/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Artificial intelligence is arguably the most captivating—and significant—investing theme of the last several years. Multiple tailwinds are pointing to why AI stocks should be central to any portfolio.

First, consider that Grand View Research believes that the global AI market size was $279.2 billion in 2024 and is expected to reach $1.81 trillion by 2030. That’s a compound annual growth rate of 35.9%. Dell’Oro Group projects that spending on data center infrastructure—including hardware, software, networking systems, power, and cooling—could top $1 trillion all by itself by 2029.

While there are several great artificial intelligence stocks, SoFi Technologies (SOFI) is now trying to attract investors to its new exchange-traded fund, the Tidal Trust SoFi Agentic AI ETF (AGIQ). The fund is the first ETF launched by SOFI since 2023.

Is the AGIQ a good method to invest in AI? Let’s take a closer look.

About the AGIQ ETF

The SoFi Agentic AI ETF launched on Sept. 3. It’s managed by SoFi Technologies, a California-based financial company that also handles personal and student loans, mortgages, auto loans, personal banking, credit cards, and insurance.

The AGIQ ETF is SoFi’s fifth ETF, following the SoFi Select 500 ETF (SFY), the SoFi Next 500 ETF (SFYX), the SoFi Social 50 ETF (SFYF), and the SoFi Enhanced Yield ETF (THTA).

In the fund prospectus, SoFi says the ETF will track the BITA US Agentic AI Index, which follows U.S.-listed companies that generate at least 30% of overall revenue from agentic AI and autonomous decision-making technologies. The index can include up to 50 companies and breaks the stocks it includes into the following categories:

- Autonomous digital agents: Providers of AI-driven platforms that enable self-managing business operations and digital transformation

- Autonomous cyber and infrastructure agents: Firms offering AI-enabled cybersecurity solutions and self-optimizing network management systems.

- Autonomous scientific and discovery agents: Companies that apply AI to accelerate breakthroughs in areas such as genomics, pharmaceuticals, and advanced materials

- Autonomous mobility and transportation agents: Companies that implement AI to enable real-time autonomous decision-making in mobility and transportation systems, such as self-driving cars and unmanned aerial vehicles.

- Autonomous industrial and robotics: Machinery and robotics solutions for applications in manufacturing, agriculture, logistics, and healthcare.

- Enabling Autonomous AI Technologies: Companies whose innovations in processing, connectivity, and data management enable the broader deployment of agentic AI technologies.

Since its launch, the AGIQ ETF has been trading in a narrow range between $19.64 and $20.40. The average trading volume is only 37,060 shares. The net asset value is 20.30, indicating that the fund is fairly valued.

The fund’s investment advisor is Tidal Investments. The AGIQ ETF has an expense ratio of 0.69, or $69 annually per $10,000 invested.

What Stocks Does the AGIQ ETF Hold?

The ETF currently holds 26 stocks that represent some of the best-known AI stocks. The top five holdings represent 36.9% of the fund.

| Company | Market Value | Weighting |

| Nvidia (NVDA) | $174,175 | 8.58% |

| Tesla (TSLA) | $169,668 | $8.36% |

| Palantir Technologies (PLTR) | $159,924 | 7.88% |

| Arista Networks (ANET) | $133,537 | 6.58% |

| Salesforce (CRM) | $111,914 | 5.51% |

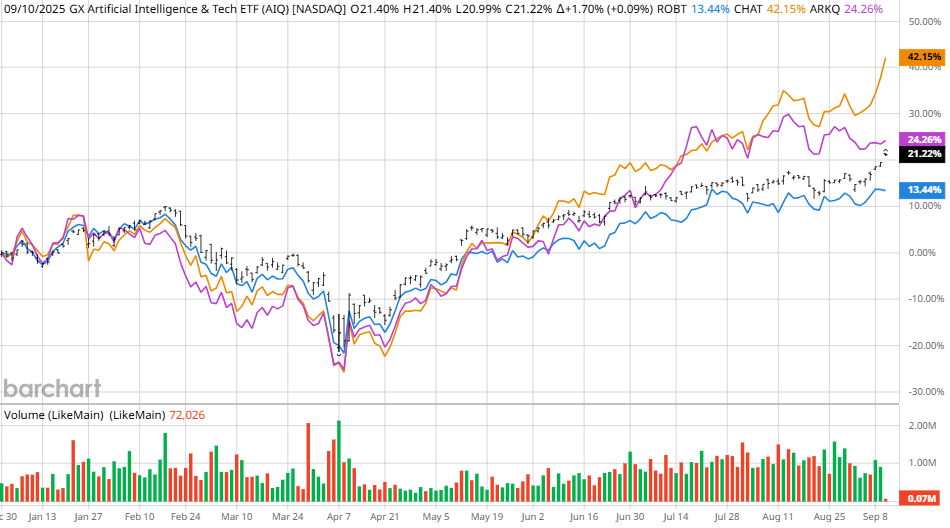

In entering the AI ETF space, SoFi will be facing some significant competition, including the Global X Artificial Intelligence & Technology ETF (AIQ), the First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT), the Roundhill Generative AI & Technology ETF (CHAT), and the ARK Autonomous Technology & Robotics ETF (ARKQ).

All four of those ETFs are currently outperforming the overall market, with the CHAT ETF leading the way, up 42.2% so far this year. The worst-performing fund on the list, ROBT, still generated a 13.4% return so far this year.

As each of those funds has an expense ratio similar to the AGIQ ETF, SoFi will need the SoFi Agentic AI ETF’s performance to match or exceed the performance of competing ETFs to attract investors.

Since the fund is still in its first few days and has not yet attracted analyst coverage, investors may want to bide their time before investing.