/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Shares of financial technology company SoFi (SOFI) have rallied significantly, rising over 226% in a year. This growth reflects the company’s strong execution across multiple fronts, from consistent growth in its member and product base to a strategic shift toward more capital-light revenue streams. Further, by focusing on lowering funding costs and solid risk management, SoFi has managed to strengthen its earnings.

While SoFi stock has appreciated significantly in value, its Q3 financials could determine whether the impressive rally has more room to run or if SoFi’s momentum will slow. Notably, the financial services company plans to announce its third-quarter earnings on Tuesday, Oct. 28.

In recent quarters, SoFi’s top-line growth rate has accelerated alongside a rapidly expanding customer base. That momentum is expected to continue into the third quarter. However, with the stock already up sharply, any signs of weaker growth could trigger a pullback.

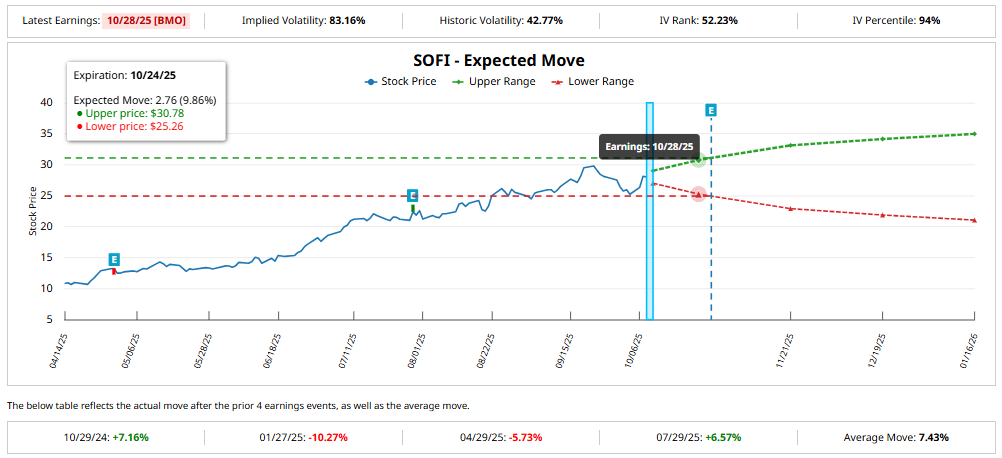

Options activity suggests traders are bracing for a volatile reaction. Current data shows the market is pricing in a potential post-earnings swing of nearly 14.7% in either direction for options that expire Oct. 31, which is well above the average move of about 7.4% over the past four quarters. For context, SoFi shares jumped 6.6% after the company’s last earnings release.

Q3 Expectations: SoFi Could Deliver Solid Growth Again

After a stellar first half of 2025, SoFi Technologies is poised to deliver strong financial performance in Q3. The digital finance platform has built strong momentum across lending, financial services, and technology. Moreover, with interest rates expected to decline, conditions look increasingly favorable for SoFi to deliver significant growth in the upcoming quarters.

Membership growth remains a key driver for SoFi, and that number is expected to rise in Q3. Notably, in Q2, SoFi added 850,000 new members, lifting its total to 11.7 million, a 34% increase year-over-year. Product adoption was equally strong, with users embracing a record 1.3 million new offerings, bringing the total number of products to more than 17 million. Impressively, about 35% of these were cross-sold to existing members, signaling increasing penetration and the success of SoFi’s strategy to grow wallet share through its integrated financial ecosystem.

One of the company’s most promising growth engines is its Loan Platform Business (LPB). This division enables SoFi to originate loans for third parties, earning lucrative fees while minimizing balance-sheet exposure. Within just over a year, LPB has scaled to an annualized $9.5 billion in originations and over $500 million in high-margin fee income. Management sees $1 billion in annual revenue ahead, with the potential to multiply further if SoFi succeeds in tokenizing these loans, turning them into digital assets accessible to everyday investors.

SoFi’s Tech Platform is another growth pillar, supporting rapid product development, operational efficiencies, and external partnerships. As the company’s technology gains traction beyond financial services, it strengthens SoFi’s role as both a fintech innovator and a platform provider.

The Lending segment also remains robust, with personal loans leading growth and strong momentum across other categories. Further, its expansion into crypto and blockchain initiatives positions it well to accelerate its growth.

In Q2, SoFi’s total assets climbed $3.4 billion, driven by $3.1 billion in loan growth. Deposits surged to $29.5 billion, providing a stable, low-cost funding base and further strengthening margins. With deposits likely to rise again in Q3, SoFi’s bottom line will likely remain strong.

Is SoFi Stock a Buy Ahead of Q3 Earnings?

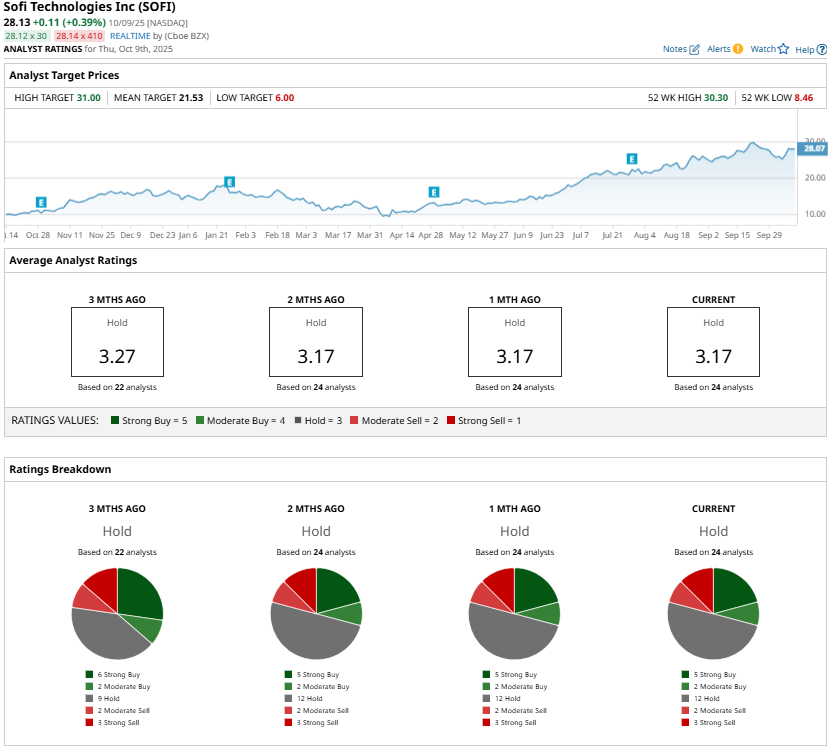

SoFi stock has seen a strong run recently, pushing its valuation higher and prompting analysts to maintain a “Hold” consensus rating. Despite this, the company’s underlying business momentum remains robust, and potential tailwinds from future interest rate cuts could provide additional support.

For long-term investors, SoFi presents a compelling opportunity. However, investors can wait for a pullback before going long.