Snowflake Inc (NYSE:SNOW) shares are on track for an 18% weekly gain, fueled by a stellar second-quarter earnings report that surpassed analyst expectations.

What To Know: The company reported second-quarter revenue of $1.14 billion, beating the consensus estimate of $1.09 billion. Adjusted earnings per share came in at 35 cents, well ahead of the 27 cents analysts had projected. Looking ahead, Snowflake raised its full-year product revenue forecast to a range of $4.33 billion to $4.395 billion.

The strong results and optimistic outlook prompted a wave of positive commentary from Wall Street. At least a dozen analysts raised their price targets on the stock. J.P. Morgan reiterated an Overweight rating and lifted its target to $250 from $210, while Bank of America maintained a Buy rating and increased its target from $230 to $265.

CEO Sridhar Ramaswamy expressed confidence in the company's trajectory, stating, “We have an enormous opportunity ahead as we continue to empower every enterprise to achieve its full potential through data and AI.”

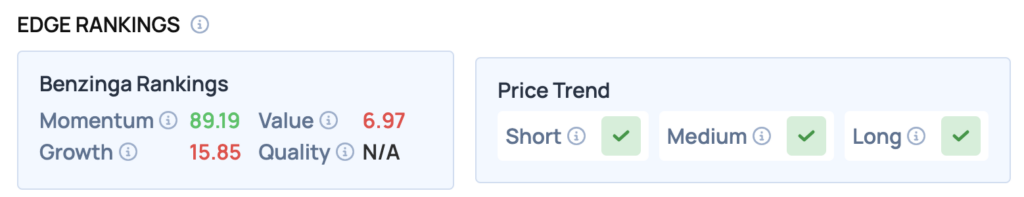

Benzinga Edge Rankings: Underscoring its recent rally, the stock carries a high Benzinga Edge Momentum score of 89.19.

Price Action: According to data from Benzinga Pro, SNOW shares are trading lower by 2% to $236.15 Friday morning. The stock has a 52-week high of $249.99 and a 52-week low of $107.13.

Read Also: Alibaba Sees Historic Opportunities As CEO Points To AI And Quick Commerce Wins

How To Buy SNOW Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Snowflake’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock