/An%20image%20of%20the%20Snowflake%20logo%20on%20a%20corporate%20office_%20Image%20by%20Grand%20Warszawski%20via%20Shutterstock_.jpg)

On December 3, Snowflake, Inc. (SNOW) reported strong adjusted free cash flow and FCF margins for its fiscal Q3 ended Oct. 31. Moreover, management maintained its 25% FCF margin guidance for the full FY.

That could lead to a 22% higher price target for SNOW stock at $276.49 per share. This article will show how that works out and some ways to play SNOW stock.

SNOW is trading at $226.82 midday on Monday, Dec. 8, well off its recent high of $265.00 just before its earnings results on Dec. 3.

SnowFlake's FCF Results

That was even after Snowflake, which calls itself the AI Data Cloud company, reported 29% YoY growth, and its adjusted free cash flow (FCF) rose 57%.

The market wanted to see more. For example, over the last 12 months its adj. FCF margin was just 19.0%. That is well below the 25% adj. FCF margin guidance that management maintained.

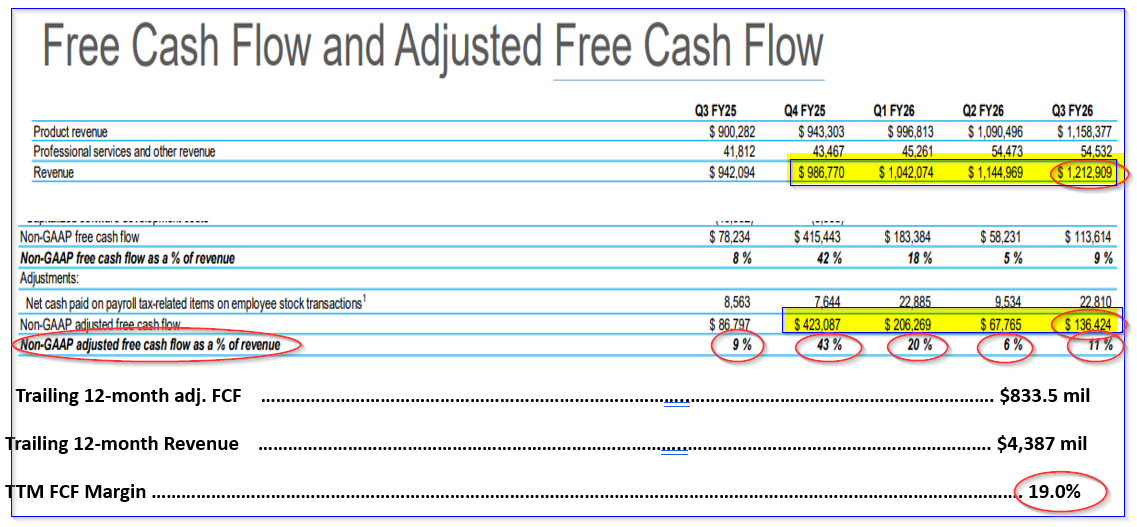

This can be seen on page 33 of Snowflake's investor presentation deck:

It shows that the trailing 12-month adj. FCF of $833.5 million was 19% of the $4,387 million trailing 12-month revenue (see also data provided by reported by Stock Analysis).

Even though this is lower than management's guidance of 25% for the full year, look at how high the Q4 margins have typically been. Last year, it was 43% of sales.

This implies that, given most of its clients renew their subscriptions during the upcoming quarter, it might be able to meet this 25% guidance.

Let's see if that is the case.

Forecasting FCF

Based on analysts' Q4 revenue forecasts, we can project its full-year adj. FCF margin. For example, Seeking Alpha reports that 42 analysts have an average Q4 sales forecast of $1.26 billion.

So, assuming it makes a similar 42% adj. FCF margin, the full year adj. FCF will be:

$1,260m x 0.42 = $529.2 million (i.e., +25% over last year's $423.087m)

$529.2m +$833.5m - $423.087m = $939.66 m adj. FCF for FY 2026

And, based on analysts' revenue forecasts of $4.65 billion:

$939.66m / $4,650m revenue = 0.202 = 20.2% adj. FCF margin

That is well below management's 25% full-year adj. FCF margin guidance. That could be why SNOW stock is faltering.

However, it does not take too much higher FCF to get to the 25% guidance:

$4650m x 0.25 = $1,162 full-year adj. FCF

That implies that Q4 adj. FCF will be $751.5 million (i.e., $1,162m - $410.5m YTD adj. FCF). That represents a 59.6% adj. FCF margin on the estimated $1.26 billion in Q4 sales.

Moreover, analysts' Q4 revenue forecasts could be too low.

My best guess is that revenue will be 30% higher and its adj. FCF margin for Q4 will be 50%. That brings the total to $1.052 billion in adj. FCF for FY 2026, or a 22.6% margin. It's still lower than management's guidance, but it looks doable.

Moreover, using this estimate for next year could lead to a higher price target (PT) for SNOW stock.

Price Targets for SNOW

Using a 1.0% FCF yield metric, the market value of SNOW stock could be over $105 billion:

$1.052b adj. FCF / 0.01 = $105.2 billion mkt cap

That is over 37% higher than its market valuation today of $76.69 billion, according to Yahoo! Finance:

$105.2b / $76.69b = 1.3717 -1 = +37.2% upside

However, just to be conservative, let's use a slightly lower FCF value of 1.125%. That's the equivalent of an 88.89x multiple:

$1.052b x 88.89 = $93.5 billion mkt value

That is +21.9% higher than today's market cap (i.e., $93.5b/$76.69b). In other words, the PT is 21.9% higher:

$226.82 x 1.219 = $276.49 PT

Analysts tend to agree. For example, Yahoo! Finance reports that the average of 51 analysts is $281.73 per share. Barchart's mean survey PT is similar: $278.20.

The bottom line is that SNOW stock looks too cheap here.

One way to play this is to sell short out-of-the-money (OTM) puts to set a lower buy-in. That way, an investor can get paid while waiting to invest at this OTM price.

Shorting OTM SNOW Puts

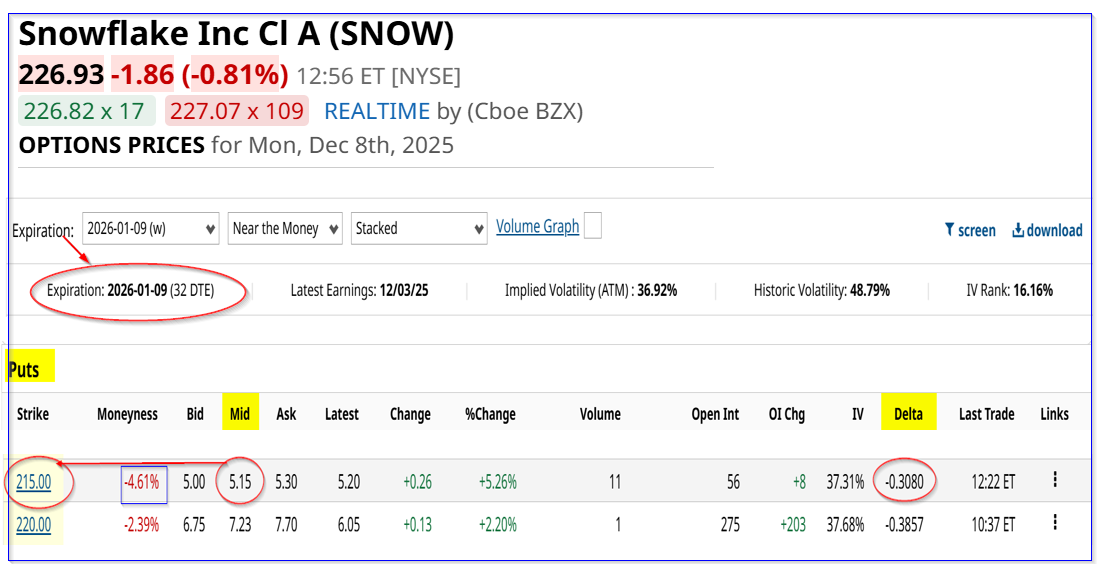

The Jan. 9, 2026, expiry chain shows that the $215.00 put option contract, which is 4.6% lower than today's trading price, i.e., out-of-the-money (OTM), has an attractive price for short-sellers.

For example, the midpoint premium is $5.15 per put contract. That allows an investor who secures $21,500 per put contract shorted to make an immediate income of $515.

This is a yield of 2.395% (i.e., $5.15/$215.00) for one month. That is a very attractive return, especially if it can be repeated for several months.

This also allows the investor to potentially have a lower breakeven buy-in point:

$215 - $5.15 income received = $209.85

That is 7.5% lower than today's price. Moreover, if SNOW rises to my PT of $276.49 over the next year, the potential upside is +31.75% (i.e., $276.49/$209.85-1).

The bottom line is that this is a great way to set a lower buy-in point.

In my last article on SNOW, I also recommended buying in-the-money (ITM) calls at $220.00 for expiry on May 15, 2025. The premium is lower today than before, but the investment is still a sound play.