Last year wasn't kind to cloud software stocks, especially those with sky-high valuations like Snowflake (SNOW). Shares fell to $110 in May 2022 from a peak of over $400 in November 2021.

However, it's been better days for Snowflake recently. Optimism has skyrocketed this year on hopes for rebounding IT spending associated with investments in artificial intelligence. As a result, large-cap technology stocks, including Snowflake, are experiencing a resurgence of investor interest.

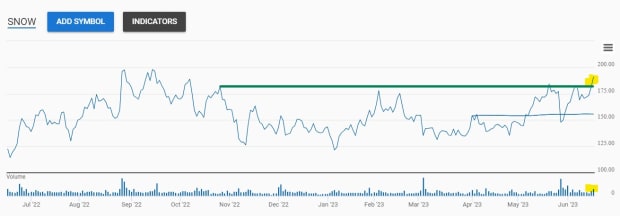

Since making a low below $120 in January, Snowflake shares have rebounded handsomely, leading to its stock doing something particularly impressive on June 15.

Image source: TheStreet

Snowflake Rides The Cloud Computing Wave

Snowflake is a software-as-a-service company that allows companies to store, query, and manipulate data that would otherwise be trapped in silos within legacy networks.

The ability to provide internal and external access to data, and tools that help customers discover new insights from their data, has turned it into one of the most widely embraced SaaS players.

DON'T MISS: Is Nvidia Stock Too Pricey?

The company IPO'ed in September 2020, yet it's already achieved an annualized sales run rate of over $2.4 billion, and over 1600 institutional money managers own Snowflake in their portfolios.

The rapid adoption of cloud computing, which offers more flexibility and potential cost savings than traditional enterprise networks, has created a domino effect. As more data migrates from silos to the cloud, where it can be easily manipulated, more data gets created, requiring more storage and demand for data tools.

That's excellent news for Snowflake because it makes money by charging customers based on consumption. The more they interact with its platform and solutions, the more significant revenue and, by extension, profit becomes.

Last quarter, Snowflake reported sales increased 48% year-over-year to $624 million, while earnings per share rose to $0.15 from a loss of $0.01. Wall Street analysts project its EPS will improve to $0.58 in the current fiscal year of 2024 and $0.91 in fiscal 2025.

Snowflake shares do something important

The company's stock is enjoying a significant rally in June, rising from about $143 in the final week of May to over $190 on Thursday, June 15. The recent gains are impressive, but what's really important is that the stock's 5.5% rally on June 15 lifted it to a new high, continuing a trend of higher highs and higher lows since last fall.

The day's gain is even more meaningful because it occurred on heavier than normal trading volume. Until June 15, it hadn't had an up day on above-average volume since June 2. Since Thursday's rally broke Snowflake's stock price to a new high on heavy volume, it adds conviction that share prices will continue higher and buyers will step in and pick up shares on down days.

What's next for Snowflake Stock?

The rally in technology stocks, including Snowflake, has been remarkable this year, but stocks don't trade in a straight line up or down forever.

At some point, investors will book some of their gains, causing shares to trade sideways or retreat to key levels, such as the 200-day moving average.

Nevertheless, there are substantial tailwinds that make Snowflake attractive. Software stocks command favorable margins, and surging investments in artificial intelligence will likely support IT spending on data solutions that help leaders better understand their businesses.

Although Snowflake has already captured the attention of many institutional money managers, thousands of funds still have yet to add it to portfolios. For perspective, over 4200 funds own shares in Salesforce.com, a well-established customer relationship management software leader.

Of course, Snowflake's stock isn't suitable for everyone. Its forward price-to-earnings ratio is over 200, high enough to give value investors palpitations. Technology stocks like Snowflake are typically more volatile than other stocks too, so risk-averse investors will likely take a pass on owning shares too.

Nevertheless, the recent move higher on heavy volume signals that institutional interest is climbing, which could mean that higher prices are in the cards.

Forget Snowflake: Here's The Tech Stock We're Buying