/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

SoFi (SOFI) stock has gained significantly in value, rising more than 270% over the past year. Its solid financial performances, accelerating growth, shift to a lower-risk, fee-based non-lending business, and steady credit performance have given a massive boost to SoFi stock.

The significant rally makes it tempting to take profits, but there are good reasons to believe that SoFi’s run is not over yet.

A Favorable Interest Rate Environment to Support SoFi

The recent interest rate cut, with more expected in the months ahead, creates an operating environment that could prove highly favorable for SoFi. Lower rates have the potential to supercharge the company’s lending division, which has already shown resilience and strong returns even during a period of elevated borrowing costs. With rates expected to trend downward, SoFi is positioned to capture renewed demand across its lending products.

Evidence of that momentum is already visible. In student lending, SoFi recorded nearly $1 billion in originations in the second quarter, a 35% jump from the prior year. To strengthen this business further, the company introduced a refinancing solution designed to ease repayment early in the loan’s life and step up later, an offering that helps borrowers manage cash flow while still working toward long-term savings. With an estimated $280 billion in student loans available for refinancing and structural changes in federal loan programs, such as Grad PLUS and Parent PLUS, SoFi has a substantial market opportunity to capture.

The opportunity is equally impressive in home loans. Total originations reached nearly $800 million in the second quarter, representing a year-over-year growth of more than 90%. Much of this surge was driven by SoFi’s home equity loan product, which has quickly become a key driver of growth. In fact, within just a year of launch, home equity loans accounted for nearly a third of the company’s home lending volume. As interest rates ease, SoFi is preparing for even greater demand in home purchase and refinancing markets, building on this strong momentum.

SoFi’s Growing Mix of Fee-Based Revenue

Besides improving the operating environment, SoFi will benefit from its transition into a more diversified financial services company, expanding beyond traditional lending to reduce exposure to credit risk while building a more stable and predictable revenue base. The key to this strategy is SoFi’s growing emphasis on fee-based services, which provide a reliable stream of income and enhance the overall investment case for the business.

In its most recent quarter, SoFi achieved $378 million in total fee-based revenue, representing a 72% increase from the prior year. This growth was driven by higher origination and referral fees, interchange revenue, substantial brokerage fees, and the solid performance of its Loan Platform Business (LPB). On an annualized basis, the company now generates over $1.5 billion in fee-based revenue, reflecting a strategic shift toward capital-light business models that complement its traditional lending activities.

The LPB is a key growth catalyst. By leveraging its robust customer base and servicing capabilities, SoFi can originate customized loans on behalf of third parties. These loans are then quickly removed from the company’s balance sheet, thereby reducing credit risk on SoFi’s books. For each loan transferred, SoFi earns a fee, creating a scalable revenue stream.

SoFi’s Tech Platform business is also expanding well, as the company is broadening its client base beyond conventional financial services firms and fintechs. This expansion positions SoFi to tap into new markets and revenue opportunities, further diversifying its business model and strengthening its long-term investment appeal.

The Bottom Line

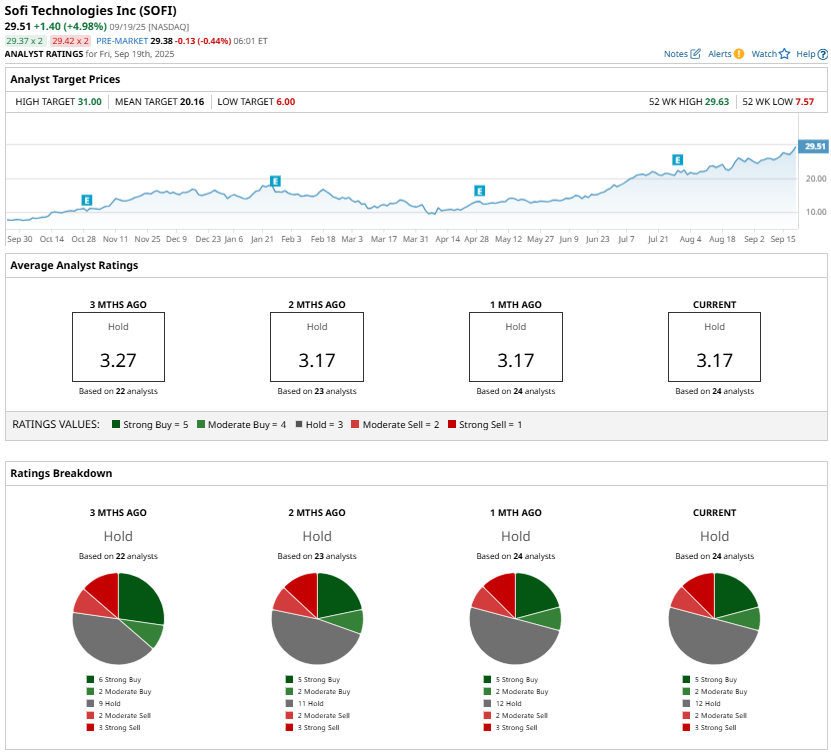

While the significant rally in SoFi stock and analysts’ “Hold” consensus rating could push investors to lock in gains, the company’s fundamentals suggest that its growth story is far from over. A favorable interest rate environment, strong momentum across student and home lending, and a strategic shift toward fee-based revenue all point to continued upside potential.