: What’s Going On With Nike Stock Ahead Of Q1 Earnings?

How To Buy SOFI Stock

By now you're likely curious about how to participate in the market for SoFi Technologies – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock